Solid December orders haul /// Airbus narrowly misses target after strong end-of-year surge /// Boeing deliveries on the rise

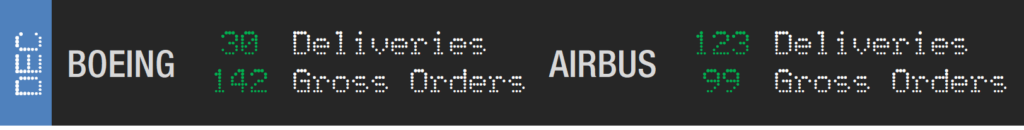

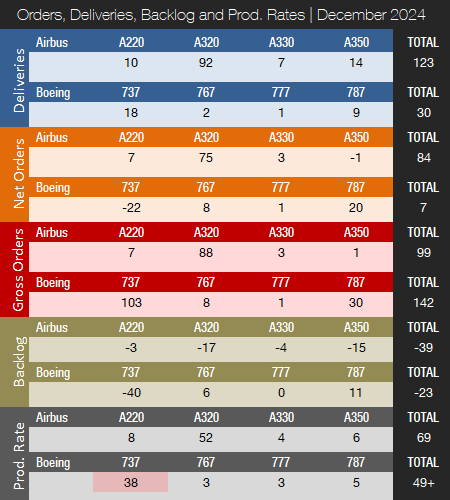

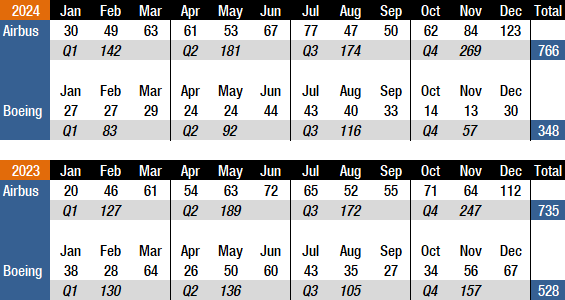

In December, both manufacturers finished the year on a high note both in terms of orders and aircraft shipments. Boeing’s deliveries jumped to 30, compared to just 13 in November and 14 in October. Meanwhile, Airbus delivered 123 units, up from 84 in the prior month. This compares to 67 deliveries for Boeing and 112 for Airbus in December of last year.

For the month, Boeing delivered 30 jets, including 18 737s (17 MAXs / 1 NG), two 767s, one 777, and nine 787s. For most of 2023, the 737 program was producing aircraft at an official rate of 31 per month. By the end of 2023, the program completed its transition to 38 aircraft per month. However, the recent strike as well as increased quality checks and audits by regulators in the aftermath of the Alaska Airlines Flight 1282 incident mean that Boeing is currently producing 737 MAXs at a reduced rate. In March 2024, Boeing Chief Financial Officer, Brian West, stated: “We are the ones who made the decision to constrain rates on the 737 program below 38 per month until we feel like we’re ready.” Before the strike, Boeing expected to return to its official production rate by the end of the year. However, a return to the official rate will now likely not happen before early spring. Boeing’s plans to increase production to approximately 50 737 MAX jets per month in the 2025/26 timeframe are still in effect. The target of 50 per month compares to the pre-crash/pre-pandemic rate of 52 737s per month in 2018. The company is still producing 737 NGs but now only has 11 737-800s remaining in backlog – of which nine are P-8 Poseidons for the U.S. Navy and allies – as well as an additional two 737-700s that will be converted into E-7A Airborne Early Warning and Control (AEW&C) aircraft for the U.S. Air Force.

In December, Airbus delivered 123 jets, including 10 A220s, 92 A320s (all NEO), seven A330s, and 14 A350s. On average, the company delivered 50 A320s per month in 2024, compared to 48 and 43, respectively, in 2023 and 2022. Production is currently being increased, however, Airbus is no longer releasing their production rate changes and prefers to announce in what year they will reach a certain rate. At this time, despite the end-of-year surge in shipments, we consider the unofficial A320 production rate to be 52 per month with further increases expected in the spring when we enter the 55-60 range. Airbus is working with its supply chain to increase A320 production to 75 aircraft per month by 2027. Previously, the target of 75 was expected to be reached in 2026, however, in June of last year, Airbus pushed the target out by a year as suppliers were unable to keep up with demand. The A320 program was expected to reach a monthly rate of 65 by late 2024, however, we would now not expect this level of production to be reached before late-2025.

