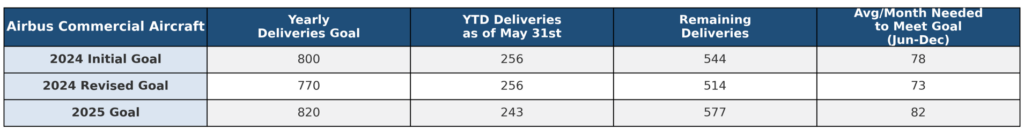

As Airbus enters the second half of 2025, the challenge of meeting its goal of delivering 820 commercial aircraft is becoming increasingly apparent. As of the end of May 2025, the company has delivered 243 aircraft, leaving 577 units still to be produced and handed over before the end of the year. To meet this target, Airbus must now maintain an average delivery rate of 82 aircraft per month from June through December, a pace that appears unrealistic given the current state of the supply chain.

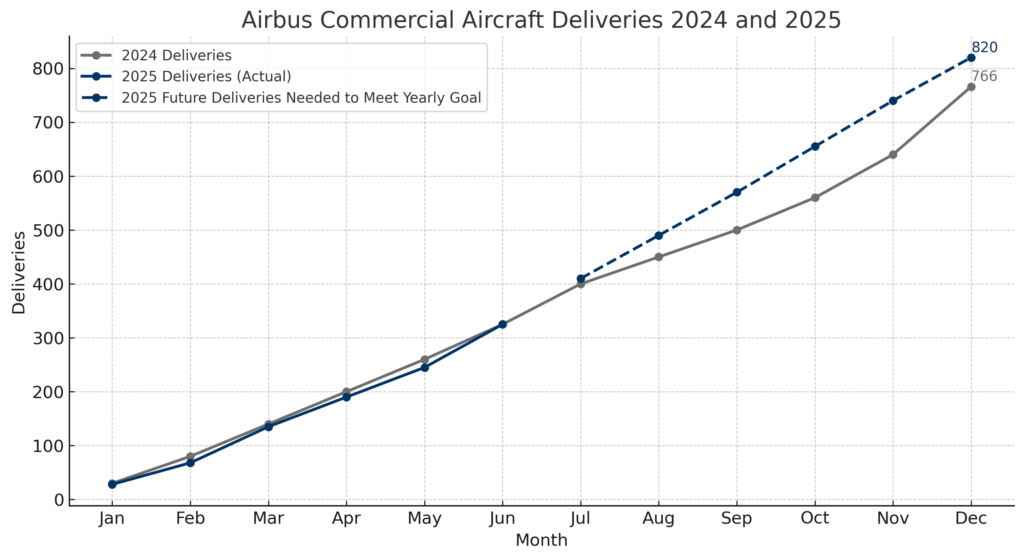

Airbus’ delivery performance in 2024 provides a cautionary benchmark. The manufacturer initially set a goal of 800 deliveries that year but later revised it downward to 770 in response to persistent production and supply chain challenges. Even with the revised target, the company ultimately delivered 766 aircraft, falling just short of its target despite an aggressive push in December that saw 123 aircraft delivered in a single month. To meet its original goal, Airbus would have needed to average 78 deliveries per month from June to year end, and 73 per month to meet the revised target.

This underperformance sets a precedent that casts doubt on the feasibility of hitting an even higher delivery rate in 2025. Reaching the required monthly average of 82 aircraft will be exceptionally difficult without meaningful improvements in both supplier performance and production output, particularly given the narrow window remaining to make up ground.

Further complicating the picture are issues specific to Airbus’s narrowbody and widebody programs. The A320neo line is now facing delays tied to a number of so-called glider aircraft that are otherwise completed but lack engines due to supplier bottlenecks. These aircraft cannot be delivered and are accumulating at final assembly sites, putting additional pressure on delivery timing. Additionally, both the A320neo and A350 production lines have struggled to meet their respective targets of 50 and six aircraft per month, falling short in recent months and highlighting the company’s struggle to increase production as the year progresses.

Despite these challenges, Forecast International believes there is still a plausible scenario in which Airbus could approach its full-year target, provided several key variables improve in the months ahead. If suppliers can increase engine and component output, and if production ramps up effectively, the company could close the gap. The blue dotted line in the 2025 delivery chart outlines the precise delivery pace required month by month to hit the 820 mark by December. However, the solid blue line tracking actual deliveries suggests that the current trajectory is closer to the pace seen in 2024, though this could change as the year progresses.

While the 2025 target remains within the realm of possibility, the margin for error is extremely narrow. Airbus will need to deliver consistently at a higher level for the remainder of the year, something it was unable to achieve throughout most of 2024. Meeting this goal will require clear and sustained improvement in the reliability of its supply chain to avoid another adjustment to its annual target. However, at this stage it is more likely that Airbus will lower its target later in the year, possibly resetting it to a range between 780 and 800 aircraft.

Meet Us at the Paris Air Show

Join Forecast International at the Paris Air Show and gain firsthand insight into the trends shaping the global aerospace market. From navigating supply chain challenges to analyzing the Airbus-Boeing rivalry and the rise of new regional players, our team delivers the industry’s most trusted intelligence and long-range forecasts. Whether you’re focused on commercial, business, or general aviation, stop by Hall 3 Booth C164 to discover how our expert analysis can elevate your strategic planning.Book time with Grant in Paris: https://lnkd.in/ekijrXhE

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.