Airbus Leads in Deliveries While Boeing Sets Record for Widebody Orders /// Airbus Secures No New Orders in May, But Expects Significant Announcements at Paris

May 2025 Summary

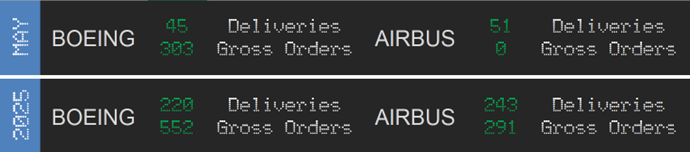

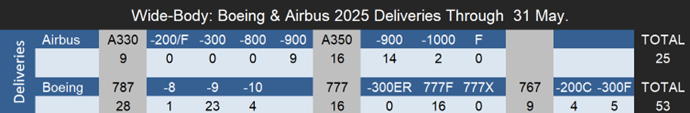

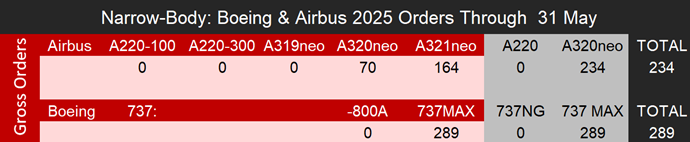

Boeing delivered a total of 45 aircraft in May, the same as the 45 aircraft it delivered in April, whereas Airbus delivered 51 aircraft, lower than the 56 it delivered in April. As we near the middle of the year questions are being raised about whether Boeing and Airbus will be able to meet their 2025 delivery targets. Airbus is particularly in the spotlight after entering 2025 with ambitious plans to ramp up deliveries to 820 aircraft from the 766 delivered in 2024, but ongoing supply chain constraints are still preventing this; the manufacturer needs to deliver an average of 82 aircraft per month for the remainder of the year to meet this goal which will be exceedingly difficult as the year progresses. As of May 31, Airbus has delivered only 243 commercial aircraft in 2025, or an average of 49 aircraft per month. Boeing on the other hand has not cited a specific target for the year, but has delivered 220 aircraft as of May 31st.

Notes:

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo.

- Production rate targets do not represent the actual number of aircraft produced in May 2025. Instead, they are generalized figures based on current monthly production estimates derived from OEM guidance and internal research conducted by Forecast International.

Deliveries

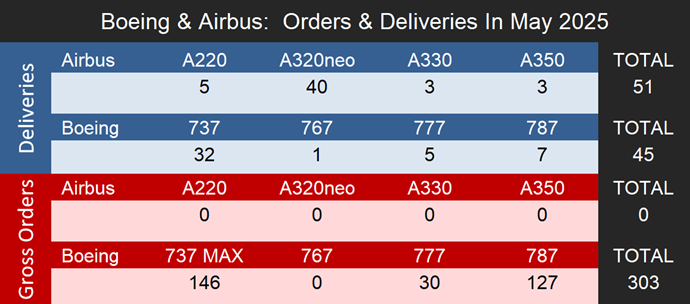

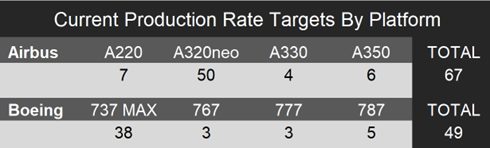

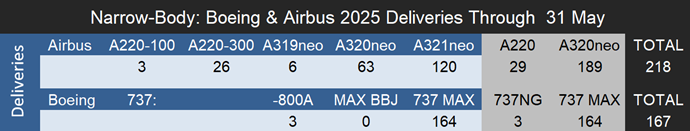

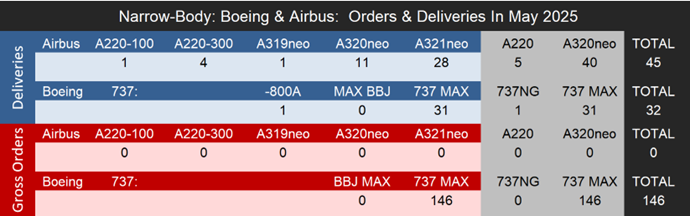

The 45 Boeing jets delivered in the month of May included 31 737 MAXs, one 737-800A, one 767, five 777s, and seven 787s. Boeing’s monthly deliveries have been consistent throughout the year but have not significantly increased, with 45 aircraft delivered in January, 44 in February, 41 in March, 45 in April and 45 in May. Positive signs are emerging for the 737 MAX as Boeing finally reached its FAA-approved production rate of 38 737 MAX aircraft per month in the month of May, and the manufacturer announced it would be resuming deliveries of 737 MAX aircraft in China after trade war tensions eased.

