Boeing Orders Continue to Outpace Airbus // Airbus Deliveries Rise but A350 Output Remains Weak

Turkish Airlines 787s. Image – Boeing

September 2025 Summary

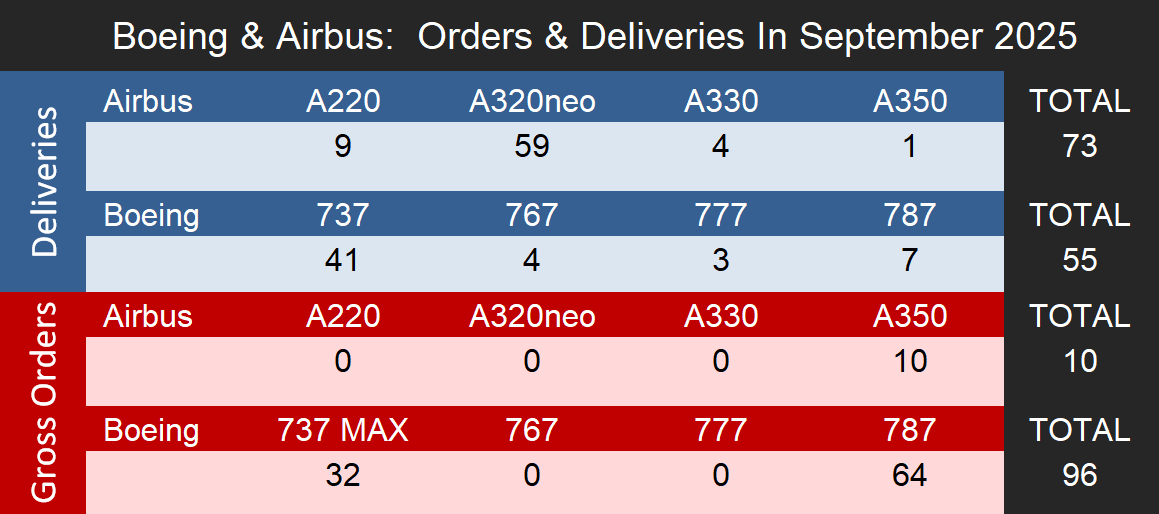

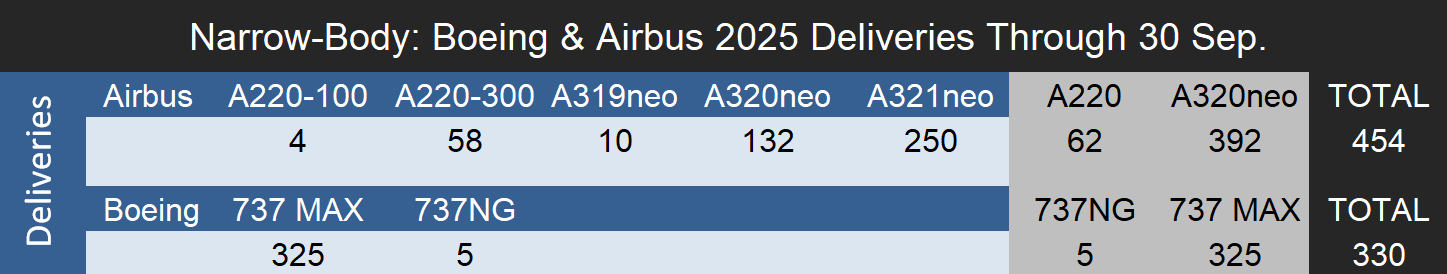

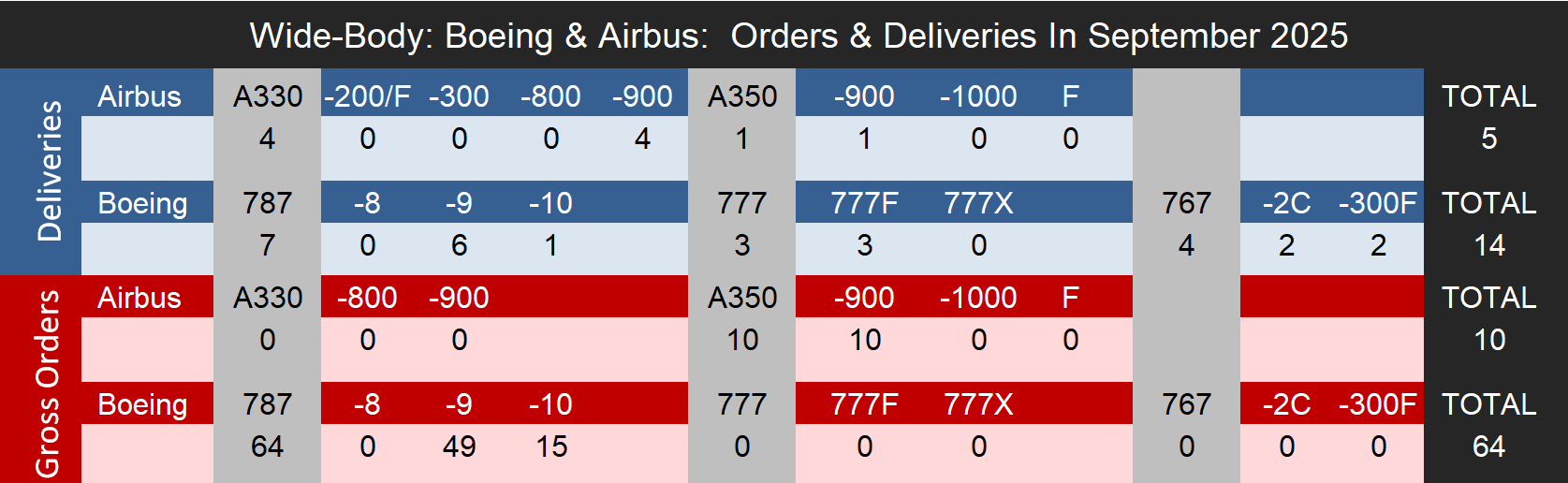

In September, Boeing delivered a total of 55 aircraft, including 41 narrowbodies and 14 widebodies, slightly below its August total of 57 deliveries. Airbus, meanwhile, handed over 73 aircraft, consisting of 68 narrowbodies and 5 widebodies, marking a notable increase from 61 deliveries in August. As of September 30th, Airbus has delivered 507 aircraft toward its 2025 target of 820, requiring an average of 104 deliveries per month over the remaining three months to meet its goal. Boeing has delivered 440 aircraft so far this year and, based on Forecast International’s projection of 590 total deliveries in 2025, will need to average 50 per month through year-end. While Airbus continues to push toward its ambitious annual target, Boeing remains focused on stabilizing production and maintaining quality across its commercial programs.

Notes:

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo.

