OEMs continue to struggle with ramping up production /// Deliveries expected to soften month-over-month to kick off the second quarter.

Overview

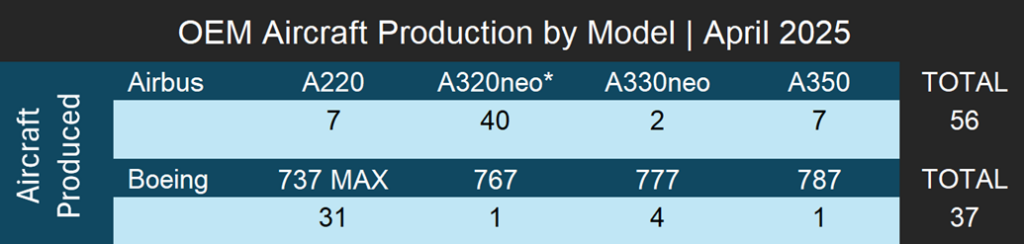

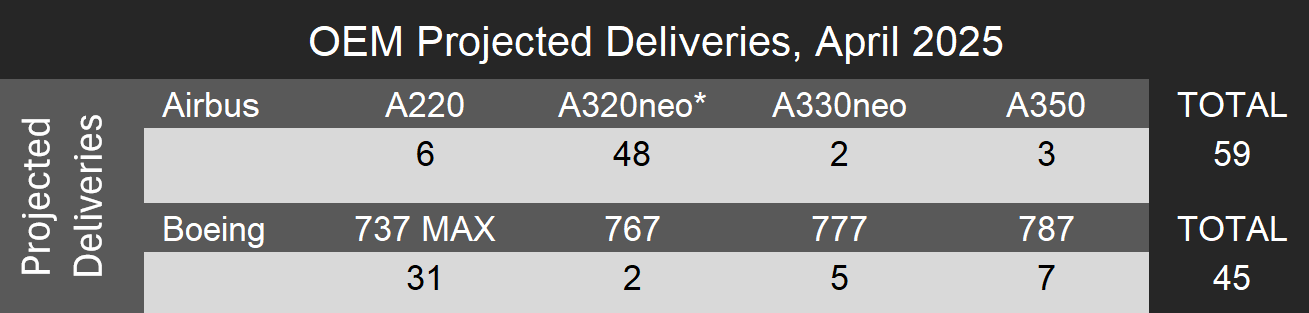

For the purposes of this article, Forecast International considers an aircraft as “produced” up completion of its first test flight, and an aircraft as “delivered” when it is contractually handed over to the customer. Airbus led the month in total production, completing 56 aircraft, while Boeing followed with 37, a total of 93 aircraft between the two manufacturers. 78 of these aircraft were Narrowbodies, while the remaining 15 were Widebodies. Airbus continues to outproduce Boeing, which is expected considering 737 MAX production is capped at 38 aircraft per month and Boeing has yet to even reach this approved rate of production. However, both manufacturers continue to experience supply chain constraints that are limiting a ramp up in production. For example, In February 2025 Airbus announced that A350 production in 2025 would be limited to six aircraft per month due to supply chain delays, after previously aiming to ramp up production to 10 aircraft per month by 2026. On the delivery side Forecast International expects Boeing to have delivered a total of 45 aircraft in the month of April, 31 of which are expected to be 31 narrowbodies and the remaining 14 to be widebodies. For Airbus, we estimate that the manufacturer will have delivered a total of 59 aircraft, 54 narrowbodies and five widebodies.

As expected, the A320neo family was the most produced model by Airbus in the month of April, accounting for 40 of the 56 total units produced. Airbus also produced seven A220 models in April. On the widebody side, two A330neos, and seven A350s were produced. For Boeing, production was dominated by the 737 MAX, with 31 units completed. The company also reported one unit of the 767, four of the 777, and one unit of the 787 Dreamliner.

