Increased Ordering Activity in March /// Yet another backlog record for Airbus

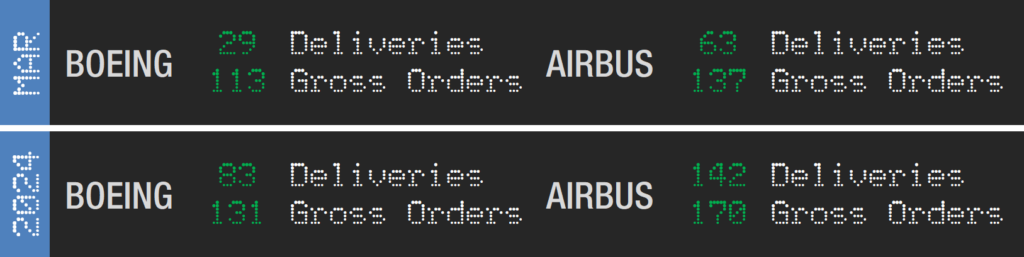

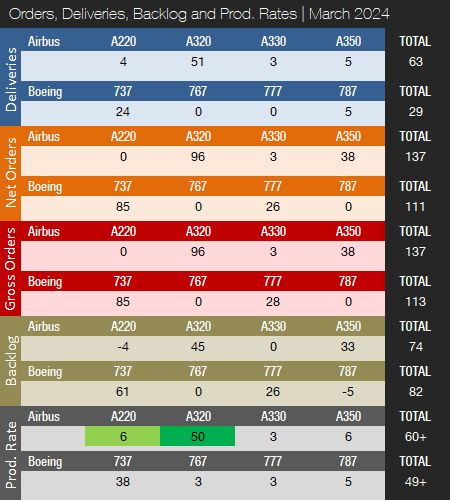

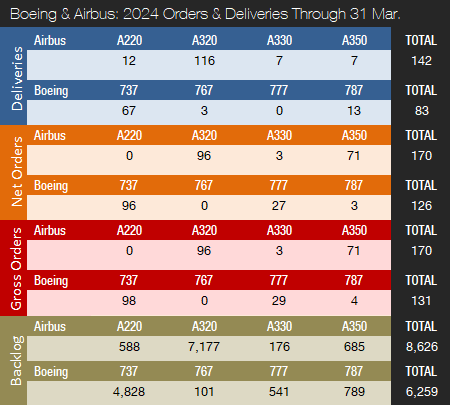

After a rather muted start to 2024, ordering activity picked up pace in March. On the deliveries front, Boeing handed over just 29 commercial jets compared to Airbus with 63 units. This compares to 64 deliveries for Boeing and 61 for Airbus in March of last year. Increased quality checks and audits by regulators were the reason for the slip in Boeing’s March deliveries. Boeing has opted to slow its production of the 737 MAX until the company feels it is ready. Year-to-date, Boeing and Airbus have delivered 83 and 142 aircraft compared to 130 and 127, respectively, during the first quarter of 2023. As of March, Boeing is 47 deliveries behind compared to last year’s totals to date, while Airbus is 15 deliveries ahead. In 2023, in total, Boeing and Airbus delivered 528 and 735 aircraft compared to 480 and 663, respectively, in 2022. In 2023, Airbus won the deliveries crown for the fifth consecutive year.

Following a more than challenging 2020 due to the COVID-19 pandemic, 2021-23 were recovery years for the two largest commercial plane makers. Boeing still has quite a way to go before setting new all-time company deliveries records, whereas Airbus could be back to pre-pandemic levels already this year. In 2018, before COVID-19 and the first 737 MAX grounding, Boeing delivered 806 jets, a level that will likely not be recaptured before the 2025-26 timeframe. Airbus’ record high of 863 shipments was set in 2019, a level that will likely be surpassed in 2025. Also, Airbus is expected to retain their deliveries lead for the foreseeable future due to the company’s comfortable backlog lead over its American rival. Before 2019, Boeing had out-delivered Airbus every year since 2012.

