Airbus A320neo Production Remains Strong /// 787 Output Holds Steady as A350 Production Faces Ongoing Challenges

Airbus A350 – Image – Airbus

For the purposes of this article, Forecast International considers an aircraft to be “produced” once it completes its first test flight, and “delivered” when it is contractually handed over to the customer.

Overview

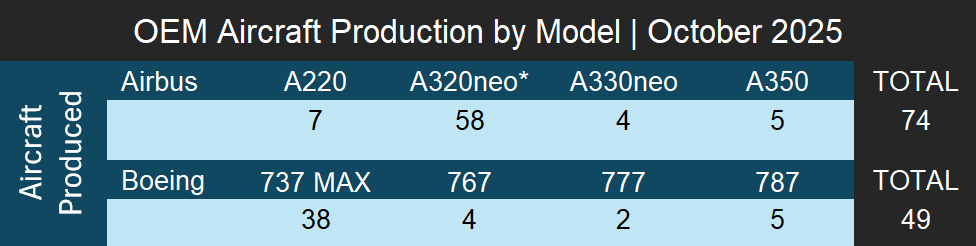

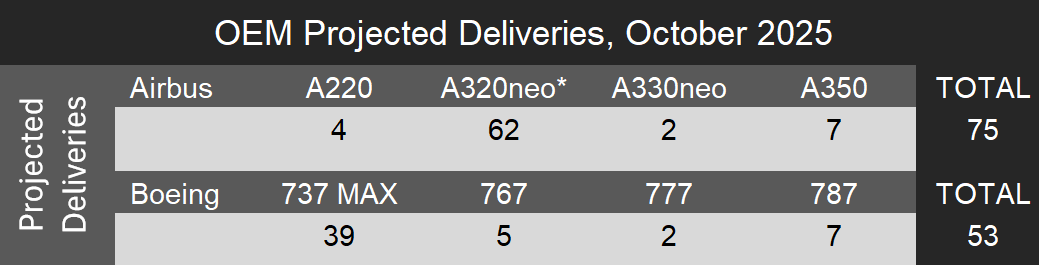

Airbus led the month in total production, completing 74 aircraft, followed by Boeing with 49, resulting in a combined total of 123 aircraft. Of these, 103 were narrowbody aircraft, while the remaining 20 were widebodies. On the delivery side, Forecast International expects Boeing to have delivered a total of 53 aircraft in October, including 39 737 MAXs with the remaining 14 aircraft to be widebodies. For Airbus, we estimate total deliveries of 75 aircraft, comprising 66 narrowbodies and nine widebodies. 62 of the narrowbodies are expected to be A320neo family aircraft, and the remaining four are expected to be of the A220 family.

Notes:

- Production data represents the actual number of aircraft produced in October 2025. Forecast International considers an aircraft produced upon its first flight. This may differ from an OEM’s definition of produced.

