Airbus Extends Delivery Lead in December // Boeing Dominates Year-End Orders // Widebody Activity Accelerates

Alaska Airlines 787-9 and 737 MAX 10. Image – Boeing

December 2025 Summary

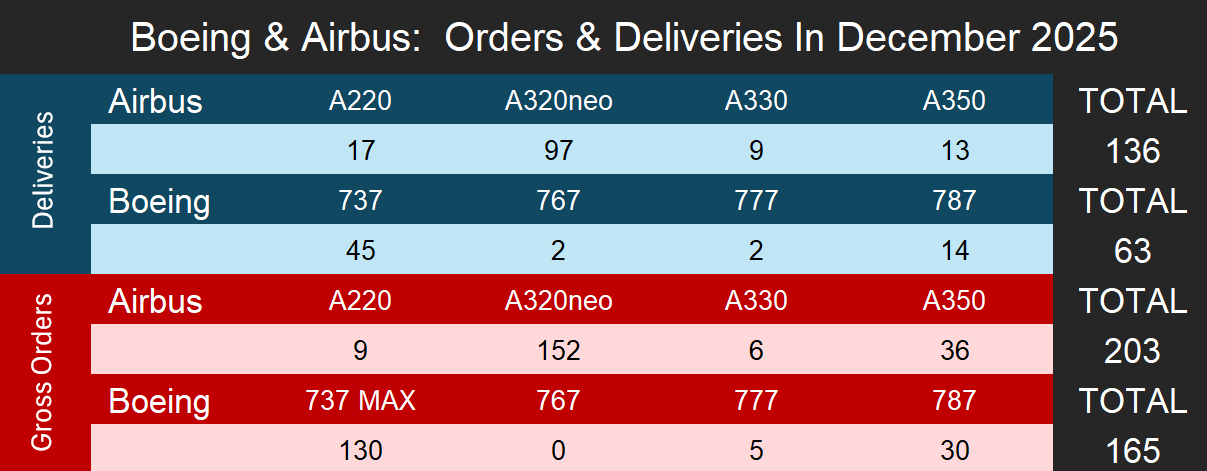

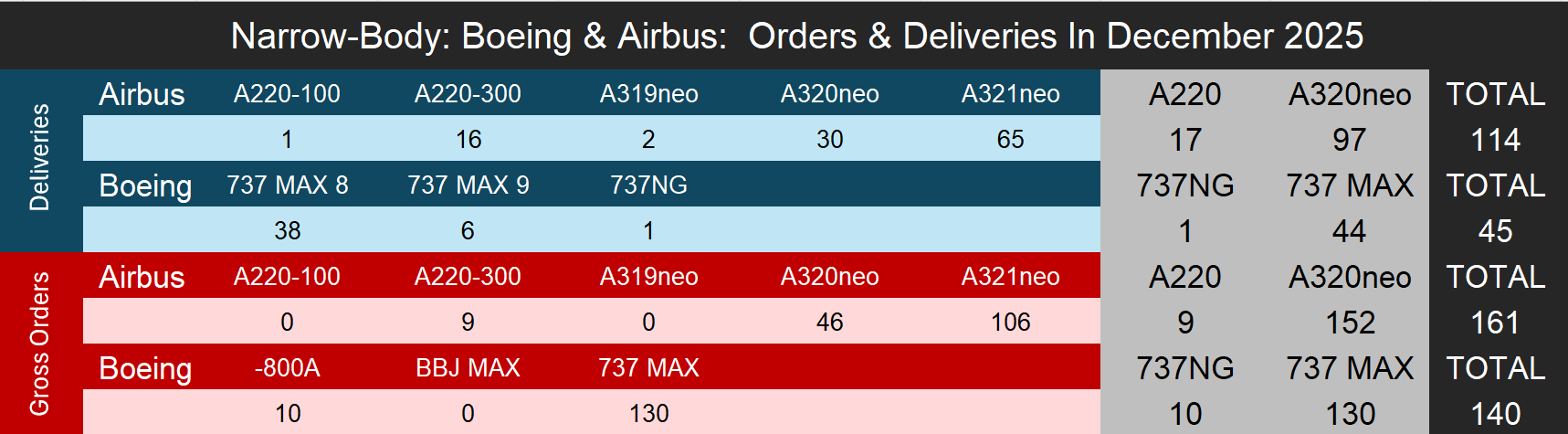

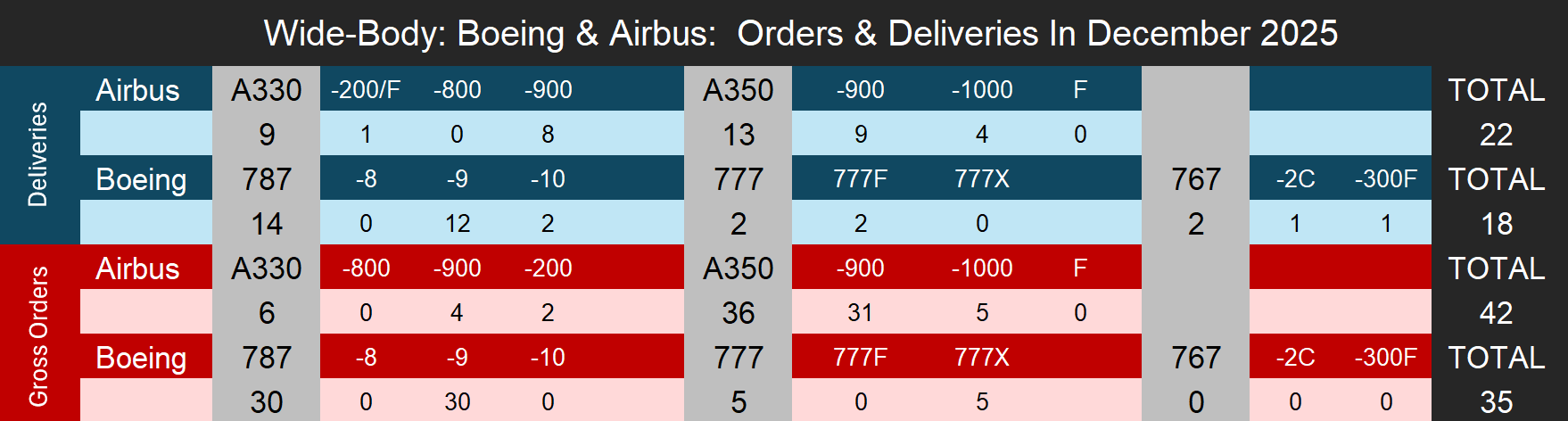

In December, Airbus delivered 136 aircraft, comprising 114 narrowbodies and 22 widebodies. Boeing delivered 63 aircraft, including 45 narrowbodies and 18 widebodies. Airbus once again outpaced Boeing on monthly deliveries, supported by strong A320neo-family handovers and steady A220 output, while Boeing’s month reflected a heavier widebody mix than in many prior months, driven by continued 787 deliveries alongside smaller numbers of 767 and 777 handovers.

From an orders perspective, Airbus recorded 203 gross orders in December, significantly ahead of Boeing’s 165 gross orders. Airbus’s order intake was dominated by the A320neo family, supplemented by additional widebody activity from the A330 and A350 programs. Boeing’s December order volume was weighted toward 737 MAX commitments, with meaningful incremental widebody demand led by the 787 and additional 777 orders. Overall, December reflected a strong year-end contracting environment for both OEMs, anchored by narrowbody demand with widebody orders providing an important secondary lift.

- Notes: A320neo numbers include all variants for the family; A319neo, A320neo and A321neo.

Boeing Deliveries

Boeing delivered 63 aircraft in December, consisting of 45 narrowbodies from the 737 program and 18 widebodies across the 767, 777, and 787 programs. Single-aisle deliveries consisted of 44 737 MAX aircraft and one 737NG. Widebody deliveries continued to be led by 14 787s, with additional handovers from the 767 and 777 programs contributing to the month’s total.

