2023 off to a mixed start. Airbus reports solid February orders.

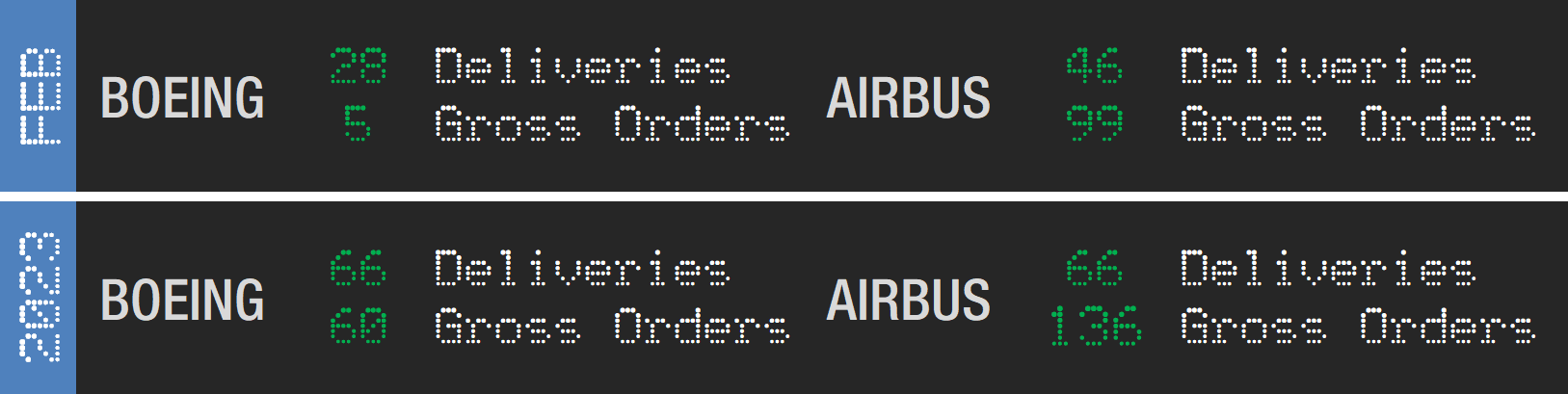

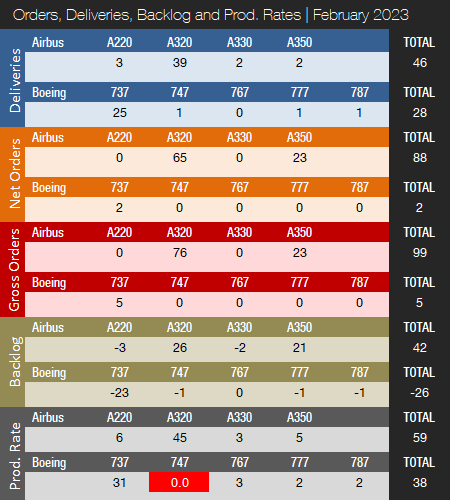

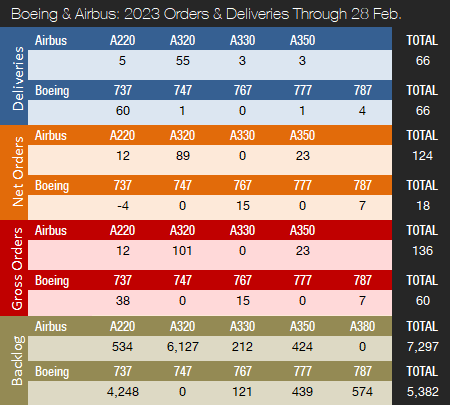

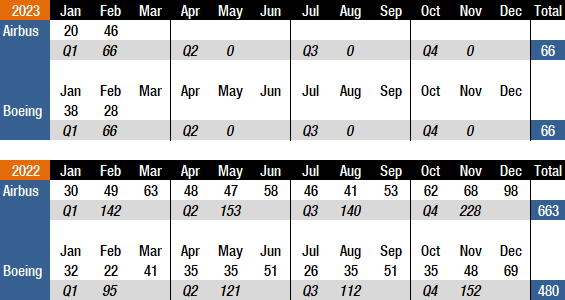

Boeing and Airbus delivered 28 and 46 commercial jets in February 2023, compared to 22 and 49 deliveries, respectively, in the same month last year – and 38 and 20 shipments, respectively, in January. In 2022, Airbus won the deliveries crown for the fourth year in a row by delivering 663 aircraft, compared to Boeing’s 480 shipments. In 2021, Boeing and Airbus delivered 340 and 611 aircraft.

Following a more than challenging 2020 due to the COVID-19 pandemic, 2021 and 2022 were recovery years for the two largest commercial plane makers. We can expect 2023 to be another year of recovery for the commercial aircraft manufacturing industry despite ongoing supply chain challenges, inflation and higher interest rates, labor shortages, and the war in Ukraine. However, Boeing and Airbus still have quite a way to go before deliveries are back to pre-pandemic levels. In 2018, before COVID-19 and the 737 MAX grounding, Boeing delivered 806 jets, a level that will likely not be recaptured before the 2025-26 timeframe. Airbus’ all-time record high of 863 shipments was set in 2019, a level that could be surpassed in 2024 if supply chain challenges ease, but most likely not before 2025. Also, Airbus is expected to retain the deliveries lead for the foreseeable future due to the company’s comfortable backlog lead over its American rival. Prior to 2019, Boeing had out-delivered Airbus every year since 2012.

