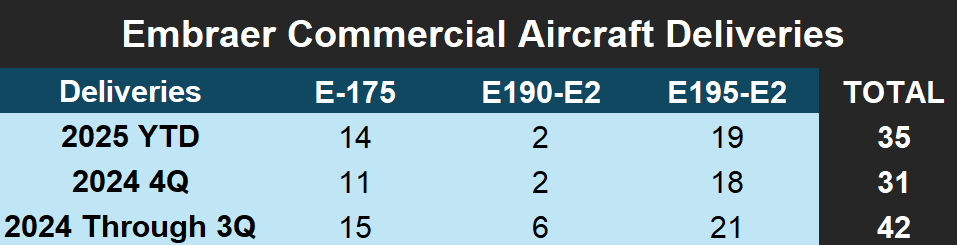

Embraer has delivered 35 commercial aircraft through September 15th, 2025, with a goal of delivering between 77 to 85 commercial aircraft this year. To meet the low end of this goal the company must deliver 42 more aircraft by year end, and to reach the high-end, it must deliver 50. Last year Embraer delivered 31 commercial aircraft in the fourth quarter, following 42 deliveries in the first three quarters, a total of 73 commercial aircraft deliveries in 2024. The manufacturer entered the year with a goal of 72-80 commercial aircraft deliveries but revised it down to 70-73 deliveries in November 2024.

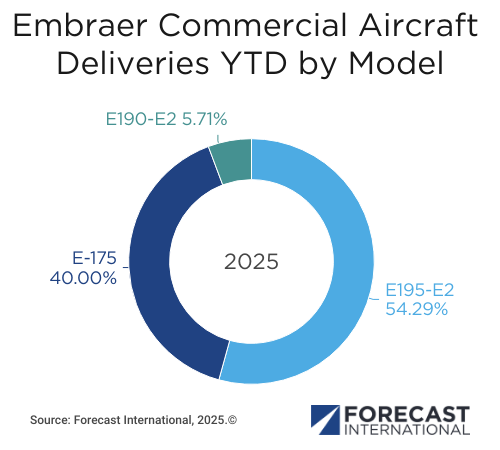

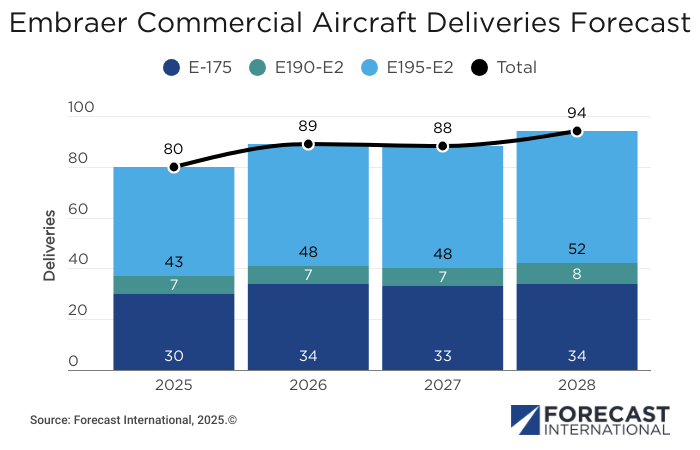

E195-E2 deliveries continue to show strength in 2025, a trend that is helping the program outpace the E-175, which faces ongoing delays of CF34-8E5 engines. As of September 15th, Embraer has delivered a total of 14 E-175s, two E190-E2s, and 19 E195-E2s. Embraer’s initial plans called for the E-175 to make up 35 percent of deliveries with the E2 making up the remaining 65 percent in 2025, but the current split has the E-175 at 40 percent and the E2 at exactly 60 percent of deliveries so far this year (54.3 percent E195-E2s and 5.7 percent E190-E2s). On the condition that the E-175 engine delays do not resolve in the fourth quarter, the E2 program will need to carry the weight of meeting the delivery target for 2025, and the 35-65 split between the E-175 and E2 Embraer was aiming for may not pan out. Our current forecast projects a total of 80 commercial aircraft deliveries for the year, consisting of 30 E-175s and 50 E2s.

Additionally, it’s more difficult to assess Embraer’s ability to meet their 2025 delivery goal because the company does not provide the same level of transparency as other manufacturers’ commercial aircraft production. While Boeing and Airbus production progress can be tracked through test flight data and other methods, Embraer obscures this information. As a result, it is not possible to determine when a specific aircraft has completed its first test flight or how it is progressing through the assembly and delivery process. Despite this lack of visibility, Forecast International believes that it is reasonable to assume Embraer may have difficulty in reaching even the low end of its delivery target for the year based on current delivery progress. We also believe it is possible the manufacturer will revise down or refine its delivery target to a tighter range for the year in the coming months, as it did in 2024.

The manufacturer recently announced a new target of 100 aircraft deliveries by 2028. This goal appears realistic given the company’s backlog and strong order activity for the E-175 and E2 programs but achieving this target will clearly depend on the health and recovery of the global supply chain. Our current forecast, based on a bottom-up analysis of each individual Embraer commercial aircraft program, currently projects deliveries to be in the mid-90s range for 2028.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.