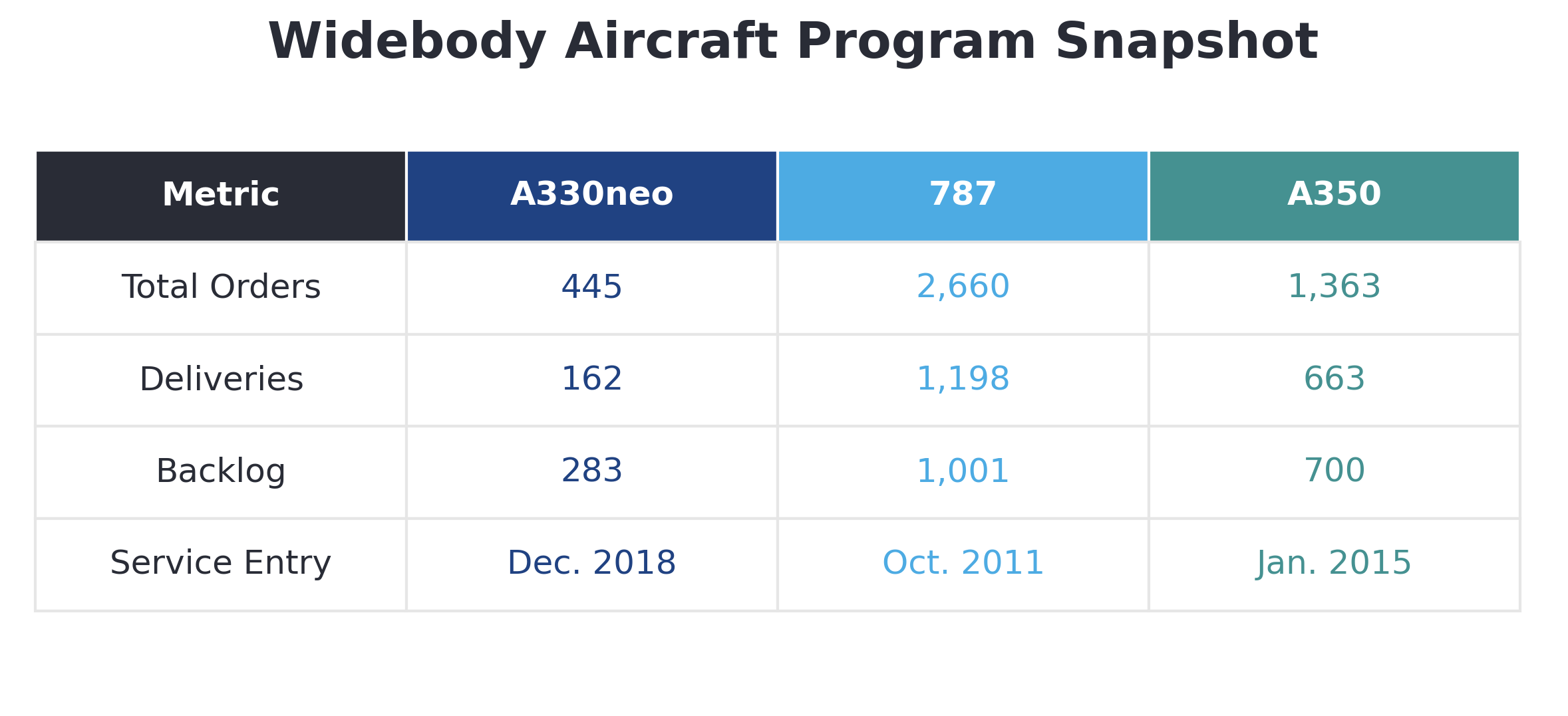

As of June 2025, there are 283 A330neo aircraft on order, with a total of 445 gross orders for the type. This is the lowest among all current generation widebody aircraft in service, including the A350 and the 787. It also trails the 777X, which has not yet entered service but has already secured 610 gross orders and 551 unfilled orders as of the end of June 2025.

At first glance, the A330neo seems to have underperformed compared to its competitors in the widebody segment. But don’t count it out just yet — here’s why.