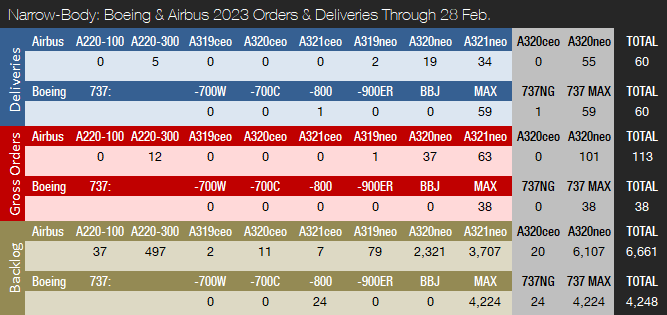

As indicated above, in February 2023, Boeing delivered 28 jets, including 25 737s (24 MAXs and one NG), one 747-8F (the last), one 777, and one 787. Since June of last year, the 737 program has been producing aircraft at an official rate of 31 per month. The monthly delivery trend is expected to remain in the low 30s for now, but will be increased as soon as supply chain constraints allow. For 2023, Boeing now targets an average rate of between 33 and 38 737s per month, or 400-450 for the year. Boeing had previously been considering a boost in production to 38 jets per month in the first half of 2023, followed by another increase to 47 jets per month by the end of 2023. Longer term, Boeing expects to increase production to approximately 50 jets per month in the 2025/26 timeframe. This is slightly below the 2018 rate of 52 737s per month. The company plans to open a fourth 737 MAX production line in Renton in the second half of 2024. Boeing ended the fourth quarter with 250 737 MAX jets in inventory, down 20 from Q3 2022. Customers in China account for 138 of these aircraft. At present, Boeing’s main supply chain headache is its engine supply. Boeing expects that supply chain constraints will remain a significant challenge in 2023. The company is still producing 737 NGs but only has 24 737-800s remaining in backlog.