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

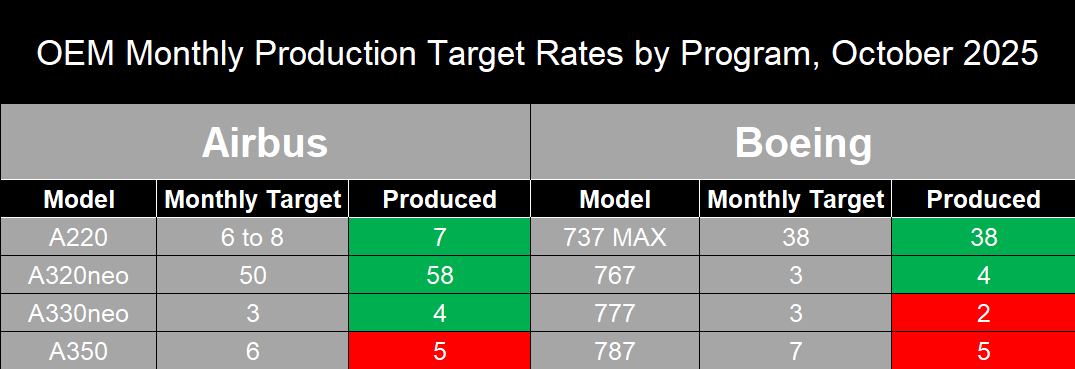

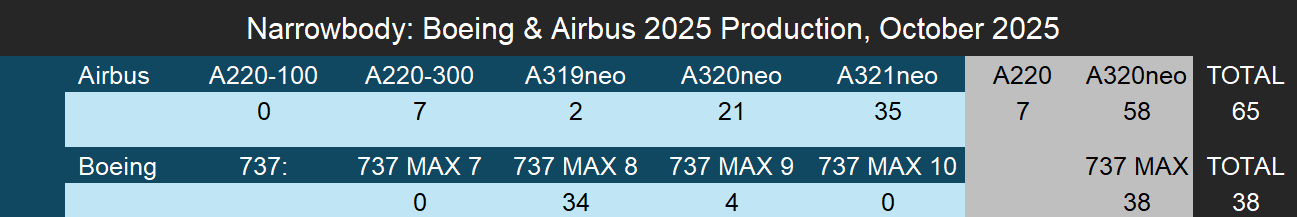

A320neo family production dipped to 38 aircraft in the month of August, but significantly rebounded in Septmeber, with Airbus producing a total of 68 aircraft in the family. Airbus continued with this stronger production by producing 58 A320neos in October. This is now only the fourth month in 2025 in which Airbus has been able to produce at or above the 50 aircraft per month target for the A320neo family. The company also produced seven A220s during the month. On the widebody front, Airbus completed four A330neos and five A350s. Per usual, Boeing’s October production was dominated by the 737 MAX, with 38 units completed, along with four 767s, two 777s, and five 787 Dreamliners.

- Monthly production targets are generalized figures based on monthly production estimates derived from OEM guidance and internal research conducted by Forecast International.

Despite the recent increase in A320neo family production in September and October, Forecast International believes this rise is still not sufficient for Airbus to reach its full-year delivery target of 820 aircraft. Based on our estimated October deliveries, Airbus would have delivered approximately 582 aircraft through October 31st. Given current production rates for the A220, A350, and A330neo families, which are not expected to meaningfully accelerate through year end, Airbus would need to deliver roughly 206 A320neo-family aircraft in the final two months of 2025, or an average of about 103 units per month. While such a pace is theoretically attainable, it exceeds Airbus’ long-term A320neo production goal of 75 aircraft per month. Production can fluctuate throughout the year, but this gap highlights the scale of the ramp-up required in November and December for Airbus to meet its target. We were also surprised that Airbus did not revise its delivery guidance during its third-quarter earnings call, particularly given the company’s current trajectory and the announcement that only 32 “glider” aircraft remain. Even if engines for all remaining gliders were secured and the aircraft delivered by year end, we do not believe this would materially change Airbus’ ability to achieve its full-year objective.

As for the A220 program, production has now stabilized at eight aircraft per month, and we believe gradual output increases are possible in the near term. In October, Airbus produced seven A220s, all of which were A220-300s. Though this steady production foundation supports future rate hikes, our long-held view that the company’s plan to ramp up to 14 aircraft per month by 2026 was unlikely has now been validated. In its third-quarter earnings call, Airbus announced that it would revise its 2026 target to 12 aircraft per month, although it did not rule out the possibility of pursuing 14 aircraft per month over a longer horizon. In our view, 12 per month represents a more realistic long-term steady rate, not just a short-term one. The A220 program continues to face challenges, including weakening order activity tied to ongoing reliability issues and widespread grounding of the PW1500G engines, which has resulted in roughly one quarter of the global fleet being parked. For a 14-per-month rate to become viable, we believe the backlog must expand significantly, which could occur with the launch of the A220-500 stretched variant, though this has yet to materialize. We will be publishing an in-depth analysis in the coming weeks examining the implications of the revised 12-per-month target and how it affects our long-term production outlook for the A220 program.

