Overture Airliner – Image – Boom Supersonic

Overture Airliner – Image – Boom Supersonic

Program Specifications

Boom Supersonic’s Overture is a high-speed commercial airliner designed to cruise at Mach 1.7 and reach altitudes of up to 60,000 feet. Capable of flying twice as fast over water and up to 50% faster over land than conventional aircraft, Overture offers a maximum range of 4,250 nautical miles (4,888 miles / 7,867 km) and will serve over 600 profitable routes globally. The aircraft measures 201 feet in length and is designed to carry 64 to 80 passengers in an all-business class configuration. The Symphony engine, which will power Overture, is also planned to be 100% sustainable aviation fuel (SAF) capable. Additionally, Boom is developing “Boomless Cruise” for Overture, which will make Overture capable of supersonic flight that minimizes or eliminates the sonic boom on the ground. This is achieved by flying at a specific speed and altitude where the shockwaves created by the aircraft refract upwards, avoiding the ground. The technology is enabled by Symphony and a computer system that adjusts flight parameters based on real-time weather data. Boom has stated that this this technology will allow Overture to fly up to Mach 1.3 with no audible sonic boom.

Status and Milestones

The Overture program is currently in the development and pre-production phase. The XB-1, a scaled-down supersonic demonstrator, completed its first supersonic flight on January 28, 2025. This marked the first time a privately developed supersonic jet broke the sound barrier since the Concorde. Boom plans to roll out the first full-scale Overture prototype by 2027, with certification and commercial entry into service targeted for around 2029 to 2030. However, Forecast International believes this is speculative and the timeline for entry into service will likely be pushed back into the 2030s considering the Symphony engine and Overture, which boom is developing itself, will take considerable time to certify as clean-sheet designs.

Overture Superfactory, Greensboro, Nc. Image – Boom Supersonic

Overture Superfactory, Greensboro, Nc. Image – Boom Supersonic

Meanwhile, Boom completed construction of the Overture Super factory in Greensboro, North Carolina in June 2024. This site will serve as the company’s final assembly line and production hub for Overture and according to Boom will have the capacity to produce 33 Overture aircraft annually. Boom also plans to add a second assembly line which will double production capacity to 66 aircraft per year and is currently installing tooling and planning for production operations at the facility. Given the current order book and the potential size for the supersonic commercial aircraft market, Forecast International believes that even a production rate of 33 aircraft per year is ambitious. However, at the same time Boom’s investment in such production capacity is a positive sign for Overture. It indicates the company expects order volume to increase as the aircraft achieves certification milestones and reflects confidence in the existence of a substantial market for Overture.

