Boeing produces 38 737 MAXs in May, Airbus A320neo family production falls below 40 aircraft /// May deliveries projected to be neck and neck between Airbus and Boeing

For the purposes of this article, Forecast International considers an aircraft to be “produced” once it completes its first test flight, and “delivered” when it is contractually handed over to the customer.

Overview

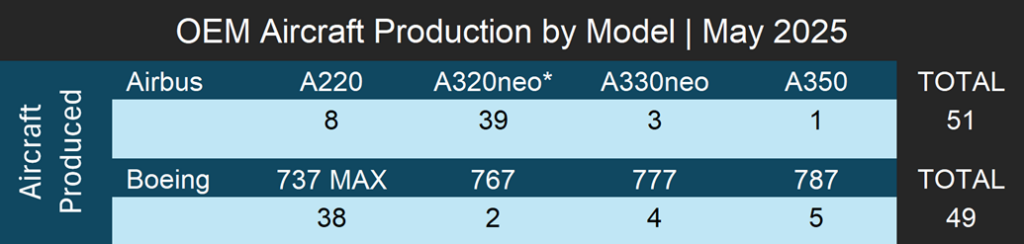

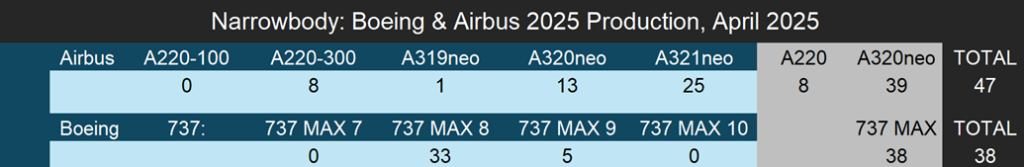

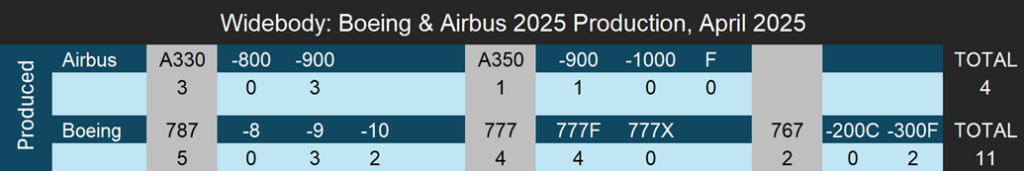

Both Boeing and Airbus continue to face significant challenges in increasing the output of new commercial aircraft, compounding existing pressures on their current production rates. Airbus led the month in total production, completing 51 aircraft, followed by Boeing with 49, resulting in a combined total of 100 aircraft. Of these, 85 were narrowbody aircraft, while the remaining 15 were widebodies. Airbus is currently grappling with engine delays from Safran affecting its A320neo family, which has reportedly led to the production of approximately 17 aircraft that remain without engines. Boeing’s improved performance was supported by increased 737 MAX production, whereas Airbus experienced a modest drop from April, primarily due to lower A320neo production.

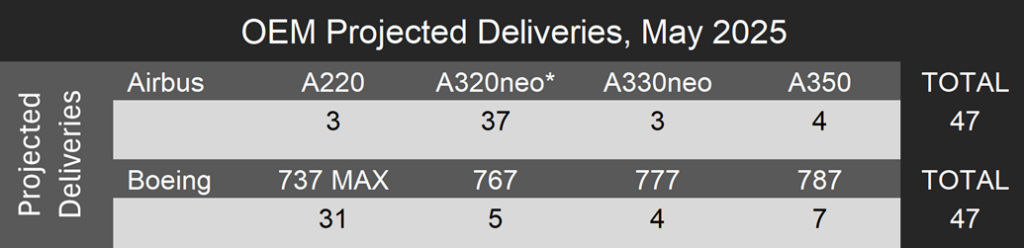

On the delivery side, Forecast International expects Boeing to have delivered a total of 47 aircraft in May, including 31 737 MAXs and the remaining 16 as widebodies. For Airbus, we estimate total deliveries at 47 aircraft, comprising 40 narrowbodies and seven widebodies.

*A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

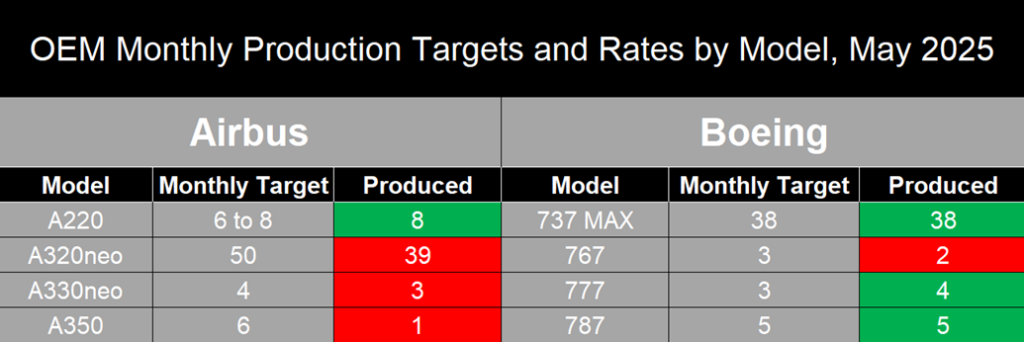

Though the A320neo family was the most produced model by Airbus in the month of May, production showed further signs of stalling, with only 39 units produced in May. Airbus also produced eight A220 models in April. On the widebody side, three A330neos, and one A350 were produced. For Boeing, production was dominated by the 737 MAX, with 38 units completed. The company also reported two units of the 767, four of the 777, and five of the 787 Dreamliner.

The Airbus A320neo Family program continues to fall short of its monthly production target of 50 units and production has steadily declined over the past three months. Airbus produced a total of 46 A320neo family aircraft in March, 40 in April, and only 39 in May. Most recently, production has been dragged down by so-called ”glider” aircraft, as supply chain issues have forced the manufacturer to park a number of completed but engineless units. Given these signs of slowing output, our short-term outlook for A320neo Family production this year is becoming more negative, and we are likely to revise our forecast downward if this pattern of slowing or stagnation continues for another month or two. Our current forecast assumes an average production rate of approximately 52 aircraft per month, or 625 units for 2025. However, we still believe it is possible that A320neo Family production increases during the remainder of the year as Airbus works to meet its annual production goal for 2025, though the degree to which production can be increased remains uncertain. In the longer term, Airbus plans to raise A320neo Family production to 75 aircraft per month by 2027, but Forecast International does not expect this goal to be met within the company’s projected timeframe. Instead, we believe that rate will be achieved later in the decade.

At this point, we still do not view the stalled A320neo family production numbers as evidence that Airbus will be unable to meet its delivery targets by year end. In 2024, Airbus ramped up production sharply in the fourth quarter, resulting in 64 aircraft delivered in October, 84 in November, and finally 123 in December. That said, production in the range of 40 to 45 aircraft per month for the A320neo family is becoming a more persistent trend, which raises the likelihood that we will revise our full year forecast downward if this pattern continues into the summer.

On the other hand, the A220 program is showing encouraging signs of production stabilizing at around six to eight aircraft per month, which supports the case for a gradual increase in output as the year progresses. In May, Airbus produced a total of eight A220s, all of which were A220-300s. While this is a positive development, we view it as highly unlikely that Airbus will achieve its target of ramping up production to 14 aircraft per month by 2026. Forecast International considers this goal unlikely due to the relatively limited backlog for the A220, persistent supply chain challenges, and current production levels remaining between six and eight aircraft per month. Furthermore, even if Airbus were able to increase output to 14 aircraft per month, assuming supply chain conditions allow, such a rate would likely be unsustainable given the program’s backlog of only around 500 unfilled orders. We believe a more realistic and sustainable production rate would be approximately ten aircraft per month. Given the current stabilization, we see it as possible that Airbus will reach this level as the end of the year approaches.

Widebody Airbus production in May 2025 slowed noticeably, particularly for the A350. The company produced only one A350, falling well below its target of approximately six aircraft per month. Airbus has set a goal to increase A350 output to ten aircraft per month by 2026 and to twelve per month by 2028, but this is unlikely based on the low production figure for May and the company’s February announcement that A350 output would be limited to around six aircraft per month throughout 2025. We believe Airbus may gradually increase production as supply chain conditions improve, but not within the timeframe it has outlined. As for the A330neo, Airbus produced a total of three aircraft in May, just under its current target rate of four aircraft per month. Airbus has not announced any plans to increase A330neo production in the near or long term, but stated during its first quarter 2025 earnings call that it is focused on stabilizing output at four aircraft per month, a target it is already approaching based on year to date monthly production figures.