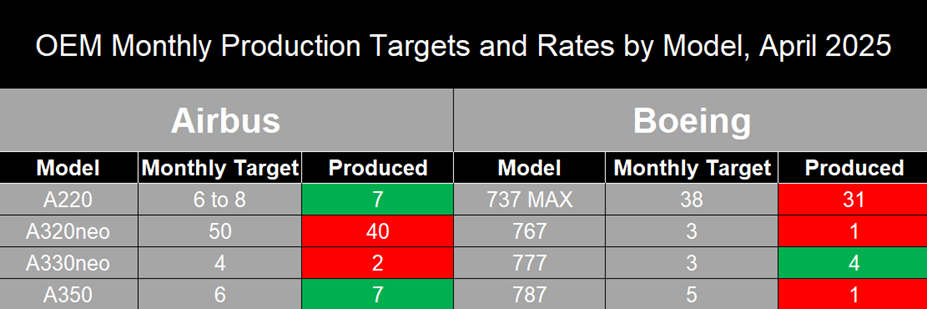

The Airbus A320neo Family program appears to have fallen short of its monthly production rate target of 50 units, only producing 40 aircraft in April 2025. However, it is important to note that production tends to run lower in the beginning of the year as OEM production lines recover and reset from the end of the year rush to deliver aircraft and typically increase and picks up as the year goes on. Therefore, it is likely that A320neo Family production will continue to increase throughout the year as Airbus pushes to meet its yearly production goal for 2025. Airbus plans to increase A320neo Family production to 75 aircraft per month by 2027, though Forecast International believes this will not occur in Airbus’ projected timeframe, though we do believe it will be reached later in the decade or early 2030s, as Airbus continues to face supply chain constraints that are not showing signs of significant easing. Additionally, tariffs are another headwind that could exacerbate supply chain issues and limit production increases. We currently do not see the lower production of the A320neo in April as a sign of a boarder slowdown in production for Airbus. These lower production numbers would need to be a consistent trend as the year progresses for us to change our stance; it is also likely that the uncertainty about tariffs may have caused a slight slowdown in production for the month. However, if this becomes a consistent trend in May and June, this is likely a sign of a broader slow down and we will revise our forecast for the year accordingly.

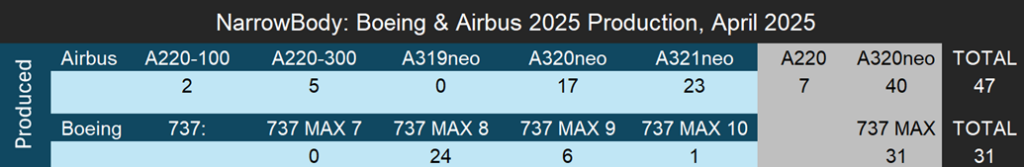

The A220 program, which Airbus produced seven units of, came in right in line with its current production rate target of six to eight aircraft per month. five of these units were A220-300s while only two were A220-100s. However, this is not a positive sign for Airbus’s goal of rapidly increasing production to 14 aircraft per month by 2026. Forecast International believes this to be unlikely considering the limited backlog for the A220 and ongoing supply chain issues and current production remaining at between six to eight aircraft per month. Additionally, if Airbus were to increase A220 production to 14 aircraft per month, on the condition that supply chains allow so, this would likely be short lived as the rate is simply too high for the only 500 unfilled orders the A220 garners.