As indicated above, in March, Boeing delivered 29 jets, including 24 737s (all MAXs) and five 787s. Since June of last year, the 737 program was producing aircraft at an official rate of 31 per month. At the end of 2023, the program completed the transition to 38 aircraft per month. At their Q4 2023 earnings call, Boeing confirmed that the rate of 38 is now in effect. However, increased quality checks and audits by regulators in the aftermath of the Alaska Airlines Flight 1282 incident mean that Boeing is currently producing 737 MAXs at a lower rate. Last month, Boeing Chief Financial Officer, Brian West, stated: “We are the ones who made the decision to constrain rates on the 737 program below 38 per month until we feel like we’re ready.” Boeing hopes to return to its official production rate in the second half of this year. Boeing’s plans to increase production to approximately 50 737 MAX jets per month in the 2025/26 timeframe are still in effect. The target of 50 per month compares to the pre-crash/pre-pandemic rate of 52 737s per month in 2018. Last year, it was reported that the company is planning to boost production to 52 jets per month by January 2025. Boeing will open a new 737 MAX production line in Everett in the second half of 2024. The new line is in addition to the three lines currently in place at Renton. For now, in the aftermath of the Alaska Airlines Flight 1282 incident, the program will remain at 38 aircraft per month. Boeing ended the year with 200 737 MAX jets in inventory, down 50 from Q3 2023. Boeing expects most of the inventoried jets to be delivered by the end of 2024. The company is still producing 737 NGs but now only has 15 737-800s remaining in backlog.

The 787 program is currently ramping up production. In January of this year, the 787 production rate was raised to five per month, and more increases will follow until the program reaches the current target of 10 aircraft per month by 2025/26. Boeing ended the year with 60 Dreamliners in inventory, down 15 from Q3 2023.

The 767 program is currently producing jets at a rate of three units per month, a mix of KC-46 tankers (based on the 767-2C) and 767-300 freighters. The 777 program is currently pushing out aircraft at a rate of three per month. Most aircraft in backlog are 777 freighters, with only five 777-300ERs left. The 777 program was expected to get a new addition in late 2023 with the delivery of the first 777X, however, the 777X’s entry into service has been postponed to 2025. Boeing will also launch a new 777X-based freighter, thereby expanding its 777X and cargo portfolio. By the 2025/26 timeframe, Boeing expects to be delivering four 777s per month.

In March, Airbus delivered 63 jets, including four A220s, 51 A320s (all NEO), three A330s, and five A350s. On average, the company delivered 48 A320s per month in 2023 compared to 43 in 2022. Production is currently being increased, however, Airbus is no longer releasing their production rate changes and prefers to announce in what year they will reach a certain rate. At this time, we consider the unofficial A320 production rate to be 50 per month up from 48 per month in February. The A320 program is expected to reach a monthly rate of 65 by late 2024. We can therefore expect a series of monthly production increases this year. Also, Airbus is working with its supply chain to increase A320 production to 75 aircraft per month in 2026. The commercial aircraft fleet is getting a new addition this year with the entry-into-service of the A321XLR. The first production aircraft entered into the final assembly line in December 2023 with entry-into-service expected to take place in Q3 2024.

The A220, meanwhile, is being produced at a rate of six aircraft per month, with a monthly production rate of 14 expected by 2026. Airbus is reportedly considering to introduce a stretch version of the A220.

The A330 production rate was increased from two aircraft per month to three at the end of 2022, with an increase to four per month expected this year. The A350 production rate was raised to six per month at the end of 2023 in line with Airbus’ announcements. Airbus expects to produce ten A350s per month by 2026.

