Supply chain constraints limit A350 production to six aircraft per month and delay A350F deliveries to 2027 /// Steel and aluminum tariffs take effect, raising concerns about production

Source: Airbus

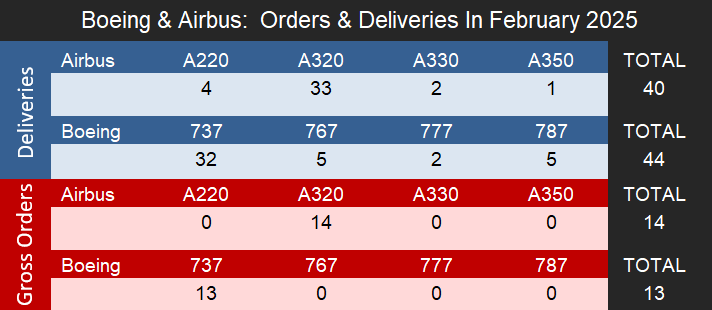

Source: AirbusIn February, ordering activity was slow. Boeing deliveries remained flat compared to last month, while Airbus saw a further slowdown from its strong finish to 2024. Boeing handed over 44 commercial jets, on par with its 45 deliveries in January, whereas Airbus delivered 40 units, a sizable increase from the 25 aircraft delivered in January. Boeing and Airbus both entered 2025 with ambitious goals, but the headwinds preventing the ramp up in production are showing little signs of easing in the commercial aerospace industry. The section 232 tariffs on steel and aluminum that were re-implemented by the Trump Administration also took effect at the beginning of March and may prove to be an additional headwind for production and could further disrupt an already fragile supply chain.

Airbus’ all-time high of 863 deliveries was set in 2019, a record previously expected to be surpassed in 2025 based on strong demand for commercial aircraft and easing supply chain constraints. However, supply chain issues have not subsided to the degree previously anticipated and our current forecast for Airbus now projects just under 840 deliveries in 2025, which pushes a full recovery to pre-pandemic production levels into 2026. This compares to Airbus’ guidance of 820 deliveries for the year, a 7.0% increase from the 766 aircraft it delivered in 2024. On the other hand, Boeing is playing catch up after only delivering a total of 350 commercial aircraft in 2024, a 33.7% decrease from the 528 aircraft delivered in 2023. We expect Boeing deliveries to return closer to 2023 levels this year, with around 570 aircraft being delivered in 2025. Unlike Airbus, Boeing remains far from its all-time delivery record, when the company delivered 806 jets in 2018. We still do not anticipate Boeing reaching this rate of deliveries until at least 2027.

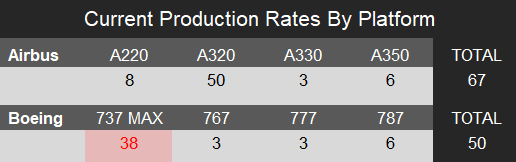

Notes:

- Production rates do not represent the actual number of aircraft produced in February 2025. Instead, they are generalized figures based on current monthly production estimates derived from OEM guidance and internal research conducted by Forecast International.

- Light red indicates the program is temporarily producing at a lower rate than what is displayed in the table.

Deliveries

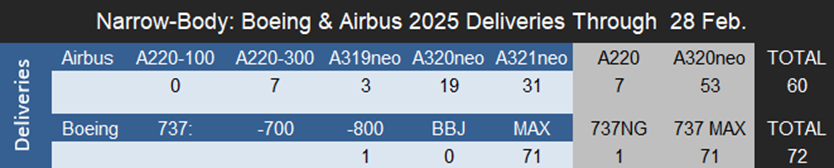

The 44 Boeing jets delivered in February included 31 737 MAXs, one 737-800A, two 777s, five 787s and five 767s. Boeing began 2025 with strong delivery numbers for January, delivering a total of 45 aircraft, outpacing Airbus, who only delivered 25. Forecast International expects Boeing to reach a production rate of 38 MAX aircraft per month by mid-2025 and to continue increasing MAX production in line with FAA-approved rates. Additionally, Boeing remains committed to its plan of ramping up 737 MAX production to approximately 50 aircraft per month in the 2026 timeframe, but whether this will be approved remains in the hands of the FAA.

