Boeing Hits 737 MAX Output Target of 38 for Second Time This Year /// Airbus A320neo Family Production Picks Up /// 787 Output Rises Above Target Rate for Second Consecutive Month

For the purposes of this article, Forecast International considers an aircraft to be “produced” once it completes its first test flight, and “delivered” when it is contractually handed over to the customer.

Overview

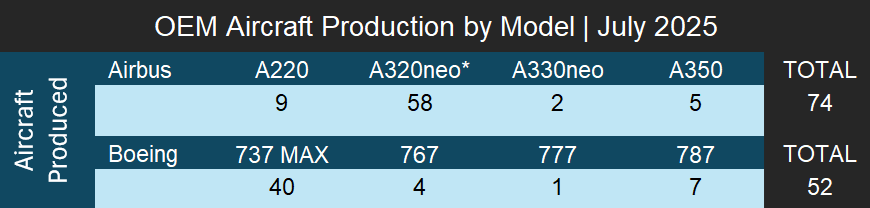

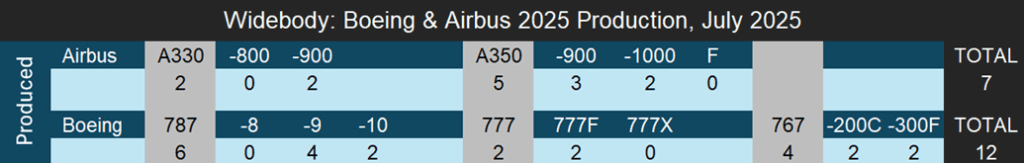

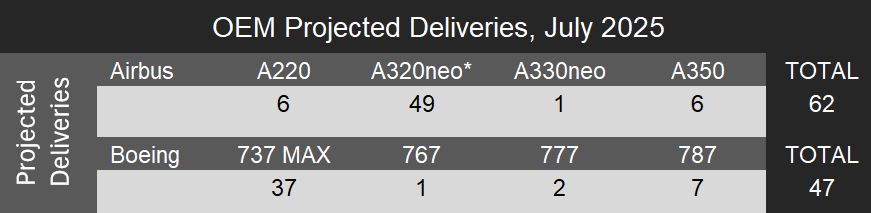

Airbus led the month in total production, completing 74 aircraft, followed by Boeing with 52, resulting in a combined total of 126 aircraft. Of these, 111 were narrowbody aircraft, while the remaining 15 were widebodies. On the delivery side, Forecast International expects Boeing to have delivered a total of 47 aircraft in July, including 37 737 MAXs and the remaining 10 as widebodies. For Airbus, we estimate total deliveries of 62 aircraft, comprising 55 narrowbodies and seven widebodies. 49 of the narrowbodies are expected to be A320neo family aircraft, and the remaining six are expected to be of the A220 family.

• Production data represents the actual number of aircraft produced in July 2025. Forecast International considers an aircraft produced upon its first flight.