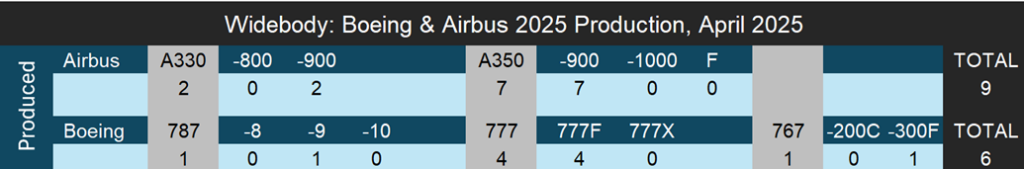

Widebody Airbus production in April 2025 was mainly in line with production rate targets. However, Airbus produced only two A330-900neo aircraft, below its production target of around four aircraft per month. Airbus has not announced plans to increase A330neo production in the near or long term but did say in its 1Q 2025 earnings call that it was stabilizing production at four aircraft per month. On the other hand, seven A350s were produced, of which all were A350-900s. Though this is slightly higher than the current target of six aircraft per month, Airbus’ goal of increasing output to ten aircraft per month by 2026 and to twelve aircraft per month by 2028 is unlikely considering it announced in February production of the A350 would be limited to around six aircraft per month in 2025 due to unresolved supply chain issues. We believe Airbus is likely to modestly ramp up output as the supply chain permits, but not in the timeframe it has provided. Additionally, while Airbus has 12 A350-1000s currently on the assembly line with identifiable MSNs, none have completed their first flight in April and are not yet considered produced.

Boeing is still struggling to reach its FAA approved production rate of 38 737 MAX per month, as evidenced by the 31 737 MAXs produced in April. 24 of these units were 737 MAX 8s, six were 737 MAX 9s and the remaining aircraft was a 737 MAX 10. Most recently Boeing had been running low on fasteners used to attach the landing gear on its 737 MAX jets, but secured new supplies in recent weeks and said it does not expect this to impact production. Boeing CEO Kelly Ortberg announced on the company’s 1Q 2025 earnings call that it plans to increase 737 MAX production to 52 aircraft per month but did not provide a timeframe. Forecast International believes this to be highly speculative and unlikely in the near-term considering Boeing still isn’t producing 38 MAXs per month, though does believe Boeing will be able to reach this rate in the medium to long term due to the MAXs strong backlog and continued orders for the aircraft. This will also depend on the FAA and the rate at which it improves 737 MAX production rate increases. Boeing also has a total of 26 737 MAX 7s and five 737 MAX 10s that have been produced sitting in inventory while the two aircraft await certification. Boeing also has a remaining inventory of 30 737 MAX 8 aircraft, all originally intended for Chinese airlines. However, with the Chinese government and its carriers now rejecting MAX deliveries, these aircraft are likely to be reassigned to new customers, such as Air India Express, for whom Boeing is already preparing to deliver a previously produced 737 MAX 8 that was destined for China Southern. We expect the remaining inventory of Chinese destined 737 MAX 8s will be easily consumed by non-Chinese customers, though their deliveries will be delayed as the aircraft will need to be re-painted and re-configured for their new operators.

Boeing’s widebody programs also produced at reduced levels for the month of April. The 787 program produced only one 787-9 in April, which falls well below its current target production rate of around 5 per month. However, it is important to note that Boeing has a significant inventory of 25 already produced 787s and is planning to deliver all of these aircraft in 2025. Our expectation is that production of the 787 will increase once Boeing delivers the remaining inventory throughout the year. Boeing also hopes to increase 787 production by the end of the year to seven aircraft per month and to 10 per month in 2026, though Forecast International believes this timeline to be unrealistic given ongoing supply chain issues and the lower production numbers for the aircraft to start the year. Meanwhile, the 767 produced only one aircraft, while Boeing produced four 777Fs. We expect no future production rate increases for either platform considering 767-300F production is scheduled to end in 2027 and the 777-8F is expected to enter service by the end of the decade. Boeing also has eight MSN specific units of 777Xs in production. The aircraft is still awaiting certification, which Boeing expects to receive this year, although Forecast International believes it may be pushed into 2026.

Unofficial/Preliminary Deliveries

In April 2025, the commercial aircraft delivery landscape was notably influenced by escalating trade tensions between the United States and China, particularly affecting Boeing’s operations. Several Boeing 737 MAX aircraft, originally destined for Chinese carriers like Xiamen Airlines, were rerouted back to the U.S., resulting in lower MAX deliveries than previous month. This shift followed China’s directive for its airlines to halt deliveries of Boeing planes and American aircraft parts, a move seen as retaliation against increased U.S. tariffs on Chinese imports.