Stakeholders and Suppliers

Overture

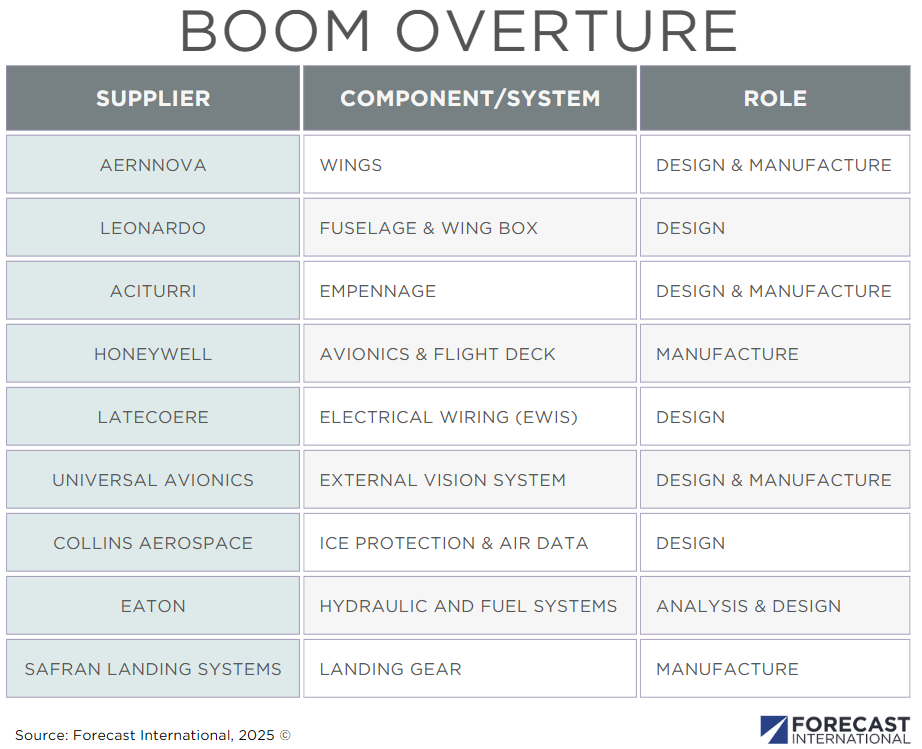

As a clean-sheet supersonic aircraft design, Boom Supersonic has assembled a consortium of aerospace firms to support the development of Overture. This ground-up approach allows Boom to optimize every aspect of the aircraft. However, it also presents potential technical and engineering challenges, along with regulatory obstacles during the certification process. Delays in certification or in the integration of systems developed or provided by suppliers could impact the overall development schedule and postpone the aircraft’s entry into service. Furthermore, any misalignment in timelines among these interdependent suppliers or delays in obtaining regulatory approvals could create ripple effects throughout the program, resulting in broader setbacks.

Symphony

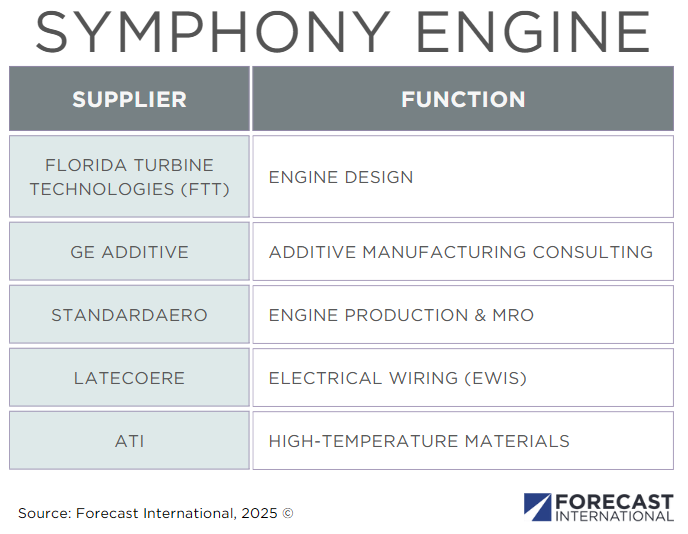

The Symphony engine is a clean-sheet design medium-bypass turbofan capable of supersonic cruise without afterburners. Overture will be fitted with four symphony engines, each producing 40,000 pounds of thrust at takeoff. The absence of afterburners is an essential feature to meet modern environmental and noise standards required for Overture. Boom supersonic is designing and developing the engine itself after Rolls Royce, whom Boom previously partnered with, announced that it would not be continuing further development of an engine for Overture, citing that the supersonic jet market was not a priority for the company at the time. The capital requirements for the research and development of a supersonic engine make it unlikely any major engine OEM would be able to make an attractive return on their investment for such a niche aircraft with a limited market size.

As a result, the Symphony engine will not be developed by external suppliers in the traditional sense. Instead, Boom retains direct control over the engine’s design, development, and certification, while also leveraging input from a select group of strategic collaborators. Florida Turbine Technologies (FTT) is providing engineering support in the design phase and 9helping to build early test units. GE Additive is offering consulting on how to optimize key components through 3D printing techniques and StandardAero will assist Boom with engine assembly and MRO (maintenance, repair, and overhaul) support. While this approach appears to be the most practical path for developing an engine for Overture, it could still present significant challenges. Any delays or misalignment in production or testing schedules may pose risks to the overall Overture timeline. Integrating new manufacturing methods such as additive design, ensuring materials meet performance and certification standards, and coordinating partner timelines with Boom’s production objectives could all contribute to delays. Additionally, since the engine is a clean-sheet design, it is likely that engineers will encounter design issues and will need to resolve unforeseen flaws during development.

Market Prospects

Conceptual render of Overture United aircraft. Image – Boom Supersonic

Conceptual render of Overture United aircraft. Image – Boom Supersonic

Customers and Orders

Boom Supersonic has yet to secure significant commercial success, with only 130 total options or orders for its Overture aircraft as stated on the company’s website. This includes a firm order and purchase agreement for 15 aircraft from United Airlines, with options for 35 more, announced in June 2021. In August 2022, American Airlines placed a deposit on up to 20 aircraft, with an option for 40 additional units. In 2017, Japan Airlines entered into a strategic partnership with Boom and is assumed to hold options for 20 aircraft. While these announcements have generated considerable attention, it is important to note that most of these commitments remain conditional, largely in the form of options rather than firm orders and are contingent on Overture achieving key developmental and operational milestones.