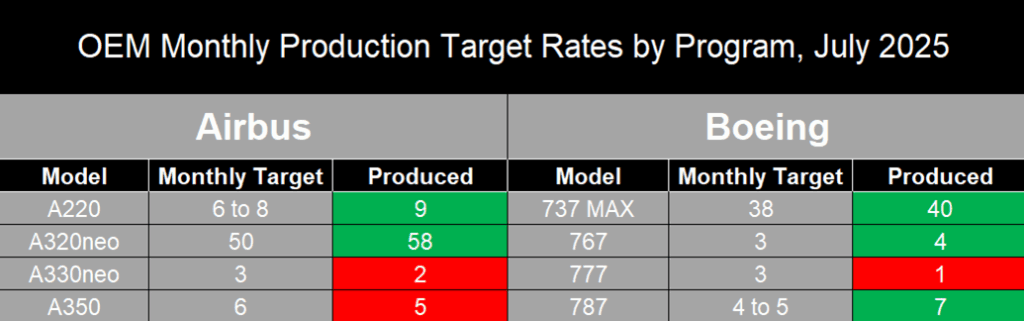

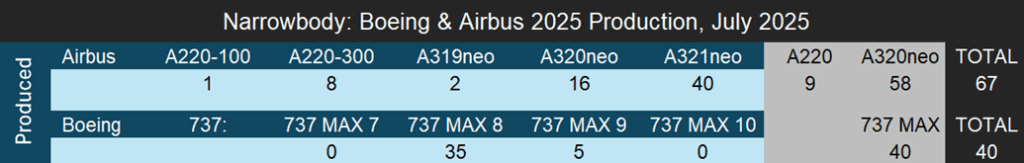

*A320neo numbers include all variants for the family; A319neo, A320neo and A321neo.

Airbus production of the A320neo family finally reached, and even slightly exceeded, 50 aircraft per month in July, following months of struggle earlier in the year to stabilize output at that level. The company also produced nine A220s during the month. On the widebody front, Airbus completed two A330neos and five A350s. Boeing’s July production was dominated by the 737 MAX, with 40 units completed, along with four 767s, one 777, and seven 787 Dreamliners.

The Airbus A320neo Family showed encouraging signs of ramping up production, with Airbus producing a total of 58 aircraft in July, exceeding its target production rate of 50 aircraft per month. However, output has generally fallen short throughout the year, and we have yet to see it stabilize around 50 aircraft per month. Whether Airbus can consistently get A320neo family production stabilized at 50 per month, or if the strong July numbers are a shot term spurt or increase, will be determined in the coming months. Additionally, given that that we are 7 months into the year and Airbus has not been able to consistently meet this rate, Forecast International has slightly lowered our delivery forecast for the aircraft in 2025. Airbus produced 46 A320neo Family aircraft in March, 40 in April, 39 in May, and 46 again in June. While this trend is encouraging for the program, we do not yet view it as a catalyst for raising production beyond the 50 aircraft per month level. In our view, Airbus would need to consistently stabilize production at around or above 50 units per month before any meaningful move toward its long-term goal of 75 aircraft per month becomes realistic.

However, during Airbus’ first half results call, CEO Guillaume Faury stated that the manufacturer’s delivery guidance for 2025 remains unchanged and that it still expects to deliver 820 commercial aircraft. That said, production is rarely linear or consistent throughout the calendar year. Airbus has demonstrated in past years the ability to significantly ramp up output in the third and fourth quarters, and we expect a similar pattern to emerge this year. Though the ramp up may be insufficient for Airbus to achieve its goal of producing an average of 50 A320neo aircraft per month across the entire year, or a total of 600 units, it is not beyond the realm of possibility. As of August 1st, achieving this goal means producing and delivering an average of 64 units per month through the end of the year. Additionally, If Airbus can produce and deliver the 60 engineless “glider” neos by the end of the year, this would likely help put them in the range of delivering 600 neos in 2025.

On the other hand, with A220 production now stabilized at eight aircraft per month, the case for gradual increases in output is beginning to take shape. In July, Airbus produced nine A220s, consisting of one A220-100 and eight A220-300s. While this uptick is a positive sign that production may be rising above the current rate, we maintain the firm view that Airbus’ stated goal of ramping up to 14 aircraft per month by 2026 is unlikely to be achieved. That said, this does not rule out further growth. Airbus appears committed to reaching the 14 per month rate as a key milestone in making the program profitable. Still, even if that target is met, we believe it is unlikely to be sustainable over the long term. The current backlog of just over 500 aircraft, combined with relatively subdued order activity, presents a significant headwind.

There is also ongoing speculation about the potential launch of a stretched A220-500 variant, which could meaningfully boost demand and alter the outlook for sustaining higher production rates. However, for now, we maintain our view that the existing unfilled order book does not support a long-term output of 14 aircraft per month.

A350 production remains subdued, with Airbus producing five aircraft in July, slightly below its current target of six aircraft per month. We believe Airbus will gradually increase output as supply chain conditions improve, but the timeline for reaching the planned rate of ten aircraft per month, originally targeted for the end of this year, is highly uncertain. The manufacturer has also stated its intention to reach a rate of twelve aircraft per month by 2028, though that goal likewise remains uncertain.