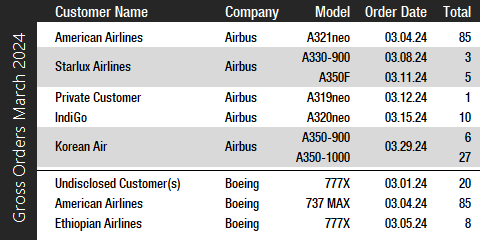

Turning to the March orders review, in terms of reported bookings, Boeing had a strong month and reported 113 gross orders from three different customers. The worlds, largest air carrier, American Airlines, ordered 85 737-10s + conversions and options. The 737-10 is the largest 737 MAX variant. Also, an undisclosed customer booked 20 777Xs, while Ethiopian Airlines ordered eight 777Xs (777-9s) + options for another 12 aircraft. Boeing reported two 777F cancellations in February, resulting in 111 net new orders. Year-to-date, Boeing has accumulated 126 net new orders (131 gross orders), compared to 56 net new orders (120 gross orders) in the first three months of last year. In 2023, Boeing booked a total of 1,314 net new orders (1,456 gross orders) – before ASC 606 changes – compared to 774 net new orders (935 gross orders) in 2022. Please note that for comparison reasons, we do not include Boeing’s so-called ASC 606 accounting adjustments in the numbers reported in this article and regard net new orders as gross orders minus cancellations.

In March, Airbus booked orders from five customers for a total of 137 jets (gross orders) and reported no cancellations. The largest order for 85 A321neos was placed by American Airlines. Meanwhile, Korean Air placed a sizeable wide-body order for 33 A350s (six A350-900s + 27 A350-1000s). Also in March, IndiGo ordered 10 A320neos, while Taiwanese international carrier, STARLUX, ordered three A330-900s and five A350Fs. Year-to-date, Airbus has accumulated 170 gross orders (no cancellations => 170 net new orders), compared to 142 net new orders (156 gross orders) in the first quarter of last year. In 2023, Airbus won the orders crown for the fifth consecutive year booking an astounding 2,094 net new orders (2,319 gross orders), compared to 820 net new orders (1,078 gross orders) in 2022.

At the end of March, Airbus reported a backlog of 8,626 jets (a new company and industry record), of which 7,765, or 90 percent, were A220 and A320ceo/neo family narrowbodies. Airbus’ previous all-time backlog record was set in January 2024 when the company reported a backlog of 8,599 jets. Both manufacturers will likely set additional backlog records this year. By the end of last month, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 6,259 aircraft, a new company backlog record, of which 4,828, or 77 percent, were 737 NG/MAX narrowbody jets. Boeing’s previous backlog record of 6,216 aircraft was set in December 2023. The number of Airbus aircraft to be built and delivered represents 10 years of shipments at the 2019 production level (the pre-pandemic level), or 11.7 years based on the 2023 total. In comparison, Boeing’s backlog would “only” last 7.8 years at the 2018 level (the most recent “normal” year for Boeing), or 11.9 years based on 2023 deliveries. Boeing’s book-to-bill ratio year-to-date, calculated as net new orders divided by deliveries, is 1.52 with Airbus coming in a bit lower at 1.20. Boeing’s book-to-bill ratio last year was 2.49 with Airbus coming in even higher at 2.85. This means that both companies received well over two new firm orders for every aircraft delivered.

2024 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology that provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecast data from the Civil Aircraft Forecast product. For 2024, Forecast International’s analysts currently expect Boeing and Airbus to deliver 571 and 797 commercial jets, respectively. Please note that these figures exclude militarized variants of commercial platforms such as Boeing’s P-8 Poseidon maritime patrol aircraft and KC-46 Pegasus tanker and Airbus’ A330 MRTT tanker.

In its current year guidance, Airbus expects to deliver 800 planes in 2024, compared to 735 delivered in the previous year. Meanwhile, Boeing decided to forgo issuing their 2024 production forecast as it focuses on safety improvements following the Alaska Airlines incident.

Note: Light green color for production rates means the program is currently transitioning to a higher rate. Green color means the rate has just been increased

References:

- https://www.forecastinternational.com/platinum.cfm

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://boeing.mediaroom.com/2024-03-04-American-Airlines-orders-85-Boeing-737-MAX-jets,-expands-fleet-with-737-10-model

- https://boeing.mediaroom.com/2024-03-05-Ethiopian-Airlines-to-Expand-Widebody-Fleet-with-Up-to-20-Boeing-777X-Jets

- https://www.airbus.com/en/newsroom/press-releases/2024-03-american-airlines-orders-85-additional-a321neo-aircraft

- https://www.reuters.com/business/aerospace-defense/boeing-deliveries-drop-by-half-march-due-increased-quality-checks-2024-04-09/

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.