Deliveries

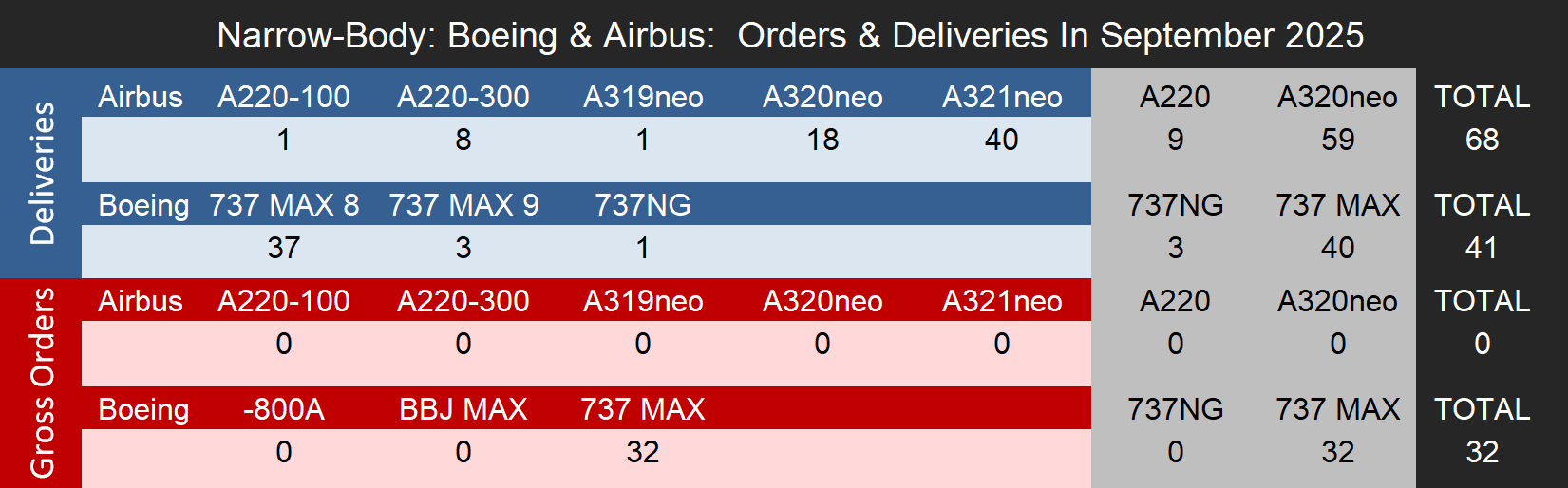

The 55 Boeing jets delivered in September included 40 737 MAXs, one 737NG, four 767s, three 777s, and seven 787s. Though Boeing has not released an official delivery target for the year, Forecast International expects around 590 deliveries from the OEM in 2025. Having delivered 440 aircraft through September 30th, Boeing needs to average 50 deliveries per month for the rest of the year to reach a total of 590, a feasible goal considering the manufacturer has already averaged 49 deliveries per month by September 30th. Forecast International believes that stabilized MAX production around 38 aircraft per month and the continued delivery of remaining MAX and 787 inventory through the end of the year will support this delivery number.

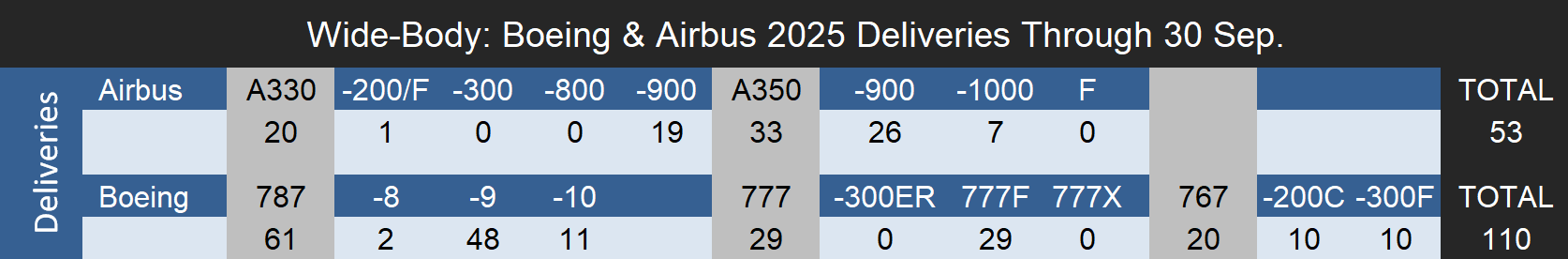

The 787 program continues to perform strongly from both a production and deliveries standpoint, with order activity for the aircraft also remaining robust in 2025. Boeing delivered a total of seven 787s in September, comprising six 787-9s and one 787-10. Deliveries are benefiting from a stabilized production rate of seven aircraft per month, along with the ongoing drawdown of remaining 787 inventory by year-end. With production now steady, Forecast International believes Boeing is well positioned to progress toward its goal of increasing 787 output to 10 aircraft per month during 2026.