Regarding the A330neo, Airbus produced two aircraft in July, falling short of its current monthly target of three to four aircraft. The company has not announced any plans to increase production in the near term or the long term but has stated that it aims to stabilize output at four aircraft per month. However, Forecast International expects this to change as the existing A330ceo fleet continues to age. Once most A330ceo aircraft begin to reach their replacement window, we anticipate that a significant number of current operators will opt for the A330neo as a replacement. This would likely drive increased orders and higher production volumes later in the decade and into the 2030s.

Boeing reached its FAA approved production rate of 38 737 MAX aircraft per month for the second time this year, having first achieved this rate in May and producing 35 MAXs in June. Of the 40 737 MAX aircraft produced in July, 35 were 737 MAX 8 models and five were 737 MAX 9 models. It is unclear why the 38 per month cap was exceeded, but it may be related to how production is measured. Since 35 aircraft were produced in June and 40 in July, it is possible that production is not calculated strictly on a calendar month basis, or that the definition of a produced aircraft varies from that of Forecast International.

Regardless, this development is a positive indication of production stability for the MAX program and strengthens the case for FAA approval to increase output to 42 aircraft per month, though the exact timing of such approval remains unknown. Boeing has also stated a long term goal of producing 52 737 MAX aircraft per month. Based on the current backlog and the expected ramp up of MAX 7 and MAX 10 production once certification is secured, this goal appears viable. However, the timeline remains uncertain, and Boeing has not provided official guidance on when it expects to reach that rate. Certification for the MAX 7 and MAX 10 was also recently pushed to 2026, as Boeing continues to face challenges in resolving issues with the de-icing system on the LEAP-1B engines.

Boeing’s widebody programs continue to show signs of stability, supporting the case for a potential increase in production, particularly for the 787. In July, Boeing produced seven 787s, exceeding its current target of approximately four to five aircraft per month. This follows the production of six aircraft in June. The company has stated its intention to raise 787 output to seven aircraft per month by the end of the year and to ten per month by 2026. Given that Boeing has produced above its target for two consecutive months, while also delivering aircraft from its existing inventory and maintaining stable production, we believe it is increasingly possible that the manufacturer could reach the seven per month rate by year end. However, we remain cautious about Boeing’s ability to sustain and stabilize production at that rate by the end of the year.

In contrast, the 767 program produced four aircraft in July, while only one 777 freighter was completed. We do not anticipate any increases in production rates for either platform. Production of the 767-300 freighter is scheduled to end in 2027, and the 777-8 freighter is not expected to enter service until later in the decade. The 777X is still awaiting certification, which Boeing aims to secure this year, although a delay into 2026 remains a possibility.

Unofficial/Preliminary Deliveries

Forecast International expects Boeing to have delivered an estimated 47 aircraft in the month of July 2025. The 37 narrowbodies expected to have been delivered account for 35 737 MAX 8s and two 737 MAX 9s. On the widebody side, Forecast International expects Boeing to deliver an estimated seven 787s; five 787-9s, one 787-8 and one 787-10. We also expect Boeing to have delivered two 777Fs and one 767-300F.

*A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

Forecast International expects Airbus to have delivered a total of 62 aircraft in July 2025. As for the A220 specifically, Forecast International expects five A220-300 and one A220-100 deliveries. The majority of narrowbody deliveries are expected to be from the A320neo Family, with 18 A320neos and 31 A321neos deliveries, or a total of 49 for the A320neo family. For widebodies we expect a total of four A350-900s, two A350-1000s and one A330-900neo to have been delivered.

Aerospace OEMs and their suppliers are currently navigating a challenging environment marked by supply chain disruptions and fluctuating markets. These pressures are intensified by ongoing issues like tariffs on materials and components, which could drive up manufacturing costs and complicate international production. To help manage these complexities, Forecast International’s Platinum Forecast System offers customized assessments designed to quickly pinpoint both risks and future opportunities within this dynamic landscape. Click here to book a demo with a Forecast International expert today.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.