2021 Expected to Be Year of Recovery for Commercial Plane Makers

by J. Kasper Oestergaard, European Correspondent, Forecast International.

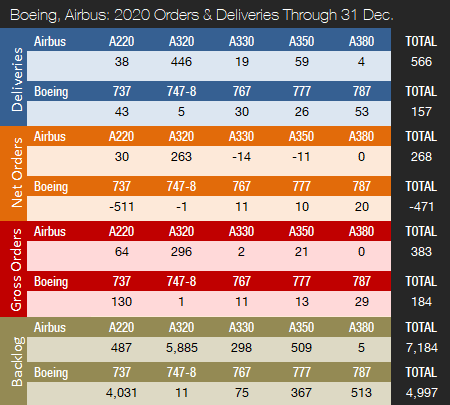

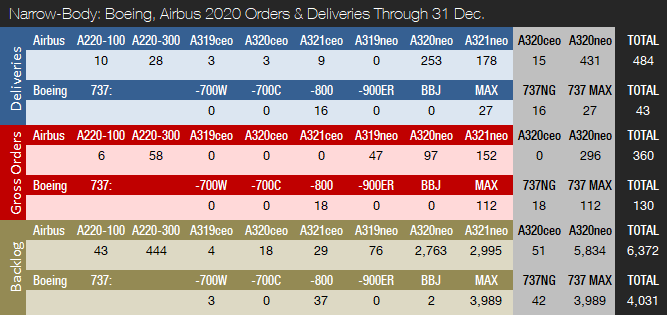

Boeing and Airbus delivered 39 and 89 commercial jets in December 2020, compared to 35 and 138 deliveries, respectively, in December 2019. For the full year 2020, Boeing delivered 157 aircraft, compared to 380 and 806 in 2019 and 2018, respectively. In 2020, Airbus delivered 566 aircraft and won the deliveries crown for the second year in a row. Due to COVID-19 fallout, deliveries were down from 863 and 800 in 2019 and 2018, respectively. Airbus is expected to retain the deliveries crown for years to come due to the company’s comfortable backlog lead over its American rival. Prior to 2019, Boeing had out-delivered Airbus every year since 2012.

The past two years have been extremely challenging for Boeing but finally, things are looking brighter. On November 18, 2020, following a comprehensive and methodical safety review process that took 20 months to complete, the FAA ungrounded the 737 MAX. On December 9, Boeing delivered the first 737 MAX in almost two years, to United Airlines. On the same day, Brazilian airline GOL performed the first scheduled 737 MAX passenger flight since March 2019. However, the 737 MAX remains grounded in Europe, Australia, China, India, Japan, and Russia. The European Union Aviation Safety Agency (EASA) expects to lift its grounding soon.

In December, Boeing delivered 39 jets, including 28 737s (27 MAX / 1 NG), one 747-8, six 767s, and four 777s. For the second month in a row, no 787 Dreamliners were delivered. Production of the 737 MAX was suspended from January 2020 until the end of May, when Boeing announced it had commenced low-rate production of the aircraft. Boeing expects the 737 MAX production rate to gradually increase to 31 per month by early 2022, with further increases as market demand allows. Prior to the 737 MAX production suspension, Boeing was manufacturing the jet at a reduced rate of 42 per month and had produced and shipped 387 jets.

Boeing has announced that the 787 production rate is being reduced from 14 per month (rate at the start of 2020) to just six per month during 2021. Boeing is in the process of moving all 787 final assembly to its facilities in Charleston, South Carolina. The move is expected to be completed by mid-2021. The combined 777/777X production rate will be reduced to two per month in 2021. Production rate assumptions have not changed for the 747 and 767 programs.

In December, Airbus delivered 89 jets, including six A220s, 67 A320s (66 NEO / 1 CEO), five A330s, eight A350s, and three A380s. Prior to the COVID-19 pandemic, Airbus was targeting a 5 percent A320 rate increase to 63 jets per month from 2021 and was also discussing a further ramp-up with its supply chain that could have brought the production rate up to as high as 67 aircraft per month, or 804 per year, by 2023. This would have put the company within reach of a total of 1,000 jet deliveries per year. These plans have now been shelved. Due to COVID-19, Airbus has cut production on several programs and is looking to hold underlying jet output at 40 percent below pre-pandemic plans for two years.