Meanwhile, Boeing has delivered a total of 29 777s through September, or an average of around three aircraft per month, in line with the manufacturer’s production target rate of three 777s per month. Additionally, the first 777X delivery, which was scheduled for 2026 to Lufthansa, has now been pushed into 2027 due to ongoing certification delays.

In September, Airbus delivered 73 aircraft, including nine A220s, 59 from the A320neo family, four A330s, and one A350. The A350 program continues to face challenges, with an average of only 3.5 deliveries per month through the end of September. The A320neo family has also struggled, though Airbus managed to increase output during October. However, Forecast International believes that even the 59 A320neo deliveries in September are still insufficient to push Airbus towards its 2025 goal of 820 total deliveries, as the A320neo family will bear most of the burden in meeting this target.

We also remain somewhat surprised that Airbus has not revised its delivery goal downward, as it did in 2024, given that the company now must deliver an average of 104 aircraft per month over the final three months of the year. For comparison, as of September 30th, 2024, Airbus had delivered 497 commercial aircraft toward a lower annual goal of 770, requiring an average of 91 deliveries per month to meet that target. This does not necessarily mean we believe Airbus will completely miss its 2025 target, but rather that the required ramp-up will need to be even greater than last year’s. Another plausible scenario is that the manufacturer falls just short of its 820-aircraft goal, similar to 2024 when it delivered 766 aircraft against a target of 770.

In September, Airbus delivered nine A220s, consisting of one A220-100 and eight A220-300s. We consider production to be stabilized at around eight aircraft per month. Although deliveries have fluctuated throughout the year, nine deliveries represent a strong monthly showing for the program. However, an uptick in production will be necessary before we can expect a sustained increase in deliveries and meaningful progress toward Airbus’s goal of reaching a rate of 14 aircraft per month. So far, production has not exceeded eight units in a consistent or significant manner. Once production does increase, we anticipate deliveries will follow shortly thereafter. That said, we continue to view a 14-per-month rate as unviable over the long term given the current backlog. Airbus could, however, achieve this higher rate temporarily in order to make the program profitable.

On the widebody side, Airbus delivered only one A350-900 in September, bringing total A350 deliveries in 2025 to just 33 aircraft as of September 30. This represents an average of only 3.5 per month, well below the manufacturer’s targeted production rate of six aircraft per month. We view the A350 as a clear example of how Airbus has fallen short of its ambitious production and delivery goals this year. The company began 2025 with a goal of reaching a rate of 10 A350s per month by 2026 but later revised that target to a maximum of six per month for 2025. However, actual output has averaged below four aircraft per month through the end of September. Any near-term consideration of ramping up production to 10 per month is effectively off the table given the program’s current performance. The most immediate priority for Airbus is to first increase and then stabilize production at its existing target rate of six aircraft per month.

Orders

In September, Boeing recorded 96 gross orders, including 32 for the 737 MAX and 64 for the 787. Over half of these 96 orders include a sizeable order of 50 aircraft from Turkish Airlines, which included a mix of 787-9s and 787-10s. Year-to-date, Boeing has outpaced Airbus in gross orders, receiving a total of 821 gross orders through September 30th compared to 610 for Airbus. Meanwhile, Airbus saw a slowdown in orders in the month of September, receiving only 10 gross orders, a sharp decrease from the 99 orders received in the month of September.

- For consistency, this article does not include Boeing’s ASC 606 accounting adjustments and considers net orders as gross orders minus cancellations.