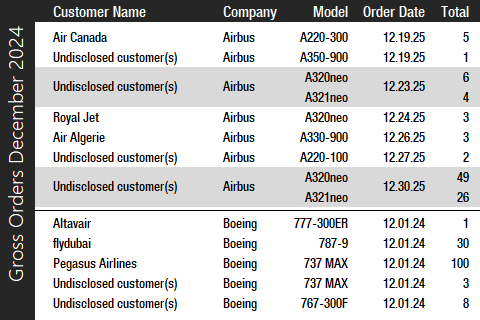

Turning to the December orders review, in terms of reported bookings, Boeing had a strong month and reported 142 gross orders from five different customers. However, Boeing at the same time also received as many as 135 cancellations (125 737 MAXs and 10 787s) due to the liquidation of India’s Jet Airways, which ceased operations five years ago. Boeing therefore finished the month with just seven net new orders. The highlight of the months was Pegasus Airlines’ massive order for up to 200 737-10 MAX jets of which 100 aircraft are firm orders + options for 100 more. Deliveries will commence in 2028. Also, 30 787-9 Dreamliners were added for flydubai. These are related to the airline’s original order placed in November of 2023 that had been debooked and now added to Boeing’s books yet again. Also in December, an undisclosed customer ordered eight 767-300 freighters, followed by three 737 MAXs for an undisclosed customer, and a single 777-300ER for Altavair.

In December, Airbus had an excellent month in terms of new orders and booked orders from seven customers for a total of 99 jets (gross orders) and reported 15 cancellations, for a total of 84 net new orders (99 minus 84). The largest order (by # of aircraft) was placed by an undisclosed customer, which booked 49 A320neos and 26 A321neos. Also, an undisclosed customer ordered six A321neos and four A321neos, followed by an Air Canada order for five A200-300s, and three A330-900s for Air Algerie. The remaining orders in December were three A320neos, two A220-100s, and a single A350-900.

2024 Orders & Deliveries White Paper

A comprehensive white paper summarizing Airbus and Boeing’s December and full-year 2024 orders and deliveries is now available for download. Stay informed on the latest industry trends—don’t miss out, and download your copy at Forecast International today!

Forecast International Clients

You can download this white paper and browse the entire library of content by logging into your Forecast International Intelligence Center account. The full white paper collection is available via the left sidebar menu.

Don’t have an account? Visit Forecast International to unlock access to critical insights and program forecasts that will help you stay ahead of the curve.

Our Intelligence Center provides:

- Comprehensive coverage: From market trends and program analyses to competitor assessments and technology forecasts, we cover the entire spectrum of the aerospace and defense industry.

- Actionable intelligence: Gain the knowledge you need to make informed decisions and drive strategic advantage.

- Expert analysis: Benefit from the expertise of our seasoned analysts with decades of experience in the industry.

Join Forecast International today and elevate your understanding of the global aerospace and defense landscape.

Note: Light red color means the program is temporarily producing at a lower rate than what is indicated in the table.

References:

- https://www.forecastinternational.com/platinum.cfm

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://www.airbus.com/en/newsroom/press-releases/2025-01-airbus-reports-766-commercial-aircraft-deliveries-in-2024

- https://boeing.mediaroom.com/2024-12-19-Pegasus-Airlines-Orders-Up-to-200-Boeing-737-10-Airplanes

- https://www.flypgs.com/en/press-room/press-releases/pegasus-airlines-places-historic-aircraft-order

- https://www.flypgs.com/en/about-pegasus/fleet-information

- https://aerospaceglobalnews.com/news/boeings-december-2024-and-year-end-orders-deliveries/

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.