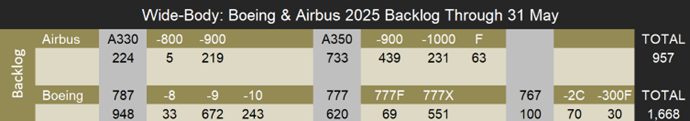

As for its remaining programs, Boeing delivered only 28 787s from January 1 through May 31 and a total of seven 787s in the month of May. The manufacturer continues to aim for a production rate of seven per month by the end of the year and ten per month by 2026. While the 787 backlog of 948 aircraft supports these targets, Forecast International believes that the uncertainty caused by tariffs and ongoing supply chain issues is likely to delay progress toward ramping up 787 production, and that this timeline is likely to be delayed.

The 767 program currently includes both KC-46 tankers and 767-300F freighters. Boeing is delivering the final 767-300Fs to FedEx and UPS ahead of the program’s scheduled conclusion in 2027, with 30 unfilled orders remaining as of May 31, 2025.

Meanwhile, Boeing has delivered a total of 16 777s through May 31, or an average of three aircraft per month, in line with the manufacturer’s production target rate of three 777s per month. Boeing also has plans to increase production to four per month by 2026. Additionally, the first 777X delivery is still scheduled for 2026 to Lufthansa, and Boeing has eight MSN-specific units of 777Xs in production and four test aircraft. However, the aircraft is still awaiting certification, which Boeing expects to receive this year, although Forecast International expects a possible delay into 2026. Boeing has also postponed the entry into service of the 777-8 freighter from 2027 to 2028.

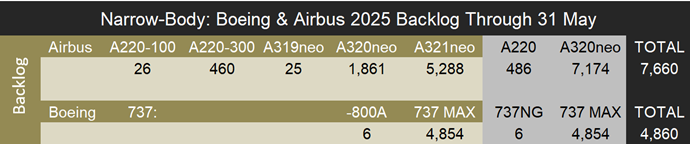

In May, Airbus delivered 51 aircraft, including five A220s, 40 from the A320neo family, three A330neos and three A350s. This compares to a total of 56 aircraft delivered in April and 71 delivered in March. Although A320neo family production and deliveries slowed in May, with only 40 aircraft delivered and just 39 produced, Airbus has reaffirmed its target of increasing production to 75 aircraft per month by 2027. Whether this goal is achievable will largely depend on the strength of the supply chain. However, Forecast International maintains that the current backlog supports this level of output over the long term but believes Airbus is currently unlikely to reach this production rate by its 2027 target.

As for the A220 program, Airbus delivered only five A220s in May although eight were produced, with a stated goal of reaching a production rate of 14 per month by 2026. However, we believe this target to be unrealistic with a current backlog of just 486 aircraft and a historical average of 95 gross orders per year since 2018. At that pace, the backlog would be exhausted in just over three years, making it difficult to justify such an aggressive production increase over the long term without a significant boost in new orders. That said, we continue to monitor A220 production, which has shown encouraging signs. We also believe it is possible that production could reach approximately ten aircraft per month by the end of 2026, though this will depend heavily on improved health of the supply chain.

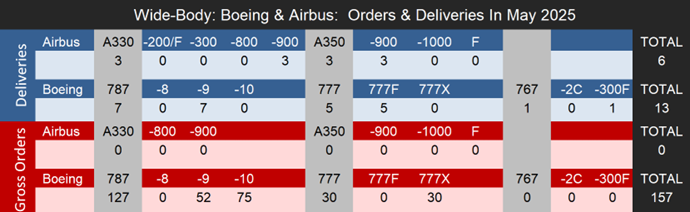

On the widebody side, only three A350s were delivered in May and Airbus produced just one during the month, highlighting the ongoing supply chain constraints affecting the program. As of May 31, Airbus has delivered only 16 A350s in 2025, an average of three aircraft per month, which is well below the manufacturer’s current targeted production rate of six per month. Airbus began the year with plans to increase A350 production to ten aircraft per month by the end of the year, but later revised this target to a maximum of six due to supply chain bottlenecks. Meanwhile, A330neo deliveries remain steady at approximately three to four aircraft per month, while no near term increases in the production rate are planned.