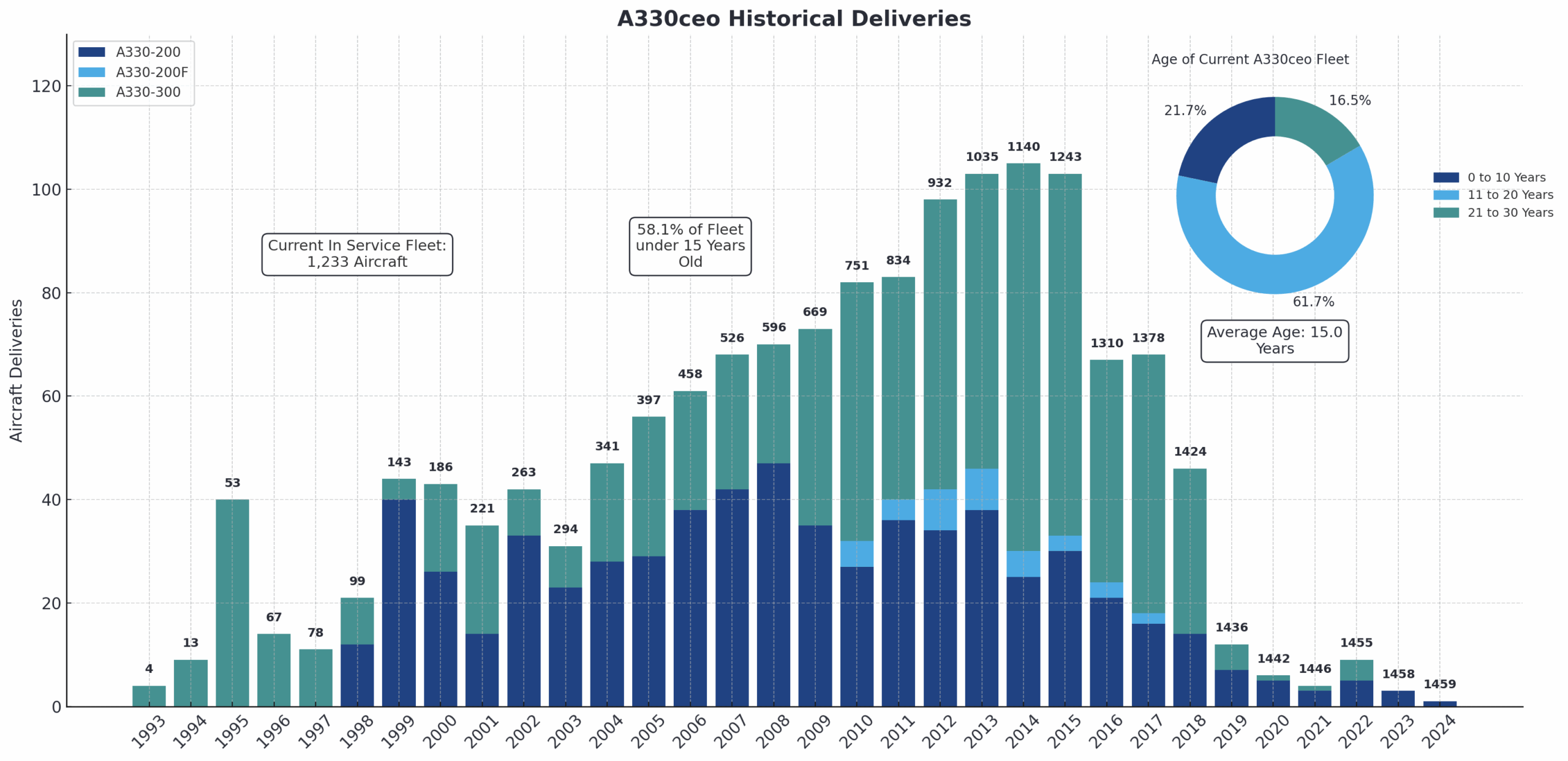

The broader context of the A330 program adds dimension to this story. The in service A330ceo fleet has an average age of approximately 15 years. About 58 percent of that fleet is younger than 15 years, and 83 percent is younger than 20. Considering the typical lifespan of a widebody aircraft spans at least 25 years, most A330ceo operators are not yet in a fleet replacement window. As a result, near term demand for the A330neo has been naturally constrained by the age profile of the current ceo fleet. But that doesn’t mean the A330neo is out of the picture. As the ceo fleet continues to age, operators with large A330 footprints will be looking for a replacement, and it will likely be the A330neo.

Additionally, Airbus announced during its second quarter earnings call that it now aims to increase A330neo production to approximately five aircraft per month by 2029. This is an increase from the previous target of four aircraft per month, when the company had only stated its intention to stabilize production at that rate. This is likely a result from strong recent order numbers, (82 net orders in 2024 and 71 net orders through the first half of 2025), and Airbus’ expectation or knowledge that current A330ceo operators will chose the A330neo as a replacement.

Forecast International’s outlook for the aircraft is positive, and we expect continued momentum in order activity and backlog growth to support the planned future production rate of five aircraft per month. We also believe it is likely that the A330neo will be adopted as a replacement by a large portion of current A330ceo operators in addition to receiving interest from new customers.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.