Boeing misses its target of 38 737 MAXs but maintains stable widebody production /// Airbus continues to struggle with A320neo output, though strong A220 deliveries appear likely

Overview

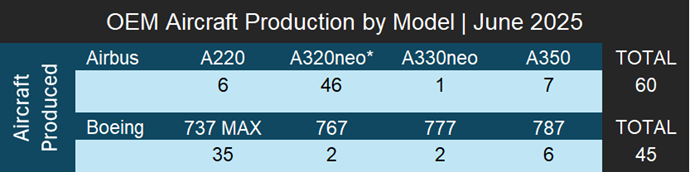

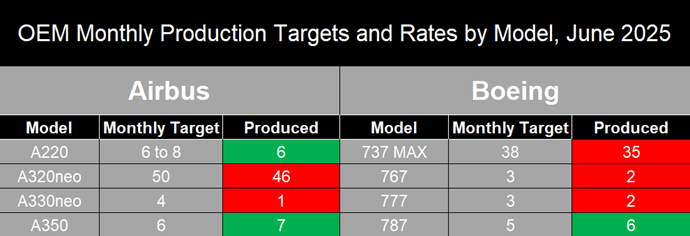

Airbus led the month in total production, completing 60 aircraft, followed by Boeing with 45, resulting in a combined total of 105 aircraft. Of these, 87 were narrowbody aircraft, while the remaining 18 were widebodies. Airbus is still grappling with engine delays from Safran affecting its A320neo family and said that it has approximately 40 produced engineless aircraft. However, the manufacturer does not believe this will impact its ability to meet its delivery targets for 2025. Boeing fell short of its maximum 737 MAX production rate but is showing signs of stabilization in production, whereas Airbus A320neo production picked up from May, though still below its target of 50 A320neo aircraft per month.

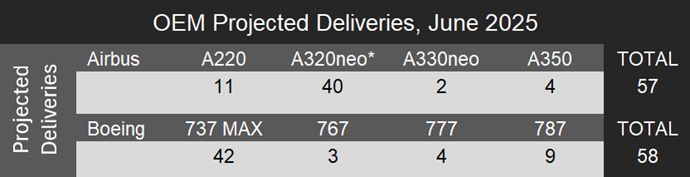

On the delivery side, Forecast International expects Boeing to have delivered a total of 58 aircraft in June, including 42 737 MAXs and the remaining 16 as widebodies. For Airbus, we estimate total deliveries of 57 aircraft, comprising 51 narrowbodies and six widebodies. Only 40 of the narrowbodies are expected to be A320neo family aircraft, though A220 deliveries for the month are expected to be strong at 11 aircraft.

*A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

Forecast International has officially reduced its A320neo deliveries forecast for the year as A320neo family production continues to show signs of stagnation, with only 46 units produced in June, below the manufacturer’s target of 50 aircraft per month. Airbus also produced six A220 models in June. On the widebody side, one A330neo and seven A350s were produced. For Boeing, production was dominated by the 737 MAX, with 35 units completed. The company also reported two units of the 767, two of the 777, and six of the 787 Dreamliner.

The Airbus A320neo Family program continues to fall short of its monthly production rate target of 50 units and production has continued to show signs of stagnation in the past four months, causing Forecast International to slightly reduce our deliveries forecast for the aircraft this year. Airbus produced a total of 46 A320neo family aircraft in March, 40 in April, 39 in May, and 46 again in June. Though Airbus CEO Guillaume Faury stated that Airbus is confident in reaching its target and that the lower production numbers are not a call for concern considering the manufacturer has 40 engineless but produced A320neos it expects to be able to deliver by the end of the year, Forecast International doubts that this amount will make up the gap between the current trajectory of A320neo production and deliveries this year and our previous forecast. Our previous forecast assumed an average delivery rate of approximately 52 aircraft per month, or 625 units for 2025, where as in the first six month of the year, Airbus has only delivered an average of 38 A320neo aircraft per month through the end of June. This means averaging just under 62 A320neo family deliveries per month for the remainder of the year, which the 40 engineless aircraft will not fully make up for.

However, Airbus has ramped up production sharply in previous years during the third and fourth quarters, which we expect to occur again this year. However, we still believe the ramp-up will not be sufficient for Airbus to meet its goal of an average of 50 A320neo aircraft per month, or 600 units for the year.

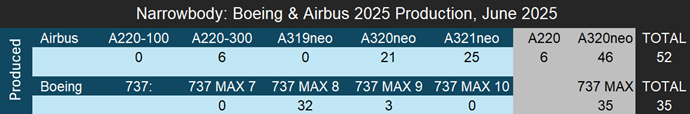

On the other hand, the A220 program has stabilized at around six to eight aircraft per month, which supports the case for a further increase in output as the year progresses. In June, Airbus produced a total of six A220s, all of which were A220-300s. While this is a positive development, we view it as highly unlikely that Airbus will achieve its target of ramping up production to 14 aircraft per month by 2026. Forecast International considers this goal unlikely due to persistent supply chain challenges and current production levels remaining between six and eight aircraft per month. Furthermore, if Airbus does go forward with increasing output to 14 aircraft per month, assuming supply chain conditions allow, such a rate would likely be unsustainable over the long term given the program’s current backlog of just over 500 unfilled orders. However, Airbus does seem intent on increasing production to 14 per month in the short term, primarily driven by the goal of making the program profitable. At current production and delivery rates, Airbus essentially loses money on each A220 that it delivers.

