Looking set to break industry order and backlog records with 523 new firm December orders

With several new large orders announced this month, Airbus is finishing the year on a strong note. After what many regarded as a disappointing orders haul for Airbus at this year’s Dubai Airshow, the month of December has been nothing less than impressive. In fact, the company is on course to break two commercial jet order records this year following a buying spree from European airlines and lessors.

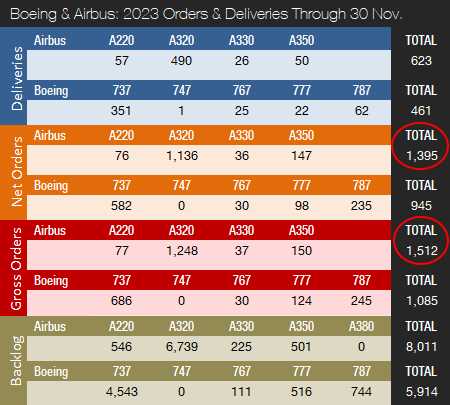

Airbus finished the month of November with 1,512 gross orders to date and 1,395 net new orders (gross orders minus cancellations). The all-time commercial jet orders record was set by Airbus in 2014 with 1,796 gross orders. The record for net new orders also belongs to Airbus and was set in 2013 and stands at 1,503 aircraft.

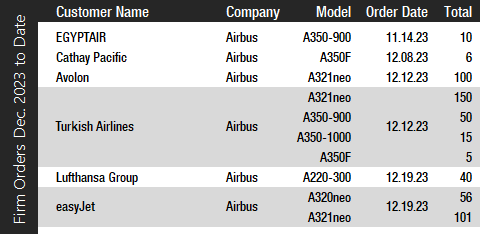

On December 12, Airbus announced that Ireland-based international leasing firm, Avolon, had signed a firm order for 100 A321neo jets. A few days later on December 15, Turkish Airlines, placed a massive order for as many as 220 jets comprised of 150 firm A321neos and 70 firm A350s (50 A350-900s, 15 A350-1000s, and 5 A350F freighters). The order will take Turkish Airlines’ total orderbook for Airbus aircraft to 504, of which 212 have been delivered. Just prior to Dubai Airshow last month, Turkish state-run Anadolu news agency announced that Turkish Airlines and Airbus were nearing a huge purchase of 355 aircraft, including 250 A321neos. In a Turkish Airlines press release dated December 18, the order was also presented as 355 jets in total including commitments, however, Turkish Airlines is reporting 80 firm A350s vs. the 70 in Airbus’ December 15 press release. While 220 aircraft is a massive number, it falls well short of industry records. For example, at this years Paris Air Show, Indian carriers IndiGo and Air India placed orders with Airbus and Boeing for 500 and 470 jets, respectively.

On December 19, the major UK-based low-cost carrier, easyJet, placed a firm order for 157 A320neo family aircraft comprised of 56 A320neos and 101 A321neos. The order also includes the upsizing of an existing order for 35 A320neos into the larger A321neo model. On the same day, Lufthansa announced a firm order for an additional 40 A220-300s. On top of this, EGYPTAIR ordered 10 firm A350-900s at Dubai Airshow that have not yet been added to Airbus’ backlog.

Adding everything up, Airbus has received an astounding 523 net new orders in December to date. If all these orders are officially booked by the end of this month and assuming no cancellations, Airbus net new orders for the year would go from 1,395 to 1,918, thereby surpassing the old record of 1,503 aircraft (set in 2013) by a wide margin.

By gross orders, the old record was 1,796 aircraft set in 2014. At the end of November, Airbus had landed 1,512 gross orders to date this year. Adding 523 orders to this figure, we have a whopping 2,035 gross orders for 2023 as of December 21 and a new industry record (surpassing the old record by 239 jets).

And it will likely come as no surprise to the reader to learn that Airbus is also looking certain to set a new all-time backlog record for the commercial aerospace industry. The current all-time backlog record for the industry was set by Airbus in August this year when the company reported a backlog of 8,024 jets. At the end of November reported a backlog of 8,011 aircraft. Adding 523 net new orders to this figure minus 97 expected Airbus December deliveries (would take the 623 YTD deliveries as of 30 Nov. to 720 deliveries this year based on Airbus’ most recent guidance), and we have a new Airbus backlog of a staggering 8,437 jets.

If all this holds when 2023 end-of-year numbers are reported next month, Airbus could announce a book-to-bill ratio of 2.66, which means that for every aircraft the company has delivered in 2023, it has received 2.66 net new orders. Clearly, the stage is being set for a commercial jet production boom for the remainder of this decade.

References:

- https://www.airbus.com/en/newsroom/press-releases/2023-12-avolon-orders-a-further-100-a321neo-aircraft

- https://www.airbus.com/en/newsroom/press-releases/2023-12-turkish-airlines-to-order-an-additional-220-airbus-aircraft

- https://www.turkishairlines.com/en-int/news-press-release/?p=1

- https://www.airbus.com/en/newsroom/press-releases/2023-12-easyjet-orders-a-further-157-a320neo-family-aircraft

- https://www.airbus.com/en/newsroom/press-releases/2023-12-cathay-group-orders-the-a350f

- https://www.airbus.com/en/newsroom/press-releases/2023-12-lufthansa-group-orders-additional-40-airbus-a220s

- https://flightplan.forecastinternational.com/2023/11/21/dubai-air-show-2023-recap/

- https://www.reuters.com/business/aerospace-defense/airbus-course-record-jetliner-orders-2023-sources-say-2023-12-19/

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.