As the commercial aerospace industry turns its attention to Le Bourget for the 2025 Paris Air Show, a familiar pre-show question resurfaces: What will dominate the conversation?

Unlike previous shows shaped by the rebound in global air travel demand and sustainability, this year’s show will reflect an industry that is navigating growth amid persistent headwinds. The focus will shift from a recovery in demand to addressing structural challenges on the supply side of the industry.

Aircraft Orders and the Strategic Positioning of OEMs

A defining feature of the Paris Air Show is the unveiling of major aircraft orders. With global passenger traffic now exceeding pre-pandemic levels and continuing to rise, Airbus and Boeing are expected to compete actively for new commitments from airlines across various regions.

Despite a more cautious market outlook shaped by geopolitical uncertainty, tariff risks, and signs of softening demand from airlines, there is still a strong appetite for fleet modernization and new technology aircraft. However, low-cost carriers are no longer pursuing capacity-driven growth due to a slowdown in travel bookings, making it likely that order volume from this segment will be softer than in previous years. In contrast, full-service network carriers are increasingly focused on replacing aging aircraft, many of which are affected by ongoing shortages of spare parts and serviceable engines. As a result, a portion of new orders is expected to come from these legacy operators.

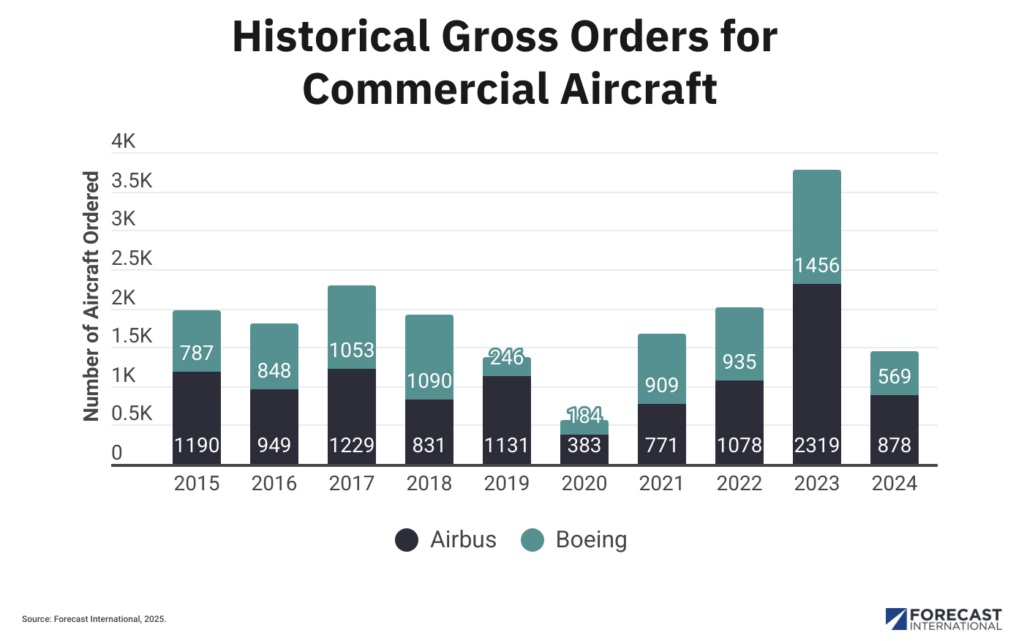

Forecast International anticipates a healthy level of order announcements, although not at the record-setting volumes seen during the surge of 2022 and 2023. So far this year, Boeing has recorded only 249 gross orders, and Airbus has secured only 291. For context, 2024 closed with 569 orders for Boeing and 878 for Airbus. A more moderate order environment is expected at this year’s show, though we still do expect significant announcements from airlines across the globe. The narrowbody segment, led by the A320neo family and 737 MAX variants, will likely see the most activity. However, developments in the widebody market will also be closely monitored, particularly as long-haul travel strengthens its recovery and airlines look to grow their international networks.

Supply Chain Disruptions and Production Ramp-Ups

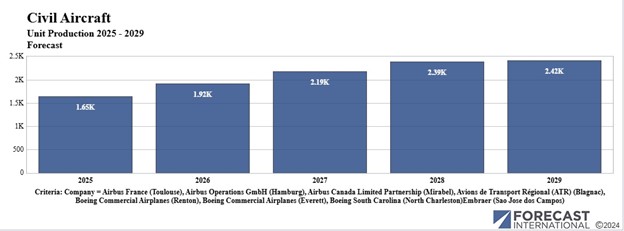

While aircraft orders generate headlines, the deeper industry conversation centers on delivery schedules and manufacturing constraints. While demand remains strong and order books are full, OEMs have not been meeting that demand, and the spotlight is shifting from backlog size to delivery performance. The post-pandemic delivery environment has exposed structural weaknesses in the commercial aerospace system. From 2015 to 2018, global aircraft deliveries steadily climbed from 1,692 to 1,842 units. Since then, delivery levels have not recovered. After collapsing to just 844 units in 2020, the recovery plateaued at 1,386 in 2023 and slid further to 1,264 in 2024. These are not blips in performance but rather reflect deeper issues tied to supply chain fragility and production bottlenecks across the sector.