A350 production continues to struggle, with Airbus producing five aircraft in October, below the current target of six per month. The program has struggled throughout the year and has shown no signs of stabilizing, even at the six-per-month rate. In 2025, Airbus produced an average of just four and a half A350s per month, for a total of 45 aircraft so far this year. This shortfall comes despite ambitious plans announced at the beginning of the year to ramp up output to 10 aircraft per month by 2026 and 12 per month by 2028. Forecast International maintains the view that to make meaningful progress toward these goals, Airbus must first achieve consistent production at the current six-per-month target.

The A330neo, by contrast, had a strong month in October with four aircraft produced, all of them A330-900neos. Airbus recently announced plans to raise production from three aircraft per month to five per month by 2029, a target that Forecast International considers viable and sustainable given the aging A330ceo fleet and the approaching replacement window for many operators. We expect a significant number of current A330ceo operators to select the A330neo as their replacement, which will drive additional orders and support higher production volumes of the aircraft.

Boeing has successfully stabilized 737 MAX production at 38 aircraft per month, and the FAA recently approved an increase to 42 aircraft per month. Of the 38 MAX aircraft produced in October, 34 were 737 MAX 8 and MAX 8-200 variants, with the remaining four being MAX 9s. This puts Boeing on a stronger trajectory toward its long-term production goal of 52 aircraft per month. While the timeline remains uncertain, Boeing has stated that MAX production increases will not exceed five aircraft at a time, with no less than six months between each step. Based on this structure, it would take at least one year for Boeing to reach its long-term target, and we believe the timeline could extend further depending on supply chain recovery. Our current forecast predicts Boeing reaching this rate between 2027 and 2028.

As for Boeing’s widebody programs, the 787 continues to be the strongest performer, although production softened compared to recent months, with five aircraft produced in October. While our previous target rate for the 787 was five aircraft per month, production has now stabilized closer to seven per month, and Boeing confirmed in its third-quarter earnings call that seven per month is the current target. The company also reiterated its goal of reaching eight aircraft per month by year-end and ten per month in 2026. We believe achieving eight per month will not be difficult and, even if it slips beyond the end of the year, it is likely to occur in 2026. However, moving from eight to ten aircraft per month will be more challenging, a point Boeing has also acknowledged, and we would need to see production consistently hold near eight aircraft per month for several months before a sustainable step up to ten becomes likely.

As for the remaining widebody programs, Boeing produced two 767-300Fs, two 767-2Cs, and two 777Fs in October. We do not anticipate any production rate increases for either platform. Production of the 767-300F is scheduled to conclude in 2027, and the 777-8F is not expected to enter service until later in the decade. Meanwhile, the 777X remains awaiting certification, which Boeing aims to secure this year, although a delay into 2026 remains possible.

Unofficial/Preliminary Deliveries

Forecast International expects Boeing to have delivered an estimated 53 aircraft in the month of October 2025. The 39 narrowbodies expected to be delivered account for 38 737 MAX 8s and one 737 MAX 9. On the widebody side, Forecast International expects Boeing to deliver an estimated seven 787s; four 787-9s and three 787-10s. We also expect Boeing to have delivered two 777Fs, three 767-2Cs and two 767-300Fs.

- Delivery data is the expected number that Boeing and Airbus will report in their October 2025 Orders and Deliveries summary and is based on Forecast International’s internal research. Numbers are not official and are not provided by Airbus or Boeing.

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

As for Airbus, we expect the manufacturer to have delivered a total of 75 aircraft in October 2025. As for the A220 specifically, Forecast International expects four A220-300 deliveries. The majority of narrowbody deliveries are expected to be from the A320neo Family, with three A319neos, 24 A320neos and 35 A321neos deliveries, or a total of 62 for the A320neo family. For widebodies we expect a total of five A350-900s, two A350-1000s and two A330-900neos to have been delivered.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.