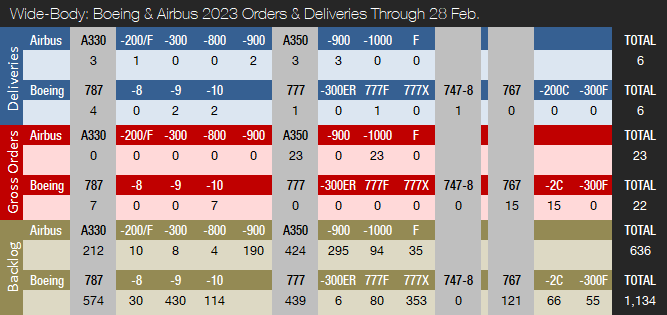

In August of last year, deliveries of the Boeing 787 Dreamliner were resumed following a suspension of shipments that lasted nearly 16 months. Boeing had suspended Dreamliner deliveries in May 2021 for the second time in less than a year. The current 787 production rate is two aircraft per month. However, in connection with the release of Boeing’s fourth quarter and full-year 2022 earnings, the company announced it will return to five per month by the end of 2023 (for a total of 70-80 deliveries for the year), followed by further increases before reaching 10 aircraft per month by 2025/26. Boeing ended the fourth quarter with 100 Dreamliners in inventory, down 15 from Q3 2022. Most of these aircraft will be delivered during 2023 and 2024.

The 747 program recently closed down production when the last aircraft was delivered to Atlas Air on January 31 (note: for some reason, this aircraft was still on Boeing’s books at the end of January but was removed in February). The 767 program is currently producing at a rate of three units per month, a mix of KC-46 tankers (based on the 767-2C) and 767-300 freighters. The 777 program is currently pushing out aircraft at a rate of two per month. Most aircraft in backlog are 777 freighters, with only very few 777-300ERs left. The 777 program was expected to get a new addition in late 2023 with the first delivery of the 777X, but in April of last year Boeing announced this will now not happen before 2025. This reflects an updated assessment of the time required to meet certification requirements. In January 2022, Boeing launched a new 777X-based freighter, thereby expanding its 777X and cargo portfolio. By the 2025/26 timeframe, Boeing expects to be delivering four 777s per month.

In February 2023, Airbus delivered 46 jets, including three A220s, 39 A320s (all NEO), two A330s, and two A350s. The official A320 production rate is 45 aircraft per month and has remained at this level since the end of 2021. On average, the company delivered 43 A320s per month in 2022. Current plans call for production to be increased later this year until reaching a monthly rate of 65 by late 2024 (pushed back twice now due to supply chain challenges). Also, Airbus is working with its supply chain to increase A320 production to 75 aircraft per month in 2026 (pushed back from 2025).

The A220, meanwhile, is being produced at a rate of six aircraft per month, with a monthly production rate of nine expected by 2025. The A350 production rate currently averages five per month and was expected to be increased to six by early 2023. However, the rate increase will likely be delayed until the end of 2023. The A330 production rate was increased from two to three aircraft per month at the end of 2022, with another increase to four per month expected in 2024.

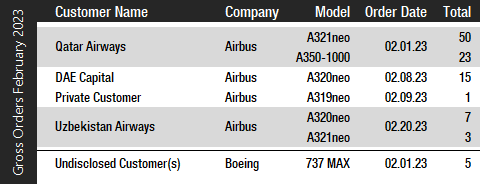

Turning to the February orders review, Boeing had a very quiet month and only booked orders from a single customer for a total of five jets (gross orders). However, the company also reported three cancellations (all 737 MAX), resulting in two net new orders. The single order for five 737 MAXs was placed by an unidentified customer. In 2022, Boeing booked 774 net new orders (935 gross orders), up from 479 net new orders (909 gross orders) in 2021 (before ASC 606 changes). Please note that for comparison reasons, we do not include Boeing’s so-called ASC 606 accounting adjustments in the numbers reported in this article and regard net new orders as gross orders minus cancellations.

In February, Airbus had a good month and booked orders for 99 aircraft from four different customers and reported 11 A320neo family cancellations, for a total of 88 net new orders. On February 1, Qatar Airways and Airbus resolved their legal dispute over A350 paint damage, and previously placed orders for A350-1000 jets and A321neos were reinstated. Airbus therefore added 50 A321neos and 23 A350-1000s to its backlog in February. Also in February, Dubai-based leasing firm DAE Capital ordered 15 A320neos, followed by an order by Uzbekistan Airways for seven A320neos and three A321neos. Finally, a private customer booked a single A319neo. In 2022, Airbus booked 820 net new orders (1,078 gross orders), surpassing both 2021 gross orders and net new orders. In 2022, Airbus won the orders crown for the fourth consecutive year by a fairly slim margin of just 46 aircraft compared to Boeing. In 2021, Airbus booked a total of 771 gross orders and received 264 cancellations, for a total of 507 net new orders.