The A320 production rate has been reduced to 40 aircraft per month, down from an average of over 53 aircraft per month in 2019. Recently, however, Airbus confirmed that the company is considering an increase to 47 A320neo jets per month in the second half of 2021. The A330 and A350 programs have been reduced to a rate of two and six aircraft per month, respectively. No rate cut was announced for the A220 or A380. With only five A380s in backlog as of December 31, 2020, the end of the A380 program draws near. The last aircraft is expected to be delivered to Emirates in May 2022.

Turning to the December orders race, Boeing had a strong month and booked three orders for a total of 90 jets; however, the company also reported 110 cancellations, of which 105 were for the 737 MAX. The December orders haul included a large order for 75 737 MAX 8-200s (a higher-capacity version of the 737-8) for Ryanair, Europe’s largest airline. Ryanair thereby increased its firm 737 order book to 210 aircraft but, at the same time, canceled an existing order for 48 737 MAX jets in a move to push back deliveries. Also in December, an undisclosed customer ordered seven 737 MAXs, while DHL – the major German international courier, package delivery and express mail service – placed an order for eight 777 freighters. In 2020, Boeing accumulated a total of 184 gross orders and received 655 cancellations, for a total of -471 net new orders. For the full year 2019, Boeing booked 243 gross orders (330 cancellations => -87 net new orders).

In December, Airbus booked two new orders and reported 31 cancellations (one A220, four A320s, 11 A330s, and 15 A350s). December orders included an A330-800 for Air Greenland as well as an A330 MRTT tanker for the French armed forces. For the full year 2020, Airbus accumulated 383 gross orders and received 115 cancellations for a total of 268 net new orders – enough to win the orders crown for the second year in a row. For the full year 2019, Airbus landed 1,131 gross orders (363 cancellations => net of 768).

At the end of December, Airbus reported a backlog of 7,184 jets, of which 6,372, or 89 percent, were A220 and A320ceo/neo family narrowbodies. This is 541 aircraft below the company’s all-time backlog record of 7,725 aircraft set in January 2020. By the end of December 2020, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 4,997 aircraft, of which 4,031, or 81 percent, were 737 NG/MAX narrowbody jets. Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 8.3 years of shipments at the 2019 production level, or 12.7 years based on the 2020 total. In comparison, Boeing’s backlog would “only” last 6.3 years at the 2018 level (the most recent “normal” year for Boeing), 13.2 years based on 2019 production totals, and 31.8 years at the extremely low 2020 level, which the company should easily exceed in 2021. In 2020, Boeing’s book-to-bill ratio, calculated as net new orders divided by deliveries, was negative due to cancellations exceeding gross orders. Airbus’ book-to-bill ratio was 0.47. In 2019, Boeing’s book-to-bill ratio was negative, while Airbus reported a book-to-bill of 0.89.

2021 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology that provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecasts and, for 2021, Forecast International’s analysts currently expect Boeing and Airbus to deliver 389 and 614 commercial jets, respectively.

On January 27, Boeing will report Q4 2020 earnings and is expected to provide guidance for 2021. Airbus will deliver its 2020 earnings report on February 13.

Note: The 777-300ER backlog includes one 777-200LR.

References:

- https://www.forecastinternational.com/platinum.cfm

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://www.faa.gov/news/updates/?newsId=93206

- https://boeing.mediaroom.com/2020-12-03-Ryanair-Orders-75-More-Boeing-737-MAX-Jets

- https://boeing.mediaroom.com/2020-11-18-Boeing-Responds-to-FAA-Approval-to-Resume-737-MAX-Operations

- https://www.airbus.com/newsroom/press-releases/en/2021/01/airbus-2020-deliveries-demonstrate-resilience.html

- https://simpleflying.com/boeing-737-max-unbanned/

- https://simpleflying.com/first-post-ungrounding-delivery/

- https://www.businessinsider.com/boeing-737-flies-first-flight-with-paying-passengers-since-2019-2020-12

- https://www.scmp.com/economy/china-economy/article/3113585/boeing-737-max-planes-return-china-riddled-uncertainty

Forecast International’s Civil Aircraft Forecast covers the rivalry between Airbus and Boeing in the large airliner sector; the emergence of new players in the regional aircraft segment looking to compete with Bombardier, Embraer, and ATR; and the shifting dynamics within the business jet market as aircraft such as the Bombardier Global 7000, Cessna Hemisphere, and Gulfstream G600 enter service. Also detailed in this service are the various market factors propelling the general aviation/utility segment as Textron Aviation, Cirrus, Diamond, Piper, and a host of others battle for sales and market share. An annual subscription includes 75 individual reports, most with a 10-year unit production forecast. Click here to learn more.

Based in Denmark, Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.