Orders

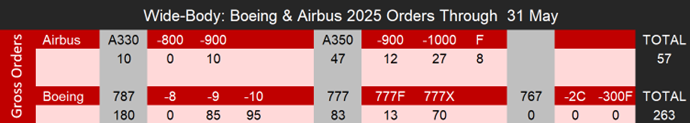

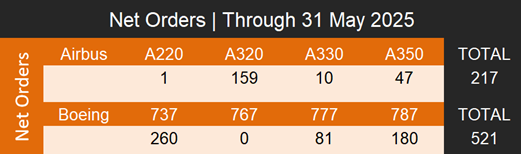

May saw a sharp slowdown in order activity for Airbus while Boeing experienced a surge. In May, Boeing logged 303 gross orders including 146 for the 737 MAX, 30 for the 777X, and 127 for the 787. The widebody totals were driven primarily by a record-breaking order from Qatar Airways. Valued at $96 billion, this deal marks the largest widebody aircraft order in Boeing’s history. While this spike in orders bodes well for Boeing’s long-term prospects, the near-term benefits are limited. These new orders only add to the company’s growing backlog. At its projected 2025 production rate, Boeing’s current backlog now equates to approximately 11.5 years of output, a clear indication the manufacturer is struggling to produce and deliver aircraft at a pace that meets demand. Looking ahead to the Paris Air Show, Forecast International does not expect Boeing to match Airbus in headline order volume. The massive Qatar Airways deal was announced in advance during a United States government led trip to the country, reducing the likelihood of a comparable splash at the show itself. However, we still do expect Boeing to receive significant order announcements at the air show.

- For consistency, this article does not include Boeing’s ASC 606 accounting adjustments and considers net orders as gross orders minus cancellations.

Airbus recorded no new orders in May. However, this sharp drop is likely due to airlines holding back in anticipation of placing their largest orders of the year during the Paris Air Show this month. Forecast International expects Airbus to receive at least 225 orders at the show based on recent reporting. Saudi startup Riyadh Air is expected to order 25 A350s, while VietJet and AirAsia are reportedly in discussions to each order 100 narrowbody aircraft, with AirAsia potentially adding the A220 to its order book. That said, it is also possible that a broader slowdown in commercial aircraft orders could follow the Paris Air Show. As operators evaluate the impact of tariffs, particularly on fleet expansion and modernization, reduced demand may lead to a more cautious stance on capital investment, limiting new aircraft commitments.

Backlog

- Airbus backlog numbers do not include A320ceo or A330-200 ghost orders.

- Boeing backlog numbers do not include 737-700, 737-800 or 777-300ER ghost orders.

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

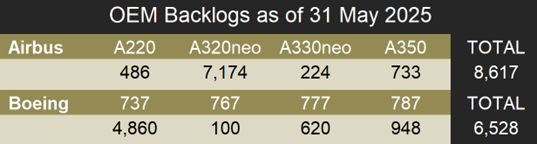

As of May 31, 2025, Airbus reported a backlog of 8,617 jets, excluding the A320ceo family and A330-200, with 7,660 or 88.9 percent of this backlog consisting of A220 and A320neo family narrowbodies. Meanwhile, Boeing’s total unfilled orders before ASC 606 adjustments stood at 6,528 aircraft, excluding the 737-700, 737-800, and 777-300ER, with 4,860 or 74.4 percent being 737 MAXs. Airbus’s backlog represents 10.5 years of production based on Forecast International’s 2025 production estimates, while Boeing’s backlog would last approximately 11.5 years. While these figures reflect a strong order book for both manufacturers, they also point to the inability of Boeing and Airbus to meet market demand and produce aircraft at a sufficient pace. A healthier backlog would reflect closer to between six and nine years of production. These figures also highlight the broader condition of the commercial aviation supply chain. With ongoing uncertainty around tariffs and persistent supply chain constraints, the timeline for both manufacturers to scale up production remains unclear.

Meet Us at the Paris Air Show

Join Forecast International at the Paris Air Show and gain firsthand insight into the trends shaping the global aerospace market. From navigating supply chain challenges to analyzing the Airbus-Boeing rivalry and the rise of new regional players, our team delivers the industry’s most trusted intelligence and long-range forecasts. Whether you’re focused on commercial, business, or general aviation, stop by Hall 3 Booth C164 to discover how our expert analysis can elevate your strategic planning.Book time with Grant in Paris: https://lnkd.in/ekijrXhE

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.