The speculative nature of these orders is not unprecedented. During Concorde’s development, it was believed there was demand for up to 350 supersonic aircraft. Over 100 option orders were placed by major airlines; however, in the end, only 14 Concordes were ever delivered to two commercial operators, Air France and British Airways. While there is hope that additional orders may be secured for Overture, it is critical to recognize that the commitments from American, United, and Japan Airlines are speculative and may not be fully realized. Additionally, Forecast International does not expect the Overture orderbook to grow to the scale of a traditional commercial jetliner, given the aircraft’s niche market and limited operational utility for most airlines. However, we do not feel it is fair to compare Overture to Concorde in this since due to Overture’s focus on a lower price point and more efficient operating economics. It still remains possible that the order book will grow and the aircraft will become a clear commercial success, though this depends on Boom’s execution and ability to deliver on its vision.

Challenges and Opportunities

For airlines to convert their options into firm purchases and for Boom to attract new orders, the company must demonstrate technological maturity through successful development, flight testing, and eventual certification of the Overture. As of now, the aircraft has yet to fly. While Boom has developed a demonstrator model, the XB-1, the first flight of the Overture itself is not expected until at least 2027, with type certification at the earliest in 2029.

Regulatory approval and certification of Overture and the Symphony engine may also present challenges. However, the most significant obstacle is the ban on supersonic flight over land in the United States. In June 2025, the Trump administration issued an executive order directing the FAA to lift restrictions on supersonic flights within U.S. airspace. This development is highly favorable for Overture, as it expands the route networks airlines can operate with the aircraft, significantly strengthening its business case.

Equally important is the need for a viable business model. One of Concorde’s most significant shortcomings was its inability to consistently make a profit. Boom must demonstrate that Overture can operate with acceptable ticket pricing, high utilization rates, and manageable operating costs, which is a key advantage Boom holds over its supersonic predecessor. While Concorde was only viable for the ultra-wealthy, with roundtrip fares between New York and London exceeding $10,000 in today’s dollars, Boom aims to price Overture tickets closer to business class fares, around $5,000 for a roundtrip transatlantic flight. If this pricing proves sustainable, it could make supersonic travel accessible to a broader segment of premium travelers. This, in turn, would increase passenger volumes, improve route profitability, and make investment in Overture more attractive to airlines. However, achieving and maintaining this price point will require a tightly managed operational cost structure, which is a major challenge for any supersonic aircraft.

Given these challenges, the likelihood of major new orders in the near term appears low to moderate. Many airlines are likely to adopt a cautious, wait-and-see approach until a flying prototype is available, and performance data can be evaluated. If Boom makes tangible progress in the next few years, particularly in flight testing and certification, the aircraft will become a significantly more viable option for operators.

Forecast International’s Outlook

Boom Supersonic’s Overture program stands at pivotal crossroads, with its future shaped by the complex relationship of technological execution, regulatory progress, and market receptiveness. Once Boom can successfully navigate the considerable technical challenges of developing both the clean-sheet design Overture airframe and the in-house Symphony engine, it will introduce a new era of economically viable high-speed commercial air travel. A successful first flight and steady progress toward certification will validate Boom’s engineering roadmap and will serve as an inflection point that will turn speculative interest into an operational reality. However, Forecast International believes that the goal of a first flight in 2027 and type certification by 2029 is unlikely to be achieved and will likely be pushed back due to the complexities involved in designing and certifying Overture and Symphony.

Should Boom meet these milestones, it could gradually expand production, scale deliveries from its Greensboro facility, and position itself as the cornerstone of a new supersonic ecosystem, one potentially large enough to justify partnerships, future derivatives, or even competition. On the other hand, if development delays continue to accumulate, if certification proves more difficult than anticipated, or if the Symphony engine fails to meet its promised performance and emissions standards, early commitments from airlines could be withdrawn. Such setbacks may erode investor confidence and leave Boom struggling to maintain momentum in the face of the immense capital demands associated with aircraft design, certification and production.

Nevertheless, Forecast International maintains a generally optimistic outlook for the Overture program. We hope that the aircraft will enter service with at least a limited number of operators. To date, over $600 million in capital has been invested in the development of both the Overture aircraft and the Symphony engine. Boom’s collaboration with several major players in the commercial aerospace industry further strengthens the likelihood that the aircraft will eventually take to the skies. However, the next five to seven years will pivotal and determine whether Overture becomes a symbolic niche achievement in aviation history or evolves into a widely adopted and commercially viable supersonic platform.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.