Boeing 787s – Image – Boeing

Forecast International has raised its production outlook for the Boeing 787 Dreamliner, pointing to strong order activity and Boeing’s investment in added capacity at its Charleston, South Carolina facility as catalysts.

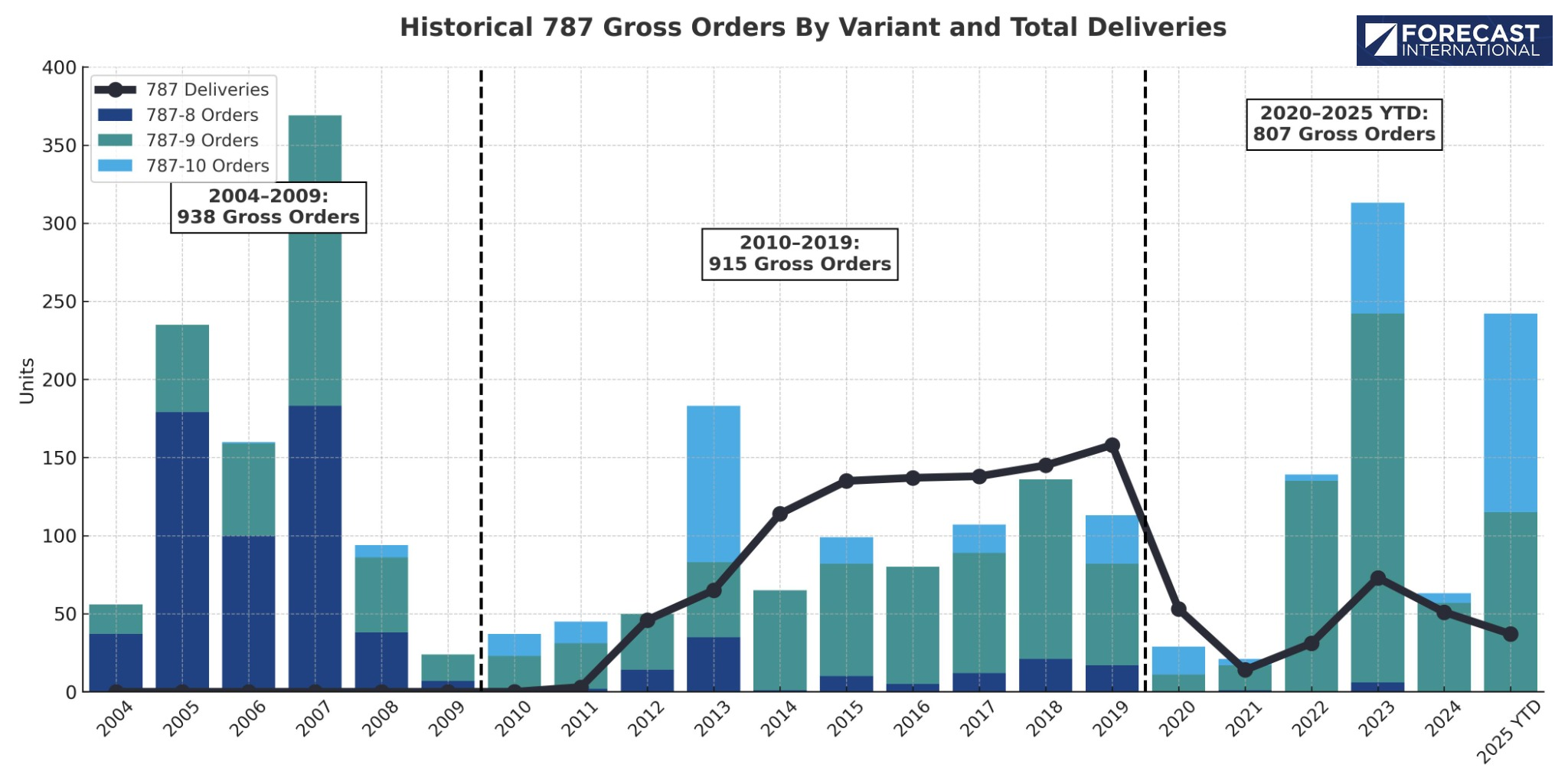

Between 2020 and July 31, 2025, Boeing secured 807 gross orders for the 787, nearly matching the 915 orders accumulated during the entire 2010–2019 period. More than 250 of those orders have been placed in 2025 alone.