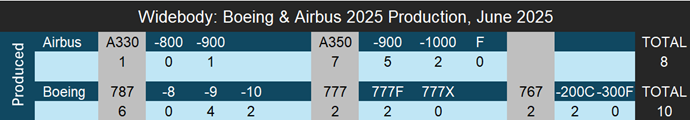

A350 production picked up in the month of June, with Airbus producing seven aircraft after only producing one in the month of May. Airbus has set a goal to increase A350 output to ten aircraft per month by 2026 and to twelve per month by 2028. Forecast International also views this as unlikely based on the low production figures for the year and the company’s February announcement that A350 output would be limited to around six aircraft per month throughout 2025. We believe Airbus will gradually increase production as supply chain conditions improve, but not within the timeframe it has outlined. As for the A330neo, Airbus produced a total of only one aircraft in June, under its current target rate of four aircraft per month. Airbus has not announced any plans to increase A330neo production in the near or long term, but stated during its first quarter 2025 earnings call that it is focused on stabilizing output at four aircraft per month, a target it is already approaching based on year to date monthly production figures.

Boeing finally reached its FAA-approved production rate of 38 737 MAX aircraft per month in May, but fell short of this rate with only 35 MAXs produced in the month of June. Of these, 32 were 737 MAX 8s and three were 737 MAX 9s. While these numbers are positive signs for 737 MAX production, we would need to see Boeing consistently produce between 36 to 38 MAXs per month to warrant the FAA to permit an increase in production to 42 aircraft per month. Doing so will require the company to formally request an increase in its FAA authorized production ceiling, a process that will occur through multiple incremental steps aimed at eventually reaching 52 aircraft per month. If Boeing is able to sustain output at or near 38 aircraft per month over the coming months, it would signal production stability and strengthen the case for FAA approval of a higher rate.

On the other hand, Boeing’s widebody programs continued to show stability in June. The 787 program produced six aircraft during the month, above its current target of approximately four to five aircraft per month. However, Boeing is still delivering the remaining aircraft in its 25 unit inventory of previously produced 787s, and plans to have delivered all of these aircraft by the end of the year. Boeing has stated its intention to raise 787 output to seven aircraft per month by the end of the year and to ten per month in 2026. Forecast International believes that it is possible for Boeing to achieve seven aircraft per month by the end of the year, though it does not expect Boeing to be able to stabilize production at this rate by then. Meanwhile, the 767 program produced two aircraft in May, while two 777 freighters were completed. We do not anticipate any future increases in production rates for either platform, given that 767-300F production is scheduled to end in 2027 and the 777-8 freighter is expected to enter service near the end of the decade. Boeing also has 26 specific units of the 777X on its assembly line, not including its four test aircraft. The 777X is still awaiting certification, which Boeing expects to obtain this year, although it is possible that certification will be delayed into 2026.

Unofficial/Preliminary Deliveries

Forecast International expects Boeing to have delivered an estimated 58 aircraft in the month of June 2025. The 42 narrowbodies expected to have been delivered account for 40 737 MAX 8s and two 737 MAX 9s. On the widebody side, Forecast International expects Boeing to deliver an estimated nine 787s; seven 787-9s and two 787-10s. We also expect Boeing to have delivered four 777Fs, two 767-300F, and one 767-2C.

Forecast International expects Airbus to have delivered a total of 57 aircraft in June 2025. As for the A220 specifically, Forecast International expects 11 A220-300 deliveries. The majority of narrowbody deliveries are expected to be from the A320neo Family, of which an estimated one will be an A319neo, 20 A320neos and 19 A321neos, or a total of 40 for the A320neo family. For widebodies, we expect a total of four A350-900s and two A330-900neos to have been delivered.

Summary and Outlook

June 2025 saw ongoing production difficulties for both Airbus and Boeing, with Airbus continuing to fall short of its A320neo family target rate, while A220 output remained steady but showed no signs of scaling up. Boeing’s 737 MAX production showed some consistency but still fell short of the FAA-approved rate, and while widebody output was stable, deliveries were supported by previously built inventory rather than new production.

Looking ahead, Forecast International expects production challenges to remain in place through the summer. Both manufacturers face limited room for error as they work to make up for a relatively slow start to the year. Airbus will likely continue pushing for gradual improvements in narrowbody output and seek better stability in A350 production, while Boeing’s path depends heavily on sustained narrowbody production near the upper end of its current ceiling, along with inventory clearance and regulatory progress of uncertified variants.

Aerospace OEMs and their suppliers are currently navigating a challenging environment marked by supply chain disruptions and fluctuating markets. These pressures are intensified by ongoing issues like tariffs on materials and components, which could drive up manufacturing costs and complicate international production. To help manage these complexities, Forecast International’s Platinum Forecast System offers customized assessments designed to quickly pinpoint both risks and future opportunities within this dynamic landscape. Click here to book a demo with a Forecast International expert today.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.