Airbus A320neo – Image – Airbus

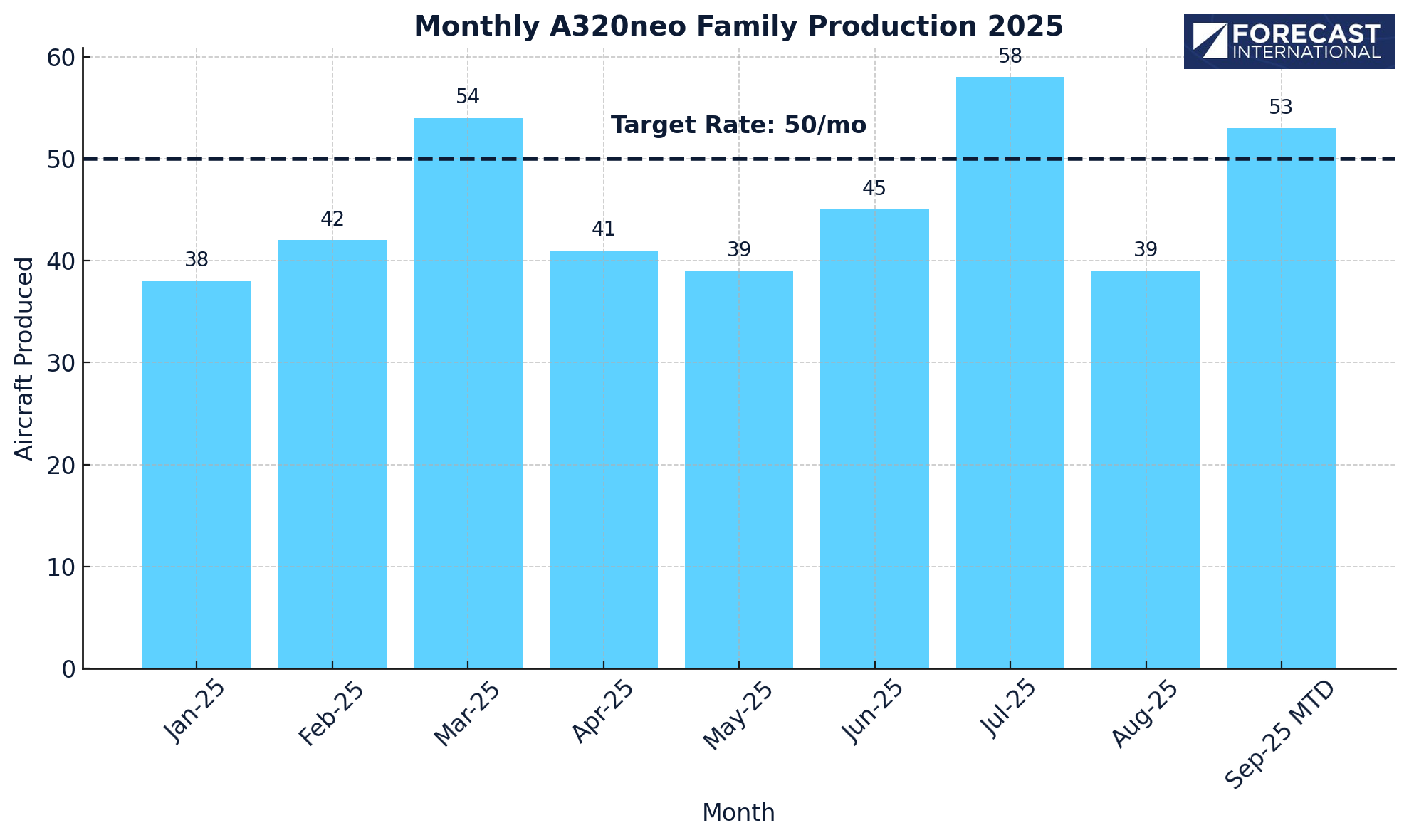

A320neo family production in the month of September is progressing significantly better than previous months, with 53 aircraft already completed through the 23rd. However, Forecast International believes that this pace alone won’t be enough for Airbus to meet its delivery target for the year. Just look at the numbers.

By August 31st of last year, Airbus had delivered 447 aircraft toward a full-year goal of 770, which had been revised down from 800. The company ultimately finished just short of that target, with 766 deliveries in 2024. This year, through August 31st, Airbus has delivered only 434 aircraft while pursuing an even higher target of 820 deliveries that it has not revised downward. The clock is ticking, and the production ramp-up required in the final months of 2025 will need to be even steeper than it was last year.

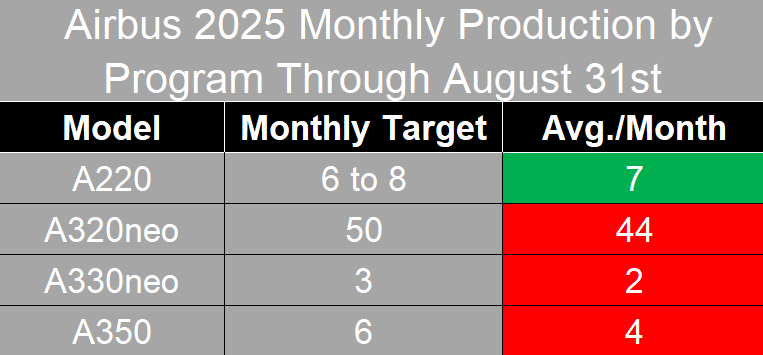

The remaining 386 aircraft needed to meet Airbus’ 2025 target equates to an average of 84 A320neos per month from September through December. This projection is based on current production rates for the A220, A350, and A330neo. However, this rate does not include the 60 engineless “gliders,” and it is unclear whether these aircraft will be delivered by year-end, though their delivery would significantly help Airbus move toward its goal.

The A320neo Family is carrying the bulk of Airbus’ delivery effort, as A350 production has struggled this year, averaging only four aircraft per month against a goal of six, despite initial plans to raise output to 10 per month by year-end. A220 production has stabilized at eight aircraft per month and has averaged 7 aircraft per month throughout 2025, but a significant increase in the remaining months of the year that could help Airbus meet its overall delivery target appears unlikely.

Note: Forecast International considers an aircraft to be produced upon its first test flight, and to be delivered upon contractual delivery by the manufacturer.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.