The delivery shortfalls at major OEMs illustrate the magnitude of the problem. Airbus, though regaining volume to 767 deliveries in 2024, continues to miss targets for ramping up production. Boeing remains under pressure from regulatory scrutiny and persistent quality control issues, with 2024 output totaling only 350 units, less than half of its 2018 high. Embraer and COMAC are rebuilding steadily, but most other manufacturers remain well below their historical production levels. Forecast International’s outlook reflects this constrained reality. Civil aircraft production is forecast to rise from 1.65K units in 2025 to 2.42K by 2029, a more tempered trajectory than earlier projections. These figures suggest that although OEMs intend to rapidly ramp up production rates, the timeline in which this occurs remains limited by systemic challenges. In Paris, we expect stakeholders to look for clearer answers on realistic delivery rates, supplier resilience, and how OEMs intend to restore industrial capacity. The discussion has shifted from sales to execution, and the credibility of OEMs now hinges not on who takes the most orders, but on who can actually deliver.

Trade Policy De-escalation

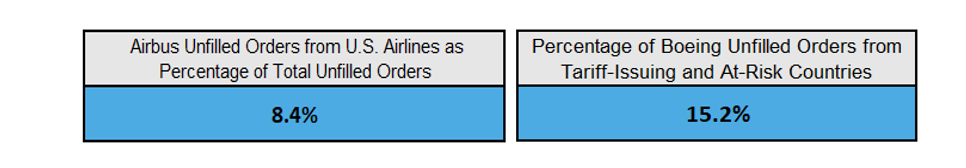

Although recent developments suggest a de-escalation in aircraft-related tariffs, the issue remains fluid. The global trade environment is still adjusting to a volatile geopolitical backdrop and changing policy stances from key economies.

While tariff headlines may take a back seat during the 2025 show, trade frictions continue to pose latent risk. Any future shifts, particularly from newly elected administrations or evolving international alliances, could reignite tensions and impact cross-border commercial aerospace activity. Trade policy will remain an important undercurrent, even if it does not dominate the formal agenda.

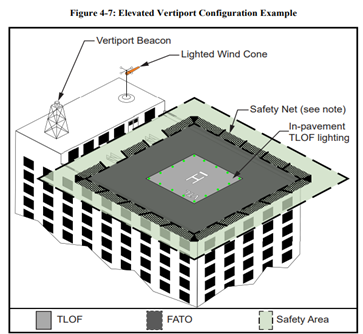

eVTOLs and Urban Air Mobility: Advancing Toward Operational Maturity

The eVTOL sector arrives at Paris 2025 with a sense of momentum. Key players including Joby Aviation, Archer, and Vertical Aerospace have advanced their flight-testing programs and are targeting certification windows within the next 24 months.

The conversation is transitioning from technical feasibility to operational integration. Updates at the show are expected to focus on certification timelines, infrastructure development, and airspace management strategies. Regulatory harmonization, public acceptance, and urban planning constraints are emerging as critical factors in determining the pace of deployment. The challenges are no longer solely technical; they are now systemic.

Next-Generation Narrowbodies

Discussion around clean sheet narrowbody aircraft is gaining traction as the industry begins to look beyond the current A320neo and 737 MAX platforms, which are expected to remain in production into the 2030s.

At this year’s show, attention may turn to propulsion concepts such as open-fan architectures, hybrid-electric systems, and sustainable composite materials. While no major program announcements are expected, engine manufacturers and systems suppliers may provide early indications of the capabilities and efficiency targets that will define the next generation of narrowbody platforms.

Sustainability: No Longer the Front Page, But Still in the Story

While sustainability continues to be a long-term strategic priority, it may not command center stage in 2025. The industry’s current focus is shifting toward operational stability, including resolving production bottlenecks and restoring supply chain robustness.

This evolving emphasis is evidenced by Airbus’s recent extension of its ZEROe hydrogen aircraft development timeline beyond 2035. Furthermore, announcements regarding sustainable aviation fuel, hydrogen propulsion, and electric aircraft have become more measured.

That said, sustainability will not disappear from the conversation. Progress reports on SAF partnerships, hydrogen infrastructure, and emissions targets are still expected. However, these updates are likely to play a supporting role rather than leading the narrative.

Meet Us at the Paris Air Show

Join Forecast International at the Paris Air Show and gain firsthand insight into the trends shaping the global aerospace market. From navigating supply chain challenges to analyzing the Airbus-Boeing rivalry and the rise of new regional players, our team delivers the industry’s most trusted intelligence and long-range forecasts. Whether you’re focused on commercial, business, or general aviation, stop by Hall 3 Booth C164 to discover how our expert analysis can elevate your strategic planning.Book time with Grant in Paris: https://lnkd.in/ekijrXhE

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.