At the end of February, Airbus reported a backlog of 7,297 jets, of which 6,661, or 91 percent, were A220 and A320ceo/neo family narrowbodies. This is 428 aircraft below the company’s all-time backlog record of 7,725 aircraft set in January 2020. By the end of last month, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 5,382 aircraft, of which 4,248, or 79 percent, were 737 NG/MAX narrowbody jets. Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 8.5 years of shipments at the 2019 production level (the pre-pandemic level), or 11.0 years based on the 2022 total. In comparison, Boeing’s backlog would “only” last 6.7 years at the 2018 level (the most recent “normal” year for Boeing), or 11.2 years based on 2022 deliveries. As of February, Boeing’s book-to-bill ratio so far this year, calculated as net new orders divided by deliveries, was 0.27, compared to Airbus at 1.88. In 2022, Boeing’s book-to-bill ratio was a very strong 1.61. Meanwhile, Airbus’ book-to-bill ratio was a solid 1.24.

2023 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology that provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecast data from the Civil Aircraft Forecast product. For 2023, Forecast International’s analysts currently expect Boeing and Airbus to deliver 492 and 710 commercial jets, respectively. Please note that these figures exclude militarized variants of commercial platforms such as Boeing’s P-8 Poseidon maritime patrol aircraft and KC-46 Pegasus tanker and Airbus’ A330 MRTT tanker.

Boeing released its Q4 and full-year 2022 results in January and reaffirmed its 2023 deliveries guidance. In November of last year, Boeing announced that it expects to deliver 400-450 737s and 70-80 787s in 2023, which equates to a monthly average of 33-38. Airbus presented its fourth quarter and full-year 2022 results on February 16 and is targeting 720 commercial jet deliveries in 2023.

References:

- https://www.forecastinternational.com/platinum.cfm

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://www.airbus.com/en/newsroom/press-releases/2023-02-qatar-airways-and-airbus-reach-amicable-settlement-in-legal-dispute

- https://www.qatarairways.com/press-releases/en-WW/222810-qatar-airways-and-airbus-reach-amicable-settlement-in-legal-dispute

- https://www.airbus.com/sites/g/files/jlcbta136/files/2023-02/EN-Press-Release-Airbus-FY2022-Results.pdf

- https://www.airbus.com/en/newsroom/press-releases/2023-02-airbus-reports-full-year-fy-2022-results

- https://boeing.mediaroom.com/2023-01-25-Boeing-Reports-Fourth-Quarter-Results

- https://www.flightglobal.com/airframers/boeing-rolls-out-plan-to-hike-deliveries-to-800-jets-within-several-years/150809.article

- https://aviationweek.com/air-transport/aircraft-propulsion/boeing-remains-cautious-737-production-ramp-plans

- https://seekingalpha.com/article/4572364-boeing-company-ba-q4-2022-earnings-call-transcript

- https://www.benzinga.com/news/earnings/23/02/30938700/airbus-expects-higher-plane-deliveries-for-2023-but-cautious-on-production-for-a320

Forecast International’s Civil Aircraft Forecast covers the rivalry between Airbus and Boeing in the large airliner sector; the emergence of new players in the regional aircraft segment looking to compete with Bombardier, Embraer, and ATR; and the shifting dynamics within the business jet market as aircraft such as the Bombardier Global 7000, Cessna Hemisphere, and Gulfstream G600 enter service. Also detailed in this service are the various market factors propelling the general aviation/utility segment as Textron Aviation, Cirrus, Diamond, Piper, and a host of others battle for sales and market share. An annual subscription includes 75 individual reports, most with a 10-year unit production forecast. Click here to learn more.

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.