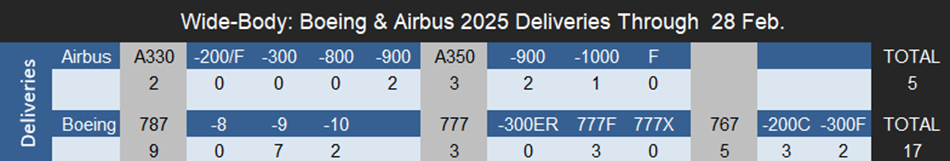

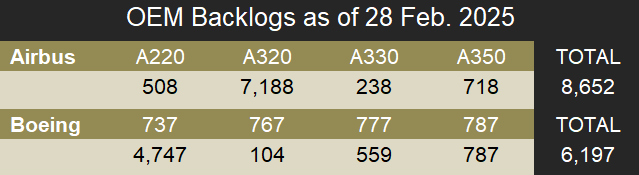

Boeing has only delivered a total of nine 787s in 2025 thus far but remains confident about plans to produce seven 787 aircraft per month by the end of this year, with hopes of increasing output to ten per month by 2026. The 787 backlog of 787 aircraft certainly would allow for such a production rate (this indeed refers to the total number of unfilled orders for the 787 and is not an error), but we expect that ongoing supply chain issues will prevent production increasing along Boeing’s projected timeline.

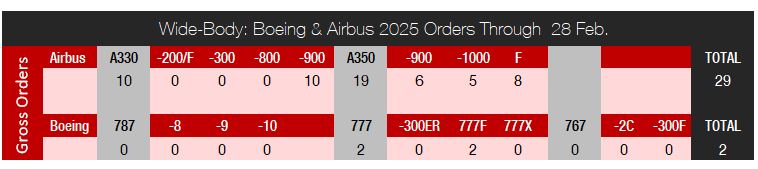

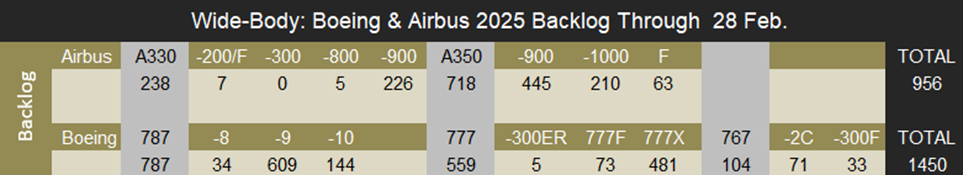

The 767 program is currently operating at a production rate of three aircraft per month, consisting of a mix of KC-46 tankers (based on the 767-2C) and 767-300F freighters. Boeing is in the process of delivering its final 767-300Fs to Fedex and UPS before production wraps up in 2027. Two of the aircraft on the remaining backlog were delivered in February, one to Fedex and the other to UPS. As of February 28th, 2025, Boeing holds 33 unfilled orders for the 767-300F, including 24 for UPS and 9 for FedEx.

The 777 program is producing three aircraft per month, though by 2026 Boeing expects to increase production to four aircraft per month. Boeing also plans to deliver the first 777X to launch customer Lufthansa in 2026, though it is possible that this will be delayed into 2027 if the manufacturer runs into production or regulatory issues like it has recently experienced with other commercial platforms such as the MAX 7 and 10. The 777X already experienced significant delays this past year after halting flight tests in August 2024 due to the failure of key engine mounts. Flight tests resumed in January of this year, and the aircraft was most recently seen in Curaçao to test operations in a hot and humid environment. Additionally, the freighter version of the 777X, the 777-8F was planned to enter service in 2027, but Boeing has pushed the first delivery to 2028.