Forecast international expects Boeing to have delivered an estimated 45 aircraft in the month of April 2025. For comparison, in the month of March 2025 the manufacturer delivered a total of 41 aircraft. The 31 narrowbodies expected to have been delivered account for 25 737 MAX 8s and six 737 MAX 9s. Though Boeing is not currently producing 737 MAXs at the FAA approved rate of 38 per month, it has been able to deliver more aircraft than this in prior months due to the remaining inventory of aircraft it produced during the MAX groundings. As of the end of April, 2025, Boeing currently has an inventory of 97 undelivered but produced 737 MAXs; 26 MAX 7s, 59 MAX 8s, seven MAX 9s, and five MAX 10s. Boeing was previously expecting to deliver its remaining 737 MAX inventory this year, though we now believe this will be delayed considering 30 of these aircraft were destined for Chinese carriers and now need to be re-marketed. On the widebody side, Forecast International expects Boeing to deliver an estimated seven 787s; six 787-9s and one 787-10. We also expect Boeing to have delivered five 777Fs and two 767-300Fs.

Forecast International expects Airbus’s April 2025 deliveries to come in lower than the 71 aircraft the manufacturer delivered in the month of March. The company remains focused on meeting its full-year target of 820 aircraft deliveries, an increase of 7 percent from the 766 aircraft it delivered in 2024. However, persistent supply chain challenges, particularly related to component shortages, and ongoing concerns over international tariffs continue to pose headwinds as Airbus moves into the second quarter of the year. Despite these obstacles, Forecast International’s current outlook for Airbus remains in line with the company’s guidance, projecting a total of 821 commercial aircraft deliveries for the year.

For the month of April 2025, we expect Airbus to deliver a total of 59 aircraft. As for the A220 specifically, Forecast International expects one A220-100 and five A220-300 deliveries. The majority of narrowbody deliveries are expected to be from the A320neo Family, of which an estimated two will be A319neos, 18 A320neos and 28 A321neos. For widebodies we expect a total of three A350s to be delivered, of which two are A350-900s and one is an A350-1000. We also expect two A330neos to be delivered, of which both will be A330-900neos.

Summary and Outlook

April 2025 highlighted ongoing challenges for both Airbus and Boeing as they continue to grapple with supply chain issues and external pressures such as tariffs and trade tensions. Airbus maintained its lead in production and is showing steady progress toward its annual delivery goals, although some programs, like the A320neo and A350, are falling short of planned ramp-up targets. Boeing, meanwhile, continues to face hurdles in reaching approved production rates for the 737 MAX, while also dealing with delays in certification of the MAX 7 and 10 and the 777X, in addition to delivery reassignments stemming from strained U.S.- China relations.

Looking ahead, both Airbus and Boeing are expected to gradually increase production rates through the remainder of 2025, though not without obstacles. Airbus is likely to sustain incremental growth in narrowbody output, particularly for the A320neo family, but significant rate increases may slip beyond current targets due to persistent supply chain issues and trade tensions. Boeing faces a more complex recovery path, with its ability to ramp up 737 MAX production contingent upon both the health of the supply chain and decisions made by the FAA. Boeing is also expected to rely on existing inventory for delivery support in the near term. Until broader supply chain constraints ease and trade tensions are resolved, substantial production acceleration will remain limited for Boeing and Airbus, keeping delivery targets achievable but tightly constrained.

Meet Us at the Paris Air Show

Join Forecast International at the Paris Air Show and gain firsthand insight into the trends shaping the global aerospace market. From navigating supply chain challenges to analyzing the Airbus-Boeing rivalry and the rise of new regional players, our team delivers the industry’s most trusted intelligence and long-range forecasts. Whether you’re focused on commercial, business, or general aviation, stop by Hall 3 Booth C164 to discover how our expert analysis can elevate your strategic planning. 👉 Book time with Grant in Paris: https://lnkd.in/ekijrXhE

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.