For decades, Boeing’s business model hinged on steady aircraft production tightly aligned with deliveries. But that synchronization has fractured in recent years. A convergence of regulatory groundings, certification delays, and supply chain disruptions has led Boeing to amass a historically high level of undelivered inventory, fundamentally altering how it approaches both production and delivery schedules. The data tells a compelling story of contrast, one where production is no longer a proxy for revenue or market strength, and delivery pipelines have grown more complex than simply rolling completed airframes out the door.

The Delivery Arc: From Peak to Plunge

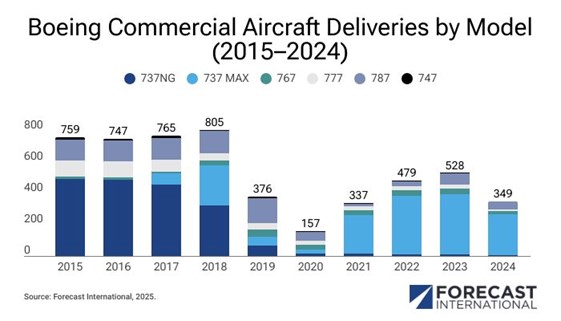

Between 2015 and 2018, Boeing operated at the height of its delivery efficiency. Annual commercial aircraft deliveries ranged between 750 and 806 units, culminating in 2018 with a record 806 deliveries. The 737NG formed the foundation of this momentum, but it was the entry of the 737 MAX that pushed Boeing to its apex. This was a period marked by strong airline demand for new technology aircraft such as the 737 MAX and confidence in Boeing’s production capabilities. However, that momentum collapsed in 2019.

The grounding of the 737 MAX following two fatal crashes halted deliveries of Boeing’s most important product. Even as widebody programs tried to offset the impact, the total delivery count fell sharply to around 380 aircraft in 2019. Then came 2020, when the COVID -19 pandemic paralyzed global aviation. Deliveries cratered to fewer than 160 aircraft for the year, an 80 percent drop from 2018. For a company built on production volume, this was not just a dip; it was freefall.

The years that followed have shown a slow and unsteady recovery. Boeing delivered approximately 340 aircraft in 2021, driven mostly by the recertified 737 MAX. Deliveries improved to nearly 480 in 2022, bolstered by recovering air travel demand and a more stable 737 MAX line. In 2023, output ticked upward again, surpassing 530 aircraft. However, 2024 saw another step backward. Ongoing supply chain issues and a critical labor strike in the fourth quarter disrupted the 737 MAX line, and overall deliveries declined once more, with only 350 aircraft delivered during the year. This demonstrates that the 737 MAX grounding was the catalyst that created Boeing’s current production and delivery challenges; the company has failed to reestablish a consistent delivery rhythm, and the once-stable correlation between factory output and cash realization has eroded.

The Hidden Problem: Aging and Idle Aircraft Inventory

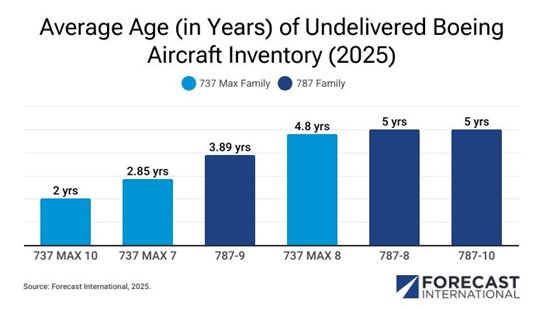

While delivery counts reflect Boeing’s immediate production struggles, they mask a deeper issue: the company is holding a substantial inventory of fully assembled and produced but undelivered aircraft. Forecast International considers an aircraft to be produced upon its first test flight. Although Boeing intends to deliver the bulk of this idle fleet in 2025, similar assurances have been made in prior years, only to be undercut by persistent industry headwinds and repeated delays. This is not a case of short-term disruption as many of these aircraft have been aging on the ground for years.

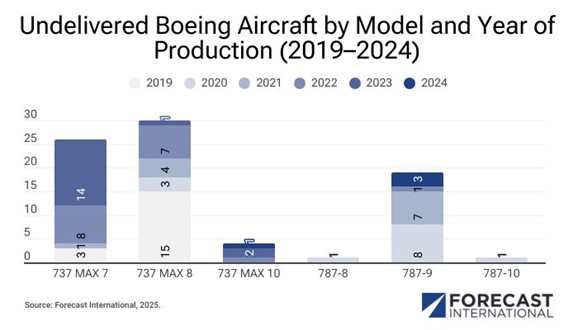

As of early 2025, Boeing’s parked inventory includes 30 737 MAX 8s with an average age of 4.8 years, 26 737 MAX 7s averaging 3.1 years in age, four 737 MAX 10s still awaiting type certification, and 21 787s, nineteen of which are 787-9s, with an average age of 3.9 years. In total, 81 aircraft are parked and undelivered, representing billions of dollars in trapped value. These are not incomplete airframes awaiting components. They are finished products, most of which are fully flight ready, yet have never entered commercial service.

Aircraft age even when grounded. Systems require updates, software becomes outdated, and parts may degrade. Maintenance costs accrue. Some aircraft may need substantial rework to meet updated standards or customer specifications. Every day these aircraft remain parked is a day Boeing loses both financial return and customer confidence. In commercial aerospace, delivery, not production, is what unlocks revenue. Boeing recognizes income only when aircraft are transferred to customers. That distinction has become critical in understanding the company’s challenges. Building jets may keep factories moving and workers employed, but it does not increase revenue and satisfy investors.