In February, Airbus delivered 40 jets, including four A220s, 33 A320neos, two A330neos and one A350. Like Boeing, Airbus entered 2025 with ambitious production plans, though ongoing headwinds pertaining to supply chains are preventing production rate increases for the manufacturer. At present, Forecast International estimates the unofficial A320 production rate to be around 50 aircraft per month, with incremental increases expected as Airbus works toward its goal of producing 75 per month by 2027.

Meanwhile, Airbus is producing around eight A220s per month, with a target of 14 per month by 2026. We believe this target rate and timeframe to be extremely ambitious and do not see sufficient demand for the A220 to justify such a high production rate in the short and long term. At a production rate of 14 aircraft per month and the current unfilled orders of only 508 A220s, the backlog would be fully depleted in just over three years. We also do not expect orders for the type to increase enough to significantly grow the orderbook, and a production rate increase to around 10 aircraft per month seems more reasonable given the current backlog.

For widebody aircraft, Airbus entered 2025 with plans to increase A350 production to 9 aircraft per month, with additional increases to 10 per month by 2026 and 12 per month by 2028. However, in February 2025 Airbus announced that supply chain issues at its supplier Spirit Aerosystems would prevent A350 production from surpassing 6 aircraft per month in 2025. Airbus also delayed delivery of the first A350F to 2027, which was initially scheduled for delivery in 2026. The A330neo is currently being produced at a rate of approximately three to four aircraft per month, with no further increases planned.

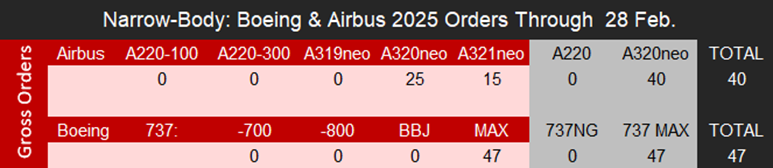

Orders

February marked a slow month for orders at Boeing and Airbus. Boeing recorded 13 gross orders, all of which were for 737 MAXs, while Airbus reported only 14, a notable decrease from the 55 orders it received in January. Boeing also received eight cancellations in February, resulting in only five net new orders. For consistency, this article does not include Boeing’s ASC 606 accounting adjustments in reported figures and considers net new orders as gross orders minus cancellations.

Airbus’ orders for the month were also markedly weak, with only 14 gross orders received. There were no cancellations for the month, though the manufacturer recorded one cancellation of an A220 in January. The largest order by volume came from an undisclosed customer for eight A321neos, and the remaining six aircraft were A321neos ordered by Korean Air. The A321neo remains by far the most popular variant in the A320neo family of aircraft, and operators continue to show preference for the aircraft over other neo variants, as evidenced by this month’s orders.

Backlog

As of the end of February 2025, Airbus reported a backlog of 8,652 jets, of which 7,696—representing 89.0% of the total backlog—were A220 and A320 family narrowbodies. Airbus’ all-time backlog record of 8,769 jets was set in October 2024. Meanwhile, Boeing’s total unfilled orders (before ASC 606 adjustments) stood at 6,197 aircraft, with 4,735, or 76.4% of the total backlog being 737 MAXs. Boeing’s highest recorded backlog of 6,268 aircraft was reached in November 2024. The volume of Airbus aircraft awaiting production and delivery represents 10.3 years of deliveries based on Forecast International’s 2025 production numbers for Airbus. In comparison, Boeing’s backlog would last approximately 10.9 years based on our 2025 production forecast.

As Airbus and Boeing navigate persistent supply chain challenges and evolving market conditions, their ability to ramp up production remains uncertain. Forecast International continues to monitor these developments closely and will provide an additional update at the beginning of April. For more detailed insights or to discuss how these developments might impact your business, reach out to our team today and elevate your understanding of the global aerospace landscape.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.

image sources

- STARLUX A350F: Airbus