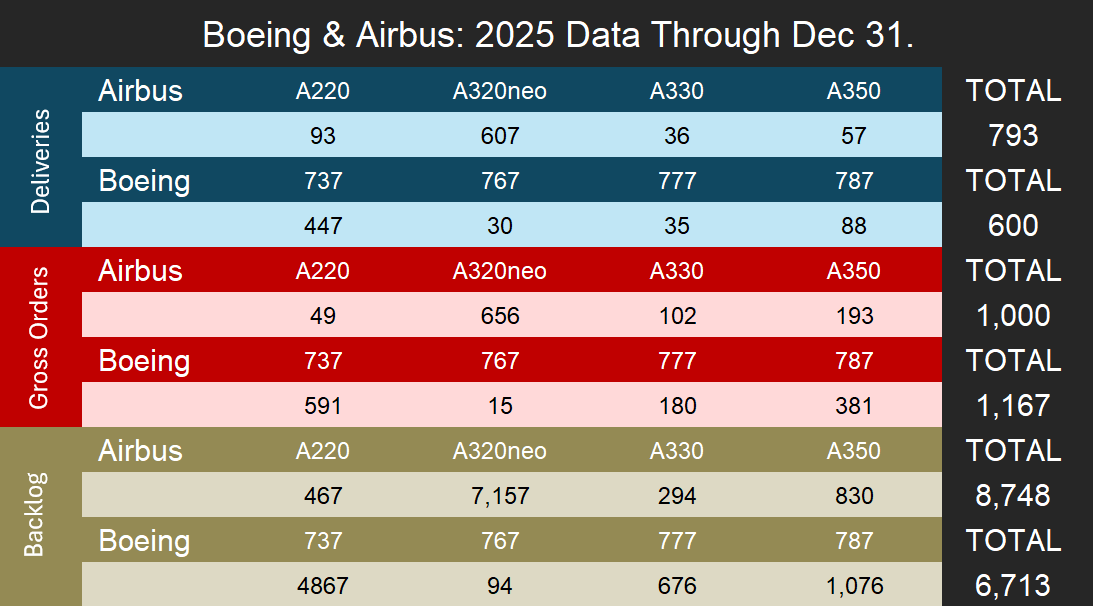

For the full year 2025, Boeing delivered 600 commercial aircraft. This included 447 737s, 88 787s, 35 777s, and 30 767s. Boeing did not publish a formal delivery target for 2025, however, Forecast International’s forecast called for 590 deliveries, meaning Boeing finished the year modestly above our expectations. Despite ongoing production and certification challenges across multiple programs, Boeing’s year-end performance reflected gradual stabilization in delivery execution, particularly on the widebody side.

Airbus Deliveries

Airbus delivered 136 aircraft in December, including 114 narrowbodies and 22 widebodies, reflecting a strong year-end push centered on the A320neo family. Narrowbody deliveries were led by the A320neo family, with 87 deliveries and an additional 17 aircraft the A220 program. Widebody deliveries included nine A330neos and 13 A350 programs.

For full-year 2025, Airbus delivered 793 commercial aircraft, consisting of 607 A320neo-family aircraft, 93 A220s, 57 A350s, and 36 A330s. Airbus finished the year slightly above its revised delivery guidance of 790 aircraft, which had been lowered from an initial target of 820 deliveries. While widebody output remained constrained relative to longer-term objectives, Airbus’s narrowbody programs once again carried overall delivery performance and enabled the manufacturer to meet its adjusted annual goal.

Boeing Orders

Boeing recorded 165 gross orders in December, driven primarily by the 737 MAX, alongside additional widebody demand for the 787 and 777 programs. No 767 orders were booked during the month. December order activity reflected continued airline focus on both near-term narrowbody capacity needs and long-term widebody fleet renewal.

For the full year 2025, Boeing accumulated 1,167 gross orders, outpacing Airbus. The total was led by 591 orders for the 737 program, followed by 381 orders for the 787, 180 orders for the 777 family, and 15 orders for the 767. Boeing’s 2025 order book remained heavily weighted toward widebodies relative to Airbus, with the 787 posting strong activity during the year.

- For consistency, this article does not include Boeing’s ASC 606 accounting adjustments and considers net orders as gross orders minus cancellations.

Airbus Orders

Airbus recorded 203 gross orders in December, with the A320neo family accounting for 152 of the total orders. The month also included additional widebody orders with 36 for the A350 and six for the A330neo, while the A220 program added nine aircraft to its backlog.

For full-year 2025, Airbus booked 1,000 gross orders. The A320neo family dominated the order intake with 656 orders, followed by 193 A350 orders, 102 A330 orders, and 49 A220 orders. While Airbus trailed Boeing in total gross orders for the year, its order mix remained strongly anchored in single-aisle aircraft, supporting long-term production stability across its narrowbody programs.

- Airbus backlog numbers do not include A320ceo ghost orders.

- Boeing backlog numbers do not include 777-300ER ghost orders.

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

Backlog

As of December 31, 2025, Airbus reported a backlog of 8,748 commercial aircraft, excluding the A320ceo. Based on Forecast International’s 2025 delivery projection of 790 aircraft, Airbus’s current backlog represents approximately 11.1 years of deliveries at the forecasted pace. The backlog remains heavily concentrated in narrowbody aircraft, with the A320neo family accounting for 7,157 aircraft, supplemented by 467 A220s. Widebody backlog stood at 830 A350s and 294 A330s, highlighting Airbus’s continued reliance on single-aisle programs to support its delivery numbers.

Boeing’s backlog totaled 6,713 aircraft at year-end, excluding 777-300ER positions. Using Forecast International’s 2025 delivery forecast of 590 aircraft, Boeing’s backlog equates to approximately 11.4 years of deliveries at the current projected delivery rate. The backlog is dominated by the 737 MAX with 4,867 aircraft. Boeing’s widebody backlog also remains substantial, including 1,076 787s, 676 777s, and 94 767s, providing long-term production coverage across its twin-aisle portfolio despite near-term execution constraints.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.