Backlog

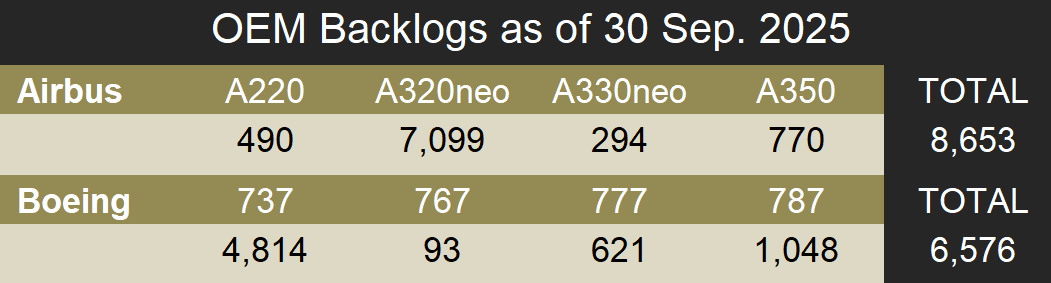

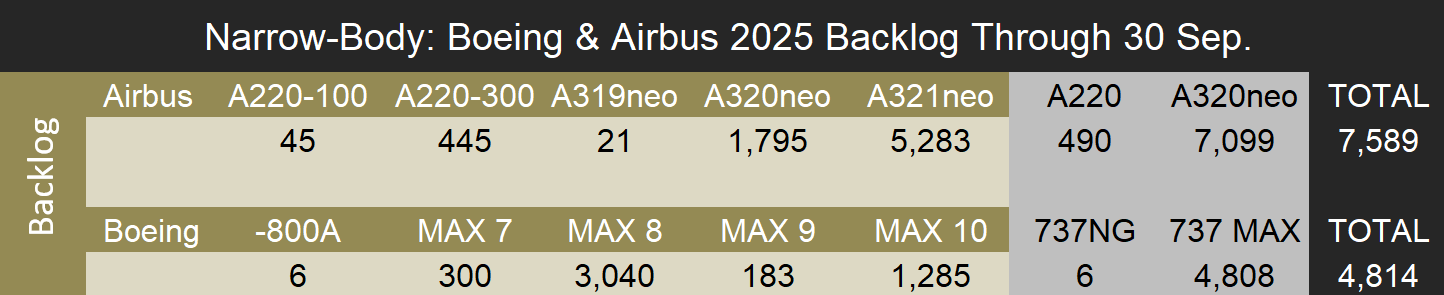

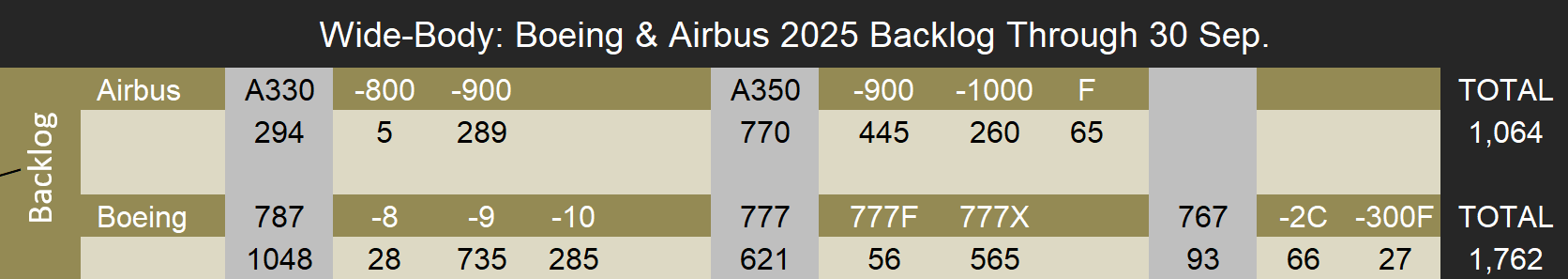

As of September 30th, 2025, Airbus reported a backlog of 8,653 jets, excluding the A320ceo and A330-200. Of this backlog, 7,589, or 87.7 percent, consisted of A220 and A320neo narrowbodies. Meanwhile, Boeing’s total unfilled orders before ASC 606 adjustments stood at 6,576 aircraft. Excluding the 737-700, 737-800, and 777-300ER, 4,814, or 73.2 percent, were 737 MAXs. Airbus’s backlog represents 10.6 years of production based on Forecast International’s 2025 production estimates, while Boeing’s backlog would last approximately 11.1 years.

- Airbus backlog numbers do not include A320ceo or A330-200 ghost orders.

- Boeing backlog numbers do not include 737-700, 737-800 or 777-300ER ghost orders.

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.