The Dreamliner’s production story has been uneven. Boeing reached a high of 13 aircraft per month in 2019, but pandemic-related demand shocks and quality control issues forced a steep pullback. In early 2025, Boeing had been targeting just four to five aircraft per month, but production has now stabilized at around seven per month, ahead of plan and in line with the company’s stated goal of reaching that level by year-end.

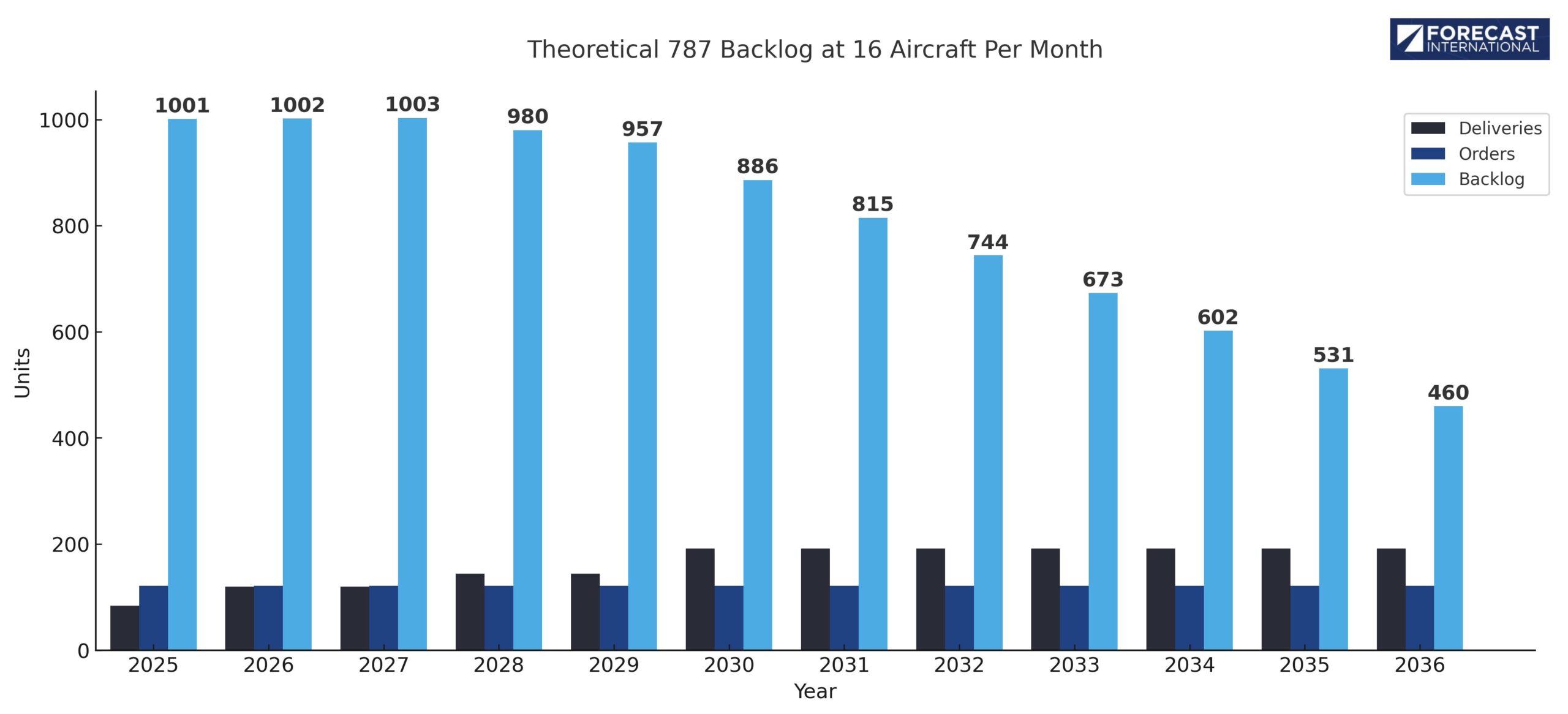

Boeing is aiming to lift output to 10 aircraft per month by 2027, while also studying a potential long-term rate of 16 aircraft per month. That target would be a substantial increase from the previously stated ceiling of 12, reflecting Boeing’s growing optimism about the Dreamliner’s long-term prospects. Forecast International is not yet projecting a rate of 16 aircraft per month but has raised its long-term outlook above 12 aircraft per month. We also acknowledge that a rate of 16 aircraft per month based on the current backlog, planned future production rate increases and their timing, and a historical average of 115 orders per year make this rate viable over the long-term.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.