Boeing has finally reached its FAA approved production rate of 38 737 MAX aircraft per month, as shown by the 38 units produced this month. Of these, 33 were 737 MAX 8s and five were 737 MAX 9s. Some industry leaders, including Safran Chief Executive Officer Olivier Andries, have stated that Boeing nearing the FAA approved rate of 38 aircraft per month signals the company is returning to a more ”dynamic production profile”. However, Forecast International considers this statement premature. While we believe it is certainly possible that Boeing will stabilize 737 MAX production at 38 aircraft per month in the near term, May marks the first time the manufacturer has either reached or come close to reaching this FAA approved rate. This comes as Boeing continues to pursue its longer term goal of returning to a production rate of 52 737 MAXs per month, a level it last achieved in 2018. With this progress, the next step is for Boeing to demonstrate consistent monthly output at the 38 aircraft level before it can realistically pursue what Safran has described as a more ”dynamic production profile”. Doing so will require the company to formally request an increase in its FAA authorized production ceiling, a process that will occur through multiple incremental steps aimed at eventually reaching 52 aircraft per month. If Boeing is able to sustain output at or near 38 aircraft per month over the coming months, it would signal production stability and strengthen the case for FAA approval of a higher rate. Furthermore, we believe that a more ”dynamic production profile” would also mean the start of 737 MAX 7 and MAX 10 deliveries, as Boeing remains significantly behind on certification for both variants, having worked toward approval for years with entry into service not expected until at least next year.

On the other hand, Boeing’s widebody programs showed positive production signs in May. The 787 program produced five aircraft during the month, in line with its current target of approximately four to five aircraft per month. However, Boeing is still delivering the remaining aircraft in its 25 unit inventory of previously produced 787s, and plans to have delivered all of these aircraft by the end of the year. Boeing has stated its intention to raise 787 output to seven aircraft per month by the end of the year and to ten per month in 2026, though Forecast International believes this may not occur within this timeline due to ongoing supply chain issues and lower production numbers in previous months this year. Meanwhile, the 767 program produced two aircraft in May, while four 777 freighters were completed. We do not anticipate any future increases in production rates for either platform, given that 767-300F production is scheduled to end in 2027 and the 777-8 freighter is expected to enter service near the end of the decade. Boeing also has 22 specific units of the 777X on its assembly line, not including its four test aircraft. The 777X is still awaiting certification, which Boeing expects to obtain this year, although it is possible that certification will be delayed into 2026.

Unofficial/Preliminary Deliveries

In May 2025, the commercial aircraft delivery landscape continued to show signs of stagnation due to ongoing supply chain constraints that are limiting increases in production rates at Airbus and Boeing.

Forecast International expects Boeing to have delivered an estimated 47 aircraft in the month of May 2025, compared to 45 in April and 41 in March. The 38 narrowbodies expected to have been delivered account for 33 737 MAX 8s and five 737 MAX 9s. On the widebody side, Forecast International expects Boeing to deliver an estimated seven 787s; all 787-9s. We also expect Boeing to have delivered four 777Fs, one 767-300F and four 767-2Cs.

Forecast International expects Airbus’s May 2025 deliveries to be lower than the 56 aircraft delivered in April and the 71 delivered in March. For the month of May 2025, we expect Airbus to deliver a total of 47 aircraft. As for the A220 specifically, Forecast International expects three A220-300 deliveries. The majority of narrowbody deliveries are expected to be from the A320neo Family, of which an estimated one will be an A319neo, nine A320neos and 27 A321neos, or a total of 37 for the A320neo family. For widebodies we expect a total of four A350-900s and three A330-900neos to have been delivered.

Summary and Outlook

May 2025 highlighted the continued operational challenges faced by both Airbus and Boeing as production momentum weakened across several programs. Airbus saw a notable trend in stagnating A320neo family output, while production of the A220 remains strong and within its target rate range. Boeing’s production saw positive trends, with the 737 MAX finally reaching its FAA approved rate and widebody production in line with current targets.

Looking ahead, Forecast International expects production pressures to persist into the summer months, casting further doubt on the ability of either manufacturer to meet full year delivery targets without adjusting timelines or expectations. Airbus will likely continue focusing on incremental gains in narrowbody output while attempting to stabilize A350 production in the face of unresolved supply chain bottlenecks. Boeing, on the other hand, faces a longer road to recovery, with short term delivery rates supported more by existing inventory than new production. Until broader systemic issues such as supply chain volatility and international trade tensions are resolved, sustained production growth will remain limited, and delivery performance will continue to track below internal goals and market expectations.

Meet Us at the Paris Air Show

Join Forecast International at the Paris Air Show and gain firsthand insight into the trends shaping the global aerospace market. From navigating supply chain challenges to analyzing the Airbus-Boeing rivalry and the rise of new regional players, our team delivers the industry’s most trusted intelligence and long-range forecasts. Whether you’re focused on commercial, business, or general aviation, stop by Hall 3 Booth C164 to discover how our expert analysis can elevate your strategic planning.Book time with Grant in Paris: https://lnkd.in/ekijrXhE

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.