This disconnect has left Boeing in a precarious position. It is managing two parallel tracks. One is forward production to sustain supply chains and fulfill ongoing orders. The other is a backlog of dormant inventory that ties up capital and undermines operational efficiency. Unless both systems are aligned, Boeing is effectively burning cash while deferring revenue. It creates a lopsided business model, producing aircraft that do not yet translate to financial return.

The Revenue Engine: Why Delivery Health is Financial Health

For Boeing, the path to financial recovery is not paved with higher production rates alone. It hinges on restoring delivery volume to levels that meaningfully convert the backlog into cash flow. In the commercial aerospace business, aircraft delivery is the revenue trigger. While production may show operational progress, only delivery results in a financial transaction, often unlocking 50 to 150 million dollars per aircraft depending on the model. With each delivery, Boeing recognizes revenue, collects final customer payments, and strengthens its balance sheet. In an environment where the company continues to face elevated debt and reduced margins, this is not just preferable, it is essential.

Cory Large, a portfolio analyst and wealth strategist at Anchor Bay Capital, explained the financial implications of Boeing’s current position: “Debt overhang is a real concern.” He noted that “Boeing is carrying roughly $53 billion in total debt, well above its 10-year average of around $36 billion. Nearly $30 billion of that matures within the next five years. While Boeing wisely tapped the bond market during the low-rate COVID years, those notes will soon need to be refinanced in a much higher-rate environment. That adds urgency to boosting free cash flow through deliveries—not just to satisfy customers, but to avoid a future refinancing crunch.”

Large’s comments highlight a key financial priority for Boeing. The company must restore and maintain delivery momentum with consistency and reliability. Aircraft deliveries are the primary means of converting the backlog into cash, which is essential for addressing the company’s elevated debt position. With a significant portion of that debt coming due in the next several years, generating free cash flow through deliveries is not simply about meeting customer commitments. It is also necessary to manage refinancing risk and avoid additional strain on the balance sheet.

Beyond the direct financial inflow, increased deliveries help unburden Boeing from the weight of dormant inventory. Every aircraft that remains undelivered ties up capital, requires ongoing maintenance, and becomes an aging asset. Delivering those aircraft not only removes stranded assets from the balance sheet, but also reduces associated costs such as parking, preservation, inspections, and retrofits needed to meet changing regulatory and customer standards. In essence, a clear delivery backlog equates to a more efficient use of capital and physical infrastructure.

Furthermore, a healthy and consistent delivery pace stabilizes Boeing’s entire industrial base. Suppliers, already strained by years of uncertainty, are more likely to invest in tooling, labor, and logistics when Boeing demonstrates clear output in its production pipeline. In this way, deliveries become a critical signaling mechanism not just to financial markets, but to Tier One and Tier Two suppliers who depend on predictable execution.

In totality, delivery health is not a byproduct of a functioning production system, it is the core determinant of whether that system generates value. For Boeing to return to financial strength, it must reorient its operating model around timely, reliable, and high-volume deliveries. Only then will the company be positioned to turn the page from recovery to resilience.

Regulatory Hurdles Remain a Gatekeeper

None of the above is possible unless Boeing resolves its regulatory bottlenecks. Until these regulatory hurdles are cleared, Boeing’s path to financial recovery will remain constrained, regardless of the demand profile or production tempo. FAA certification for the 737 MAX 7 and MAX 10 remains a critical barrier. As of now, 30 built but uncertified 737 MAX 7 and 10 aircraft cannot be delivered. These variants are vital to both the growth in Boeing’s narrowbody portfolio and its ability to compete against Airbus’s A320neo family.

Similarly, the 787 program still bears the weight of a prior delivery pause in 2021 and 2022. The remaining 21 787s are expected to be delivered this year by Boeing, but this ties up resources and creates increased costs to configure and prepare the aircraft for delivery, preventing the manufacturer from focusing further on efforts to increase 787 production.

Conclusion: Delivery is the Fulcrum

In commercial aviation, the finish line is not the factory, it is the moment an aircraft is delivered to the customer. Boeing’s future will not be measured by what it builds, but by what it delivers. The current disconnect between production and delivery reflects more than operational delays. It exposes a deeper imbalance that threatens both financial performance and customer trust. The way forward is not simply about building more aircraft. It is about restoring the rhythm between production and delivery by reducing lead times, securing certifications, and aligning internal operations with customer expectations. Every day an aircraft sits idle, Boeing loses capital, confidence, and momentum. To regain strength, Boeing must prioritize execution over output. That means delivering aircraft on time, to standard, and without delay. Deliveries must once again become the heartbeat of the business.

Meet Us at the Paris Air Show

Join Forecast International at the Paris Air Show and gain firsthand insight into the trends shaping the global aerospace market. From navigating supply chain challenges to analyzing the Airbus-Boeing rivalry and the rise of new regional players, our team delivers the industry’s most trusted intelligence and long-range forecasts. Whether you’re focused on commercial, business, or general aviation, stop by Hall 3 Booth C164 to discover how our expert analysis can elevate your strategic planning. 👉 Book time with Grant in Paris: https://lnkd